Resin Prices Still Heading South

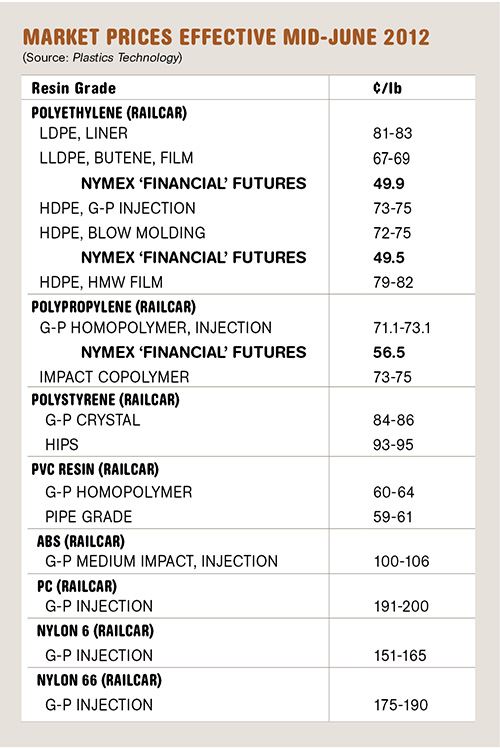

A sharp decline in U.S. energy prices and tabs for all key feedstocks, along with dismal-to-lackluster domestic and global demand, have brought significantly more attractive pricing for the four commodity thermoplastics and downward movement for four high-volume engineering resins.

A sharp decline in U.S. energy prices and tabs for all key feedstocks, along with dismal-to-lackluster domestic and global demand, have brought significantly more attractive pricing for the four commodity thermoplastics and downward movement for four high-volume engineering resins. Coupled with traditionally slower demand in summer, even lower prices are likely through much of this quarter, according to consultants at Resin Technology, Inc. (RTi), Ft. Worth, Texas (resinpros.com), and Michael Greenberg, CEO of Chicago-based The Plastics Exchange (theplasticsexchange.com).

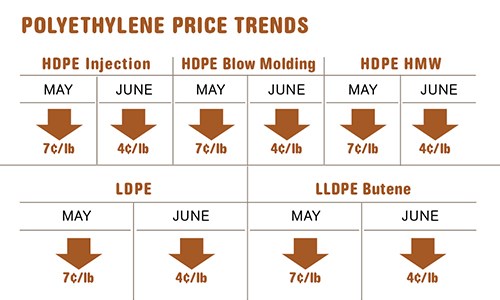

PE PRICES DROP MORE

Polyethylene prices dropped across the board by 7¢/lb in May. Another drop of about 4¢ was expected for June, and both Greenberg and Mike Burns, v.p. of PE at RTi, expect further price decline in July if similar conditions persist. Namely, that inventories continue to outpace demand; feedstock production remains free of disruptions; and export activity remains low.

Suppliers pushed PE price hikes of 11¢/lb in the first quarter that were based on the high end of spot-market prices, says Burns. Spot prices fell from the year’s high of 75¢/lb on Apr. 4 (a figure that actually reflected only 1-2% of the market) to 41¢/lb on June 5. In May alone, spot ethylene monomer prices dropped 20¢ to 45¢/lb, when all ethylene crackers were back up and running again. According to Greenberg, ethylene for delivery in the third quarter was being priced last month at 40¢/lb.

Domestic demand has continued to grow this year, as it has in the last few years, at a relatively steady pace of 3-5%. A lot of this growth is due to continued inroads in film packaging markets such as zippered food-storage bags and dog-food bags, notes Burns.

At the same time, resin suppliers have lost their biggest customer, China. Exports, which have historically accounted for between 25% and 30% of domestic production, have now dropped to 15%. Not only has China not been buying resin lately, but it now has more nearby supply sources in the Middle East.

Meanwhile, suppliers’ resin inventories continued to build for five consecutive months, and operating rates through that period remained in the high 80s percentile. Days of inventory were at 35 in April, and were expected to approach 40 last month.

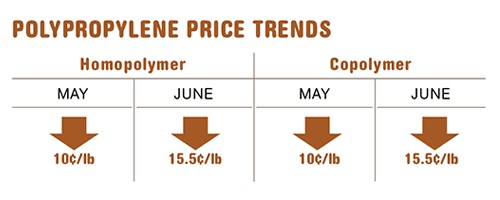

PP PRICES CONTINUE TO TUMBLE

Polypropylene contract prices dropped 15.5¢/lb in June, following the 10¢ price drop in May, more than wiping out the 21.5¢ hikes of the first quarter. All this has been exactly in step with propylene monomer price moves.

In fact, last month’s monomer contract price settlement of 52¢/lb is the lowest for polymer-grade propylene since Nov. 2009, according to Greenberg and Scott Newell, RTi’s director of client services for PP. Both note that in addition to higher output after the planned maintenance outages, crackers are now increasingly using propane instead of ethane as a feedstock, which results in more propylene.

“I think we are turning the corner in the PP market and getting a taste of the future,” said Newell. “You will be hearing of the ‘propane advantage,’ as propane is cheaper than ethane in the cracker and will result in higher propylene monomer yields.”

Spot PP prices, which were heavily discounted off contract pricing between March and June, were expected to stabilize after the significant drop in June contract prices. Industry sources see a good possibility of yet another drop in contract prices for July. After that, some rebound could take place, but one far more modest than the spikes seen in the last couple of years.

Domestic demand was expected to show an uptick last month and into July, owing to dwindling downstream inventories. However, both Greenberg and Newell note that such an uptick will more likely represent “opportunistic pre-buying than real demand.”

Resin plant operating rates have yet to be throttled back—estimated to be in the mid-80s—so that suppliers’ days of inventory in June had climbed to 40.2 from a norm of low-to-mid 30s. Newell notes that if June/July demand shores up, that number will drop to about 36 days.

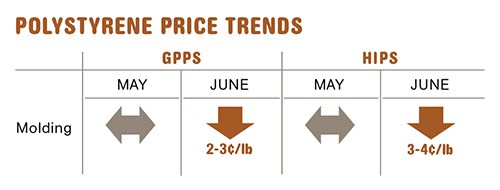

PS PRICES SLIDE

Polystyrene contract prices held generally flat through much of the second quarter after peaking in April, but the trend is now downward. This was indicated by spot prices, which dropped 2-3¢/lb for GPPS and 3-4¢ for HIPS. Domestic demand has been flat after the prebuying ahead of the price hikes in the first quarter, and exports are down. “Overall, demand for the first half of the year is flat-to-down. We think that third-quarter contract and freely negotiated prices will drop,” says Stacy Shelly, RTi’s director of business development for engineering resins, PS, and PVC.

Also contributing to the downward movement is the decline in feedstock prices. Styrene monomer contracts were largely flat through the second quarter but spot prices were looser, down by about 3¢/lb in step with benzene prices. Butadiene prices continued to drop in June, for a total decline of more than 50¢/lb in the second quarter.

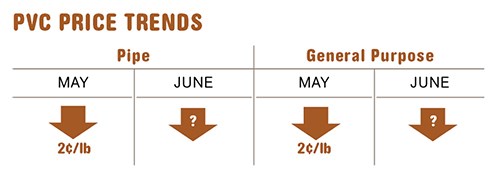

PVC PRICES DROPPING

PVC resin prices fell 2¢/lb in May, and a larger drop was expected by the end of June, according to Mark Kallman, director of client services for engineering resins and PVC at RTi. One key factor is the decline in ethylene prices, with May contracts falling by 9¢/lb, which reduced PVC manufacturing costs by nearly 5¢/lb, says Kallman.

In addition to further projected decline in ethylene prices, resin demand is expected to slow in the third quarter. Kallman says slowed demand for exports will be followed by lower domestic demand, which was already flattening out in April and May. PVC plant operating rates continued to be in the upper 80s percentile, but could well be throttled back, as suppliers’ inventories were building before the close of the second quarter.

ABS PRICES DROP FASTER THAN FEEDSTOCKS

ABS prices were falling in May and June, and a total of about 12¢ to 14¢/lb was expected to be shaved off by end of the second quarter, according to RTi’s Shelly. Feedstocks played a major role: In addition to butadiene prices collapsing by over 50¢/lb in the second quarter, acrylonitrile dropped 25¢, as it’s heavily reliant on propylene price fluctuations.

While decline in key feedstock prices was a major cause, ABS prices were dropping as fast, if not faster. Two other related factors are very low global demand and an influx of Asian ABS imports priced as much as 16-18¢/lb lower than domestic resin, according to Shelly. ABS plant operating rates were down in the mid-50s in the second quarter.

Still, domestic demand for ABS this year is trending up and could register a 3-4% increase, says Shelly, who notes that this demand appears to be equally steady in automotive, construction, heavy equipment, and thermoformed sheet.

NYLON 6, 66 PRICES DOWN

Prices for nylon 6 and 66 were trending lower late in the second quarter. A 5¢ price hike on nylon 6 in February-April was eroding in May and June, according to RTi’s Kallman. Further decline in nylon 6 prices is likely if June benzene contracts settled at substantially lower levels, as they were expected to do. Meanwhile, demand remains good for nylon 6 in the automotive sector but is softer in other applications and in exports, according to Kallman.

After dropping 3-4% in the first quarter, Nylon 66 prices remained relatively flat through the second quarter as feedstock prices peaked and demand remained below that of last year. If lower feedstock prices and soft demand are sustained, lower prices can be expected in the third quarter, says Kallman.

Overall, demand for both nylon 6 and 66 has increased in the domestic automotive sector through the last two quarters, while demand in the Asian auto market continued to slow, and the European auto sector also has been ‘negative.’ Kallman expects more of the same, and has some concern that the U.S. auto market could fade somewhat. He notes, “There are no indications of that so far, with strong auto production expected through the third quarter.”

PC PRICES FLAT TO DOWN?

Polycarbonate prices did move up in the second quarter by around 10¢/lb, less than the 17-25¢ sought by suppliers. Pressure for flat or lower pricing was evident before the close of the second quarter as feedstock prices dropped.

Further downward pressure on PC prices can be expected through the third quarter, given continued lower feedstock costs and softer global demand, according to RTi’s Kallman. “Until we see renewed recovery in global growth, we could be in for lower prices than expected, but still higher than last year’s dip.”

Kallman adds that suppliers are responding by lowering plant operating rates and, in at least one case, posting a third-quarter price increase.

Related Content

Melt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

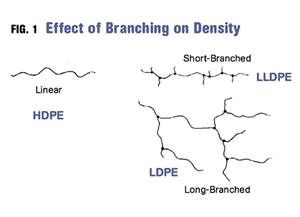

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More