Resin Prices Flat to Lower

Second quarter ends with flat to declining prices, even for high-volume engineering resins.

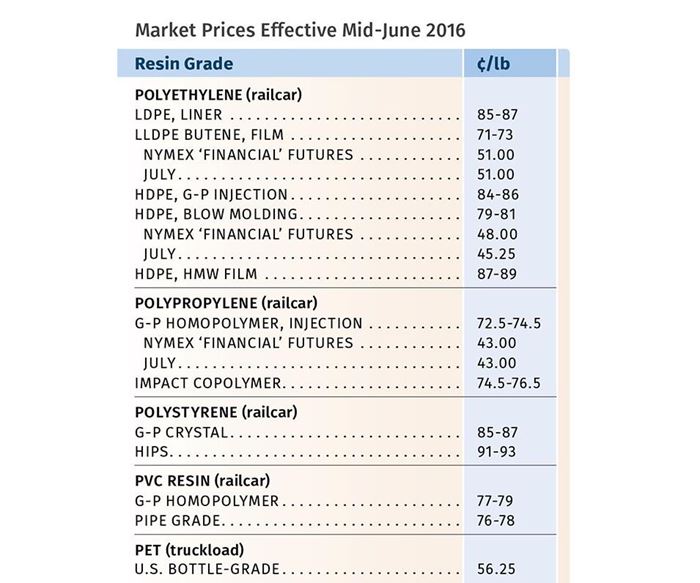

Prices of nearly all large-volume commodity and engineering resins ended the second quarter largely on a flat note, though PP was once again the exception, but this time with a downward trajectory. Entering the third quarter, flat-to-down appears to be the overall trend for resin prices. These are the views of purchasing consultants from Resin Technology Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of The Plastics Exchange, Chicago; and Houston-based PetroChemWire (PCW).

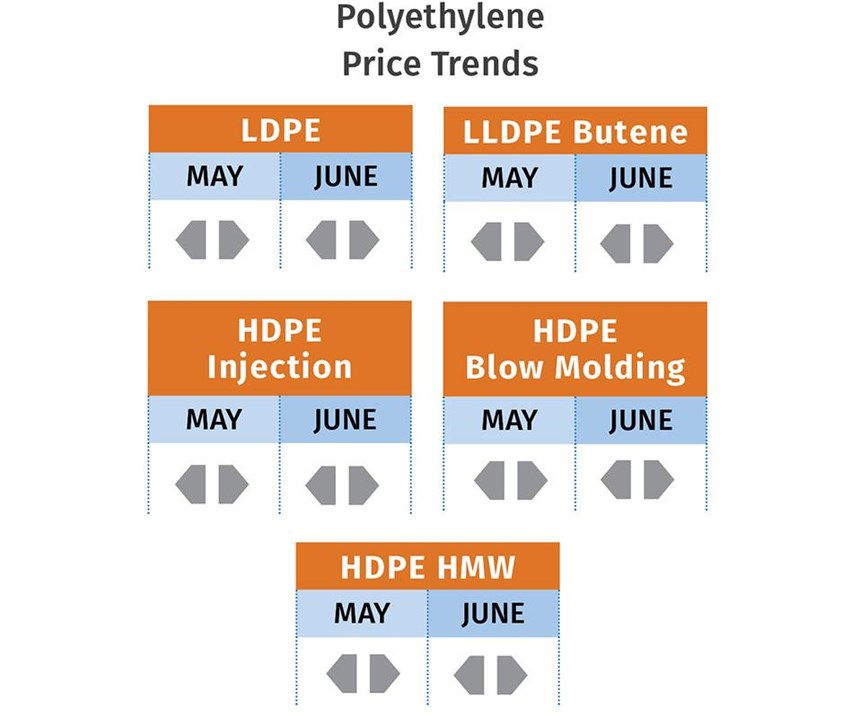

PE PRICES GOING NOWHERE

Polyethylene prices were flat in May and were expected to remain that way through last month. There was strong potential for downward pressure starting this month and perhaps through the rest of the year, barring major disruptions, according to Mike Burns, RTi’s v.p. of client services for PE. He pointed out that crude oil prices appear to have “decoupled” from PE pricing, as an over-supplied global PE market seems likely to influence domestic prices, despite rising oil prices. Competitively priced offers from Chinese traders have already appeared for export to Latin America, a market that has been a stronghold for U.S. exports.

