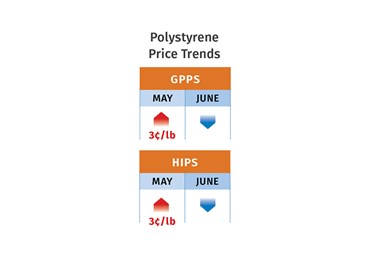

Soft Prices for Volume Resins

While PP and PE prices may be bottoming out, a downward trajectory was likely for all other volume resins, including engineering types.

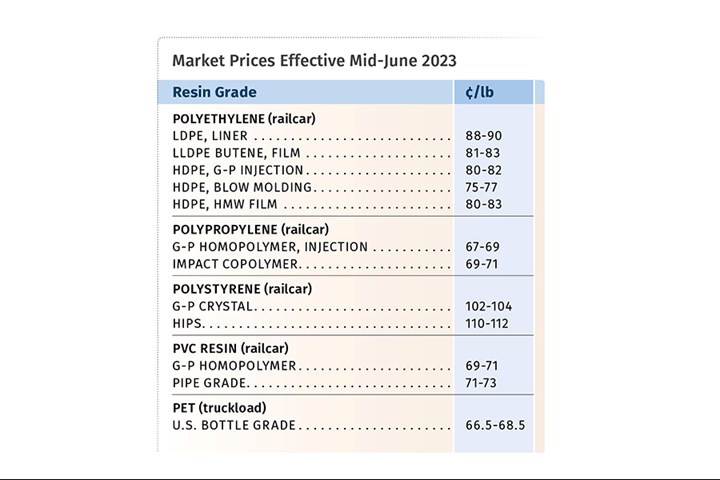

At midyear, prices of volume resins appeared to be headed farther down or holding even, due to slowed domestic and global demand in most key sectors and generally softening feedstock prices. These were the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

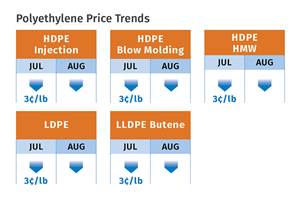

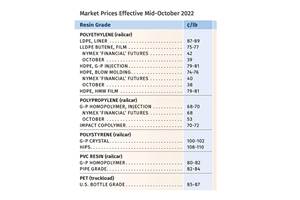

PE Prices Flat to Lower

Polyethylene prices in May appeared to have settled largely flat with some market opportunities for decreases of 2¢ to 3¢/lb in May to July, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Greenberg. Nonetheless, suppliers were seeking 3¢/lb hikes for June. Said Barry, “The industry is now oversupplied and the situation will depend on how hard suppliers run their operating rates. I don’t see PE prices rebounding soon.”

Chesshier noted that processors are buying only as needed and that even with lowered operating rates, supplier inventories grew to over 300 million lb in March and April. She added, “China has already brought online more than 70% of new PE supply.”

Barry reported that Shell was starting up in early June two of its three new PE production lines based on Unipol gas-phase technology, adding capacity for butene LLDPE as well as some hexene and metallocene grades, as well as HDPE injection resins. The third line, an Innovene slurry process, is scheduled for startup in early 2024 and will produce primarily HDPE blow molding grades.

Greenberg reported that PE spot availability was ample and that suppliers would be happy to hold PE contracts flat if possible. “At best, contracts should remain up 6¢/lb for 2023, with some erosion possible, since processors are clamoring for the contentious 3¢/lb increase to come back off,” referring to the unexpected hike that was implemented in March.

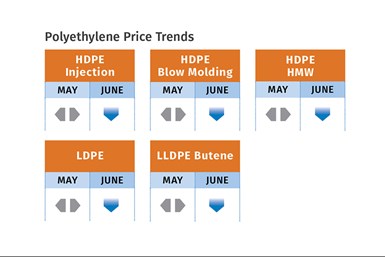

PP Prices Bottom Out?

Polypropylene prices dropped in May by 8¢/lb in step with propylene monomer and attempts for non-monomer price hikes issued by a couple of PP suppliers fell by the wayside, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. As for the June-July timeframe, these sources ventured prices would be flat with some potential for further erosion, depending on demand and the trajectory of crude oil prices.

