Processors Extend 2020 Expansion into New Year

Survey data report quickening expansion in plastics, notably in custom processing.

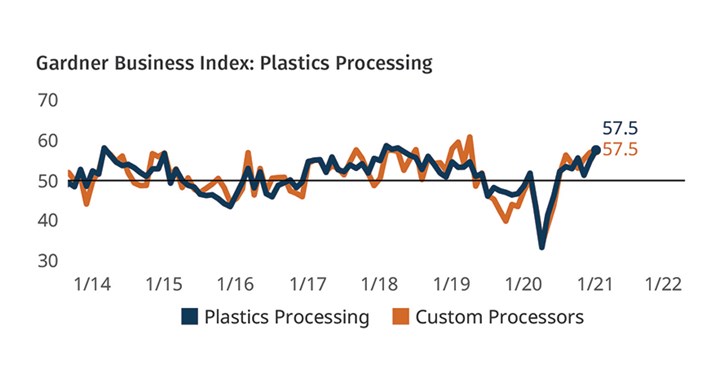

The Gardner Business Index (GBI) for plastics processing registered 57.5 in January, pointing to a quickening expansion in industry activity. (Index values above 50 indicate expansion; the larger the value, the faster the expansion.) The latest reading was supported by higher readings for supplier deliveries, production, and new orders. Employment and backlog activity both showed quickening expansion during the month, while export activity was unchanged. January’s results mark the first time since January 2019 that all six index components registered flat or expanding activity.

FIG 1 The GBI for plastics processing rose modestly in the first month of 2021, thanks to higher supplier deliveries, new orders and production. Five of the Processing Index’s six components expanded in January.

FIG 1 The GBI for plastics processing rose modestly in the first month of 2021, thanks to higher supplier deliveries, new orders and production. Five of the Processing Index’s six components expanded in January.Data provided by custom processors also indicated an expansion in overall business activity. However, all of January’s improvement resulted from the meteoric rise in the supplier delivery measure, which is now 11-points above its previous all-time cyclical peak of 65.4. The latest reading overshadows the fact that that all other measures of business activity expanded during the month, a feat that has not happened since Q1 2018.

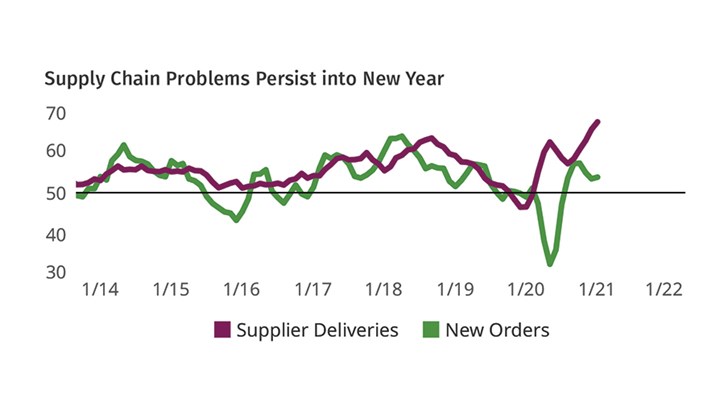

If recent months’ data (based on surveys of Plastics Technology subscribers) can serve as a strategic guide for manufacturing managers in 2021, the message it seems to convey is that processors will have to quickly find ingenious ways to mitigate their supply-chain issues or else potentially miss out on the growing wave of new-orders activity.

FIG 2 January’s exceptionally high supplier-delivery reading points to greater industry problems than merely coping with the seasonal fluctuation in shipping-services demand. The combination of supply challenges and rising orders could create missed opportunities for processors early in 2021.

FIG 2 January’s exceptionally high supplier-delivery reading points to greater industry problems than merely coping with the seasonal fluctuation in shipping-services demand. The combination of supply challenges and rising orders could create missed opportunities for processors early in 2021.Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

-

Plastics Processing Contracted Again in March

Processing activity contracted for the ninth straight month, and at a faster rate.

-

Processing Activity Contracts More Slowly in January

Despite contracting again in January, plastics processing activity rebounded a bit from a rather significant drop in December.

(2).jpg;maxWidth=970;quality=90)

.jpg;width=70;height=70;mode=crop)

(2).jpg;maxWidth=300;quality=90)

(1).jpg;maxWidth=970;quality=90)