In late May, PetroChemWire reported that spot PE trading was sparse, with flat to lower prices. PCW noted that export buyers were eyeing weaker international demand, while U.S. suppliers appeared disinclined to push for sales. The domestic secondary market was sluggish as buyers avoided discretionary purchases.

The Plastics Exchange’s Greenberg reported that all spot-market film grades remained snug, but signs of improved availability were evident, despite some unexpected PE plant shutdowns. “HDPE managed to hold steady, but there is a negative undertone as new capacity in Mexico threatens to displace some of that country’s high-volume demand for exported U.S. material. As the Mexican plant (Braskem’s new HDPE unit) moves past startup phase and into full production, it will create the need for alternative outlets for surplus North American HDPE resins.”

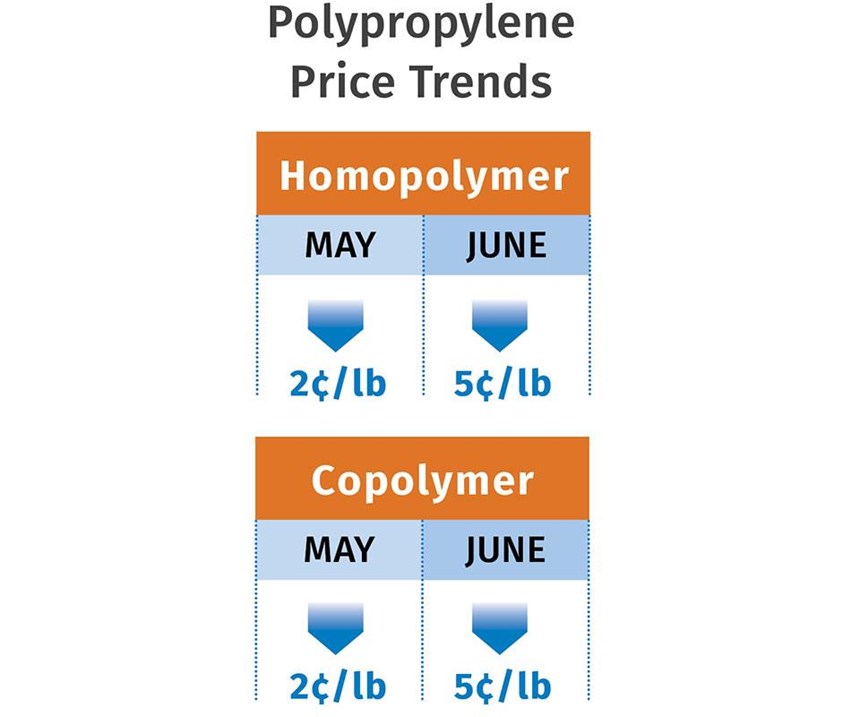

PP PRICES DROP FARTHER

Polypropylene prices fell another 2¢/lb in May, following the previous month’s 2.5¢/lb decline. Moreover, two suppliers had announced decreases of 5¢/lb, in addition to any change in monomer price, effective June 1. Scott Newell, RTi’s v.p. of PP markets, ventured that other suppliers would follow.

Several factors that have brought about a change of trajectory in PP pricing. “The supply/demand dynamics in the PP market have made a 180° turn from the five quarters ending March 2016,” said Greenberg in late May. “Material is now plentiful, including most homopolymer and copolymer grades, in bulk railcars and packaged loads warehoused around the country. At the same time that resin imports came to satisfy the shortfall in domestic supply, competitively priced finished PP products also came ashore to impact processors’ end-use markets, sapping domestic resin demand.”