Barry saw PP prices as largely bottoming out, noting that the major part of the price correction had already taken place.“Some buyers feel that third quarter will be worse than the second. Demand in automotive sounds like the most decent in terms of demand with PP compounders in the U.S. and Mexico pretty busy through second quarter.” Newell noted that demand was still weak with operating rates having dropped down to the low 70 percentile from mid-70s in first quarter. He noted that even with low operating rates, suppler inventories continued to build with days of inventory at 43.6, a high range he had not seen in years. He also saw more potential for lower monomer prices, particularly as another new on-purpose propylene (PDH) plant was being brought on by Enterprise which will globally keep U.S. propylene at the lowest cost.

Greenberg reported that spot PP trading was very robust heading into June; prices for prime PP homopolymer dropped by another 1¢/lb from the previous week, while PP copolymer prices held firm as it was somewhat scarce. He noted that with lower homopolymer PP prices, the differential vs. PP copolymer expanded for the first time since late September 2022. “There is still much uncertainty about the economy and markets,” he said, “but it felt like there was a hint of enthusiasm in the air as demand picked up and buyers became more bold in their procurement efforts.”

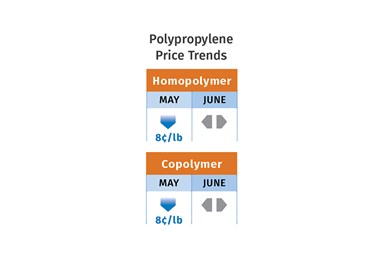

PS Prices Up, Then Flat to Lown

Polystyrene prices moved up in May by 3¢/lb in step with benzene contract settlements and were poised to be flat to lower in the June-July period as spot benzene prices were dropping, according to PCW’s Barry and RTi’s Chesshier. The latter, in fact, ventured that prices in June could drop by as much as 2¢ to 4¢/lb, with further price concessions in July, if benzene prices keep dropping.

PS resin operating rates were down in the 50% range, with no upward movement in demand, and plunging exports. Well-priced PS imports continued to be a factor. Barry reported that implied styrene cost based on a 30% ethylene/70% benzene spot formula had dropped by 8¢/lb going into June from four weeks prior. “Unlike last summer, when benzene prices skyrocketed in late May and early June, supply of benzene was adequate amid weak downstream demand.”

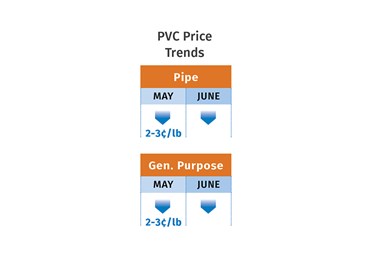

PVC Prices Drop Further

PVC prices were heading 2¢ to 3¢/lb lower in May and had the potential to drop by another 2¢/lb in the June-July timeframe, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. She reported that contract PVC prices were forecasted to be largely flat from July through October, with drops of 1¢/lb each in November and December. “Prices were being pulled down by the continued erosion of export prices on top of lackluster domestic demand,” she noted.

Both sources saw that the typical seasonal demand surge in the second quarter never materialized. Said Kallman, “Construction is still soft while consumer goods are down. Moreover, there is a global abundance of PVC, so exports have suffered and China is bringing on more new PVC production.”

PET Prices Modestly Up, Than Down and Flat

PET prices dropped by 2¢/lb to 2.5¢/lb in May, having moved up 1¢/lb in April, for contracts based on paraxylene/PTA and MEG feedstock prices, according to RTi’s Kallman. He anticipated flat prices in June-July as paraxylene prices move up a bit higher due to octane demand for gasoline. He characterized the market as well supplied, despite lower production rates, due partly to good availability of lower-cost imports.

ABS Prices Lower

ABS prices dropped in the range of 5¢/lb to 8¢/lb in the April-May timeframe and had the potential to remain flat or drop a bit lower through July, according to RTi’s Kallman. This, after dropping in the range of 5¢/lb to 10¢/lb in first quarter and in the vicinity of 30¢/lb to 45¢/lb in third and fourth quarters of 2022. He attributed the downward trajectory to an amply supplied domestic market despite lowered operating rates, lots of well-priced Asian ABS imