R&D Thermoformer: Tek Pak Is Launch Pad For New Products

Toolmaker and thermoformer takes concepts to production-ready parts in record time.

When resin maker Eastman Chemical Co., Kingsport, Tenn., and sheet extruder Pacur in Oshkosh, Wis., wanted a thermoformed demonstration part to show off a new three-layer, foam-core PETG sheet, they knew where to go.

“We don’t have a lot of competition, because hardly anyone one else does what we do,” declares Tony Beyer, president and founder of Tek Pak, Inc., in Batavia, Ill. “We are willing and able to go after new-product development applications, while most big thermoformers want to get in after that stage of the project cycle, when it’s time to make hundreds of thousands of parts. We’ll make tens of parts, if that’s what’s needed.

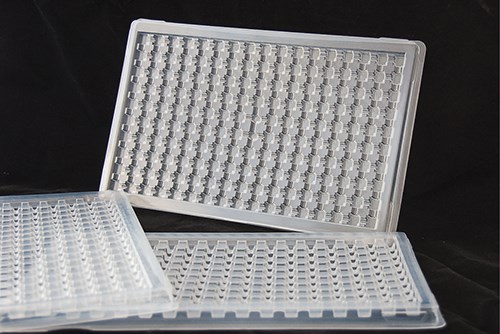

“That’s why Eastman and Pacur came to us when they wanted someone to design a mold that would really challenge Eastman’s new Eastalite material, extruded into sheet by Pacur. When people see the part we designed (photo on next page), they’ll know that material has good formability.” Seeing interesting potential in the new tri-layer sheet, Tek Pak itself prototyped a medical tray to protect sensitive equipment.

NOT YOUR TYPICAL THERMOFORMER

Beyer’s path to becoming a specialty thermoformer started in the early 1970s as a toolmaker at Plastofilm Industries, Wheaton, Ill., leading custom thermoformer. In those days, Plastofilm had 550 people in five locations and was a pioneer in medical thermoforming. Beyer rose to plant manager of the home facility, which had 400 employees. After the original owner retired and the firm was sold and resold three times in five years, Beyer left and started Tek Pak in 1992.

His initial focus was on carrier tapes that held components for automated assembly of cellphones. That application started at Plastofilm in 1981, Beyer says, “but the finance people there said it would never amount to much.” How wrong they were. Carrier-tape business at Beyer’s new firm grew 50% a year for seven years in a row during the 1990s, with Motorola as the leading customer. Tek Pak even opened a plant in Sweden to make carrier tapes for cellphone maker Ericsson in the late ’90s.

Then China happened. “It all changed a lot faster than anyone thought possible,” recalls Beyer. In around 2000, 40% of his business moved to China in just six months. He closed the Swedish plant, which is now a sales office. “We went into survival mode and refocused on standard thermoforming, tooling, and prototyping.”

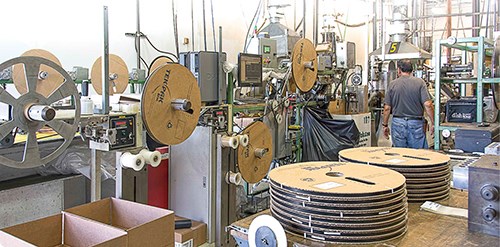

Today, Tek Pak has a main office and production plant in Batavia with 27,000 ft2, 70 people, five extrusion lines for carrier tapes, and 40 thermoforming machines, 35 of them for carrier tape. In addition, Tek Pak also has a 12,000 ft2 R&D center 3 miles away in St. Charles, Ill., which houses seven small machines. That separate R&D facility, with a dedicated staff of 15, is part of what distinguishes Tek Pak from the vast majority of thermoformers.

“We work for startup companies and for Fortune 500’s,” says Beyer. “They have an idea and need someone to help them get it started. Many projects come in as concepts, not full-blown designs.” He cites the example of a surgical tray kit, for which Tek Pak was given only the parts the kit had to contain and a general layout scheme. “They ask, ‘Can you make this?’ For the answer, we rely on our tool kit—our knowledge of tooling and of uncommon materials and how to form, cut, punch, and weld them. A Fortune 500 company came to us after working on a new project for 16 weeks without success. In two months, we had working samples for them.”

This sort of development work can take a lot of iterations. “Medical development can take 18 months of trials and sometimes up to 16 or more revisions,” says Beyer. “We got into this business because no one else wanted to mess with prototyping—too much detail, too little volume. We do 50 prototypes a month—nobody else even comes close to that.”

This approach has paid off for Tek Pak. Says Beyer, “We’re not caught up in commoditization. Most customers realize there’s a cost associated with what we do.” Tek Pak’s biggest market is electronics, followed by medical and food packaging, as well as some retail packaging. General thermoforming is only about 20% of its $13 million annual business.

One medical application prototyped by Tek Pak just received FDA approval after passing a range of tests. It’s a PETG tray package for an implantable heart pump worth upwards of $100,000. Durability and impact protection of the contents were critical considerations, Beyer points out.

Tek Pak typically helps a customer optimize a product design to ensure its manufacturability, then builds prototype tooling and forms initial samples. Beyer explains, “We usually start with a single-cavity prototype tool, but it’s built just like a production tool and is suitable for mid- or long-range, low-volume production.” For some customers, Tek Pak also provides initial or “bridge” production to support market development or allow time for a customer to ramp up to full-scale volumes.

One resource for bridge production is Tek Pak’s largest continuous former, a Kiefel KDM 60 B pressure former with mold area of 460 x 600 mm (about 18 x 24 in.). On a recent day, the machine was running a blister package for a consumer electronic device using recycled PET (RPET). The blister was running 3-up at 1000 shots/hr. The order called for 60,000 parts over three months.

After development and perhaps initial production, Tek Pak usually hands off the job to another thermoformer for full-scale production. “We typically run 10,000 to 100,000 parts. But we have made millions of some specialty parts, like carrier tapes or difficult parts that others won’t run.

“Telescoping time is our business,” adds Beyer. “Lead time for a design change in carrier tapes is generally three days or less. A food package for Wal-Mart took us three weeks for development and we had products for them in four weeks.” Tek Pak’s speed record is 4 hr to design and build a mold and run sample parts. For its demanding clientele, Tek Pak has to be fast. “We’re working on 30 prototypes this month—and it’s a slow month,” exclaims Beyer.

R&D TOOL KIT

The “toolkit” that makes this possible includes knowledge of a broad range of materials, including less common resins like PEEK, Ultem PEI, PVDF, TPU, specially formulated conductive/antistatic compounds, and even metalized films. Notes Scott Carter, v.p. of R&D, “Around 30% of our materials are multilayer combinations, which aren’t in any property database.” He cites the example of a PE/nylon/PE film for a medical containment bladder. The nylon layer adds stiffness and puncture resistance.

Another example is the three-layer solid/foam/solid sheet developed by Pacur using PETG skins over Eastman’s Eastalite copolyester foam core. It’s a styrene-free alternative to HIPS with faster cycles, greater resilience, lighter weight, more durable living hinges, and excellent cushioning ability. Beyer sees a range of applications potential in protective packaging for medical devices and fragile electronics, and even some consumer packaging. (See August Close-Up for more on Eastalite foam-core sheet.)

Carter, a Ph.D. in chemical engineering, has an analytical lab the likes of which you won’t see at many thermoformers. It includes a Thermo Scientific FTIR spectrometer, used to identify unknown materials that customers send in and to validate that incoming materials are what they are supposed to be. There’s also a dynamic mechanical analyzer (DMA) from TA Instruments, with which Tek Pak can measure the glass-transition temperature (Tg) of unfamiliar materials and determine the optimal preheat and forming temperatures. One current task for the lab is analyzing 10 different varieties of mineral-filled PP sent in by a customer to produce samples of coffee-cup lids that would replace PS.

When it comes to detailed design of new products and molds, Tek Pak utilizes two different 3D CAD packages and 2D AutoCAD software. While that’s twice as many 3D CAD programs as most thermoformers use, “It means we can accept more native CAD files from customers—depending on what they use in-house—and that means higher accuracy in translating their geometry,” explains design engineer Kevin Swanson.

Another tool in Tek Pak’s kit is its equipment, much of it homemade. “We have adapted commercial machines for prototyping and low-volume work,” says Carter, “and we have built our own small-footprint R&D machines with up to 4 x 6 in. forming area and radiant heat top and bottom.” These roll-fed, continuous forming machines are equipped with “gripper chains”—conveying chains with finger grippers—developed by Tek Pak for thck materials, like 40-mil ABS, and flexible polyolefins as thin as 2 mil, that can’t be handled effectively with conventional pin chains.

These R&D machines are designed for small, 1-up prototypes. “Some customers think we should start prototyping with a 12- or 16-up tool,” observes Beyer. “But that just multiplies the difficulties and burns up more time, money, and material in learning to get it right. We start out to make one good part consistently, then scale it up. And some particularly difficult parts have to run 1-up in production, too.”

Another special piece of technology is laser trimming, performed by a pair of LaserSharp LPM Flex 400 machines from LasX Industries, White Bear Lake, Minn. “These are great for R&D because we don’t have to wait for trim dies to be built,” enthuses Beyer. “Instead of spending $12,000 for a matched-metal punch, the laser can cut a part in 0.5 sec.” On some special electronic parts, the laser cuts patterns of up to 400 tiny holes (1.2 x 0.6 mm) in about 4 sec.

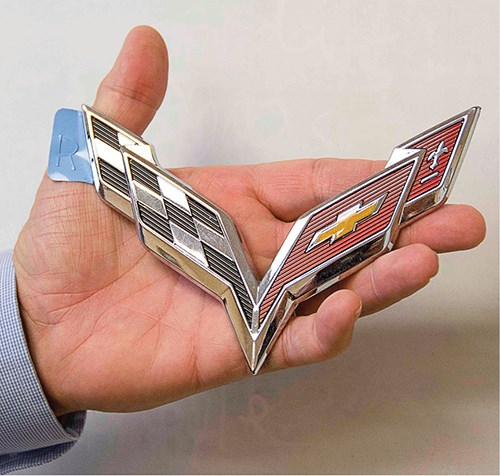

Besides prototypes, Tek Pak manufacturers inserts for Corvette hood “badges.” formerly injection molded, the inserts are thermoformed and laser trimmed at volumes of around 65,000 annually. Beyer notes that laser trimming is used by some other thermoformers, mainly on some heavy-gauge automotive jobs, but those are not high-speed models like Tek Pak’s.

TOOLING SPECIALIST

Tek Pak builds all its own tools, and also many for other thermoformers, even for some heavy-gauge jobs. It also machines its plug assists from thermoset syntactic foam. Beyer is understandably proud of his 6000 ft2 toolroom with a staff of 12 and a dozen CNC machines with up to 40 x 60 x 15 in. working area. He calls it “the largest toolroom in the thermforming industry that nobody knows about.”

Most of the molds are aluminum—“It can do millions of shots,” according to Beyer, who believes steel is nearly obsolete for most thermoforming applications. Most of Tek Pak’s work uses cavity inserts that fit into standard mold bases. The toolroom has built 10,000 molds for carrier tapes alone, with six to 12 cavities. “We make 30 to 40 tools a month,” says toolmaker Rick Spera. “Our record is 86 carrier-tape molds in one month.”

“We have 250 man-years of experience in our toolroom staff,” says Beyer. “But I want to push the limits of what our tooling people think they can do. We live by accomplishing new things, so we have to take risks. For example, we frequently violate the rules on draw ratios in carrier-tape tools.” He adds, with a sense of irony, “We constantly try out things that don’t work!”

SPECIALIZED PRODUCTION

Clearly, a lot of things do work for Tek Pak. Besides its focus on prototyping, the firm has also developed a couple of specialties in commercial production. One that has already been mentioned is carrier tapes for automated electronic assembly. Wound on reels, these tapes are formed with tiny pockets—as small as 0.1 x 0.15 x 0.1 mm—to hold components that race through assembly stations at speeds up to 75,000 cycles/hr.

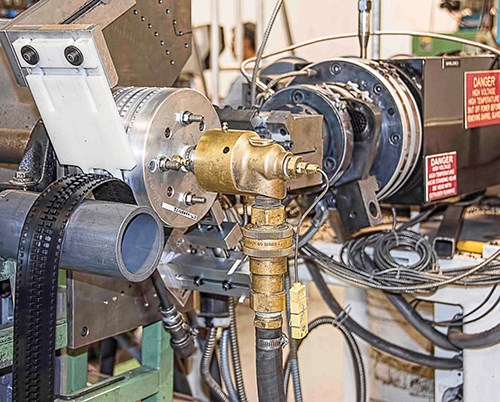

As a result, tight tolerances of ± 0.1 mm or less are standard, says Tracy Wolf, director of sales and business development. Accounting for half of Tek Pak’s business, the 35 carrier-tape forming lines at the Batavia plant constitute the largest production facility for this product in North America, according to Beyer. (He says the largest plant in Asia has over 600 lines.) The tapes are extruded on-site from five small extrusion lines with flat dies up to 8 in. wide. Typical materials are conductive HIPS 0.3-0.4 mm thick or 40-mil conductive ABS. These specialized antistatic compounds are not available from standard sheet producers, so Tek Pak has to work directly with compounders. It also sells some sheet to electronic OEMs that do their carrier-tape forming.

Some of the sheet is slit into narrower tapes and wound on reels for subsequent thermoforming. Some is extruded, formed, and punched inline. In the latter cases, the hot sheet passes around a rotary forming mold and then is slit in two. Deionized air is blown over the tape to remove particulates, which are trapped in a receptacle underneath.

Because of frequent product changes, quick mold changes are vital in the carrier-tape business, typically taking 30 min, though sometimes as little as 5 min if there is no material change. According to Beyer, quick changes are also “becoming more critical in general thermoforming as we grow the business.”

A second specialty, of much newer vintage, is being developed at Tek Pak. Production forming (not just prototyping) of very thin, flexible materials, such as LDPE or EVA at 2-3 mils up to 20 mils, has promising potential for diaphragms, containment bladders, and gaskets for medical and electronic applications. An example is a domed diaphragm 4-6 mils thick ± 2 mils. “We’re doing it because most people don’t want to do it,” says Beyer. “Standard equipment can’t handle it. That’s why we built our own with finger grippers instead of pin chains, which won’t hold these materials.” He adds, “Most of these projects start out very small—no truckload orders in six months.”

Beyer sees opportunities for thin flexibles in markets that don’t exist yet. For instance, he envisions that such materials in medical applications could reduce hospitals’ disposal costs for hazardous or infectious “red-bag waste” by making the waste less bulky and more compressible.

‘GAME CHANGER’ AHEAD

Tek Pak has carved out another niche for itself, by riding the leading edge of what Beyer sees as a new wave about to wash over the medical thermoforming business. “It’s a game-changer that’s just happening now and is gaining momentum. Medical-device OEMs want to do their own thermoforming in-house to save freight.” Examples are packaged surgical kits, for which the OEM ultimately may want to make the devices and package them in the same facility.

Since few medical OEMs have much experience in thermoforming, Tek Pak has developed a role as a consultant and a supplier of turnkey forming systems. The Kiefel machine, because of its mid-range production capacity, is a good tool for developing a turnkey package.

“It has already happened in carrier tape for the past decade around the world,” says Beyer. “We have supplied 15 or 16 carrier-tape systems with our own specialized machines. There’s no standard catalog for that.”

When a “game-change” like this threatens to strike your market, Beyer says, a manufacturer has to ask some vital questions: “How do you position yourself for that change? When do you invest to survive and profit from that change? And how long is the ‘on ramp’ before you can get cash out of it?”

Related Content

DeDuster Systems Cleans Up rPET Sheet

rPlanet cut its gel count drastically—allowing it to sell more sheet at prime prices—after installing a DeDuster system.

Read MoreVacuum System Gives Molds a Chance to Vent

When the in-house vacuum systems and tooling tricks that NMC Dynaplas usually deploys to deal with trapped gas failed, it turned to a Mold-Vac system and saw reject rates go from 44% to zero.

Read MoreYoung Stretch-Film Processor Bets on Nanolayers

Going up against companies with as much as double its capacity, young stretch-film processor Zummit believes that new technology — notably 59-nanolayer films — will give it a competitive edge.

Read MoreAs Currier Grows in Medical Consumables, Blow Molding Is Its ‘Foot in the Door’

Currier Plastics has added substantial capacity recently in both injection and blow molding for medical/pharmaceutical products, including several machines to occupy a new, large clean room.

Read MoreRead Next

PETG Foam-Core Sheet Cushions Thermoformed Medical Packaging

New option is lighter, cleaner, tougher than HIPS at a comparable price.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)