According to Newell, demand is more complicated to assess because of domestic suppliers’ inventory buildup—heading into May, inventory levels were the highest they had been since May 2012. This does not include the significant amount of imported inventory, he added. One of the reasons Newell expects the June-July period to show an improved supply/demand balance is that he ventures the flow of imports will slow due to higher global prices, and he expects some processors may return to their domestic suppliers as prices drop further. The export market to Latin America has been one outlet for domestic suppliers.

PS PRICES FLAT

Polystyrene prices were flat in May and were expected to continue that way last month. Driving this are benzene prices, which reversed direction and dropped a total of 9¢/gal in May and June, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. He ventured that PS prices had some potential for a drop of 1-2¢/lb last month, and expected July prices to be flat.

At the end of May, PCW described demand as slow to seasonal. PCW also reported that the drought of HIPS availability in the secondary market continued and was beginning to look like a structural market feature. Offgrade GPPS demand was sluggish, though offerings were abundant.

PVC PRICES LEVEL

PVC prices stayed put in May after moving up a total of 6¢/lb in March and April. June prices were generally expected to be flat as well, said RTi’s Kallman. For the July/August time frame, he foresaw some potential for lower prices.

Although suppliers may aim to increase prices another 2¢/lb, they will be challenged. Domestic supply will loosen up as maintenance shutdowns conclude and demand for exports to Asia ease. Exports to Mexico are not expected to have much impact on domestic supply buildup, said Kallman.

PET PRICES UP

Bottle-grade domestic PET prime resin prices rose through May and by June 3 averaged 56.25¢/lb, up 2¢ from April, according to PCW. The typical price of imported PET averaged 52.1¢/lb in May, up less than 1¢/lb, according to Xavier Cronin, senior editor of PCW’s “PET Daily” report. Cronin said there was potential for domestic PET prices to move up another 1-2¢/lb in June, bolstered by seasonal demand from bottlers and packaging manufacturers. Average costs of PET feedstocks in the U.S. in May averaged 49.04¢/lb, down 2.6¢/lb from April.

Domestic PET supply remains plentiful and growing, which could result in a supply glut by early 2017, said Cronin. M&G Chemicals’ 2.4-billion-lb/yr PET complex in Corpus Christi, Texas, is due on stream in early 2017, though M&G is sticking by its startup target of late 2016. Also adding to supply buildup are PET imports from all over the world—19 countries in March.

ABS PRICES FLAT TO DOWN

ABS prices early in the second quarter appeared to move up a bit, but then dropped along with benzene prices; by end of the quarter, prices were expected to be about where they started or lower, according to RTi’s Kallman.

Imports continue to be a factor in the domestic market. Moreover, ABS prices have fallen in Asia due to slow demand, so even more attractively priced imports are expected. Kallman describes the domestic market as well supplied and notes that there’s continued good demand from automotive and appliances.

PC PRICES MAY SOFTEN

Polycarbonate prices were largely flat through the second quarter, as there was no feedstock pricing argument for increasing resin tabs, said Kallman. He ventured that prices would remain unchanged but with some potential for easing downward due to competition among suppliers and Asian imports. The market is well balanced with pretty good demand from the automotive and construction market sectors.

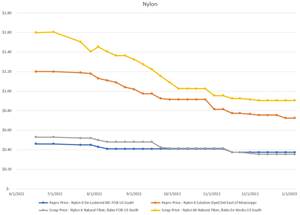

NYLON 6, 66 PRICES FLAT-TO-DOWN

Nylon 6 prices moved up by about 2% in April but quickly fell back and remained flat through May as benzene prices dropped. There was potential for further decline of 1-2¢/lb last month, according to RTi’s Kallman.

Nylon 66 prices remained flat through much of the second quarter and were expected to end June that way. Some potential for an increase this month could come from upward movement in benzene and butadiene.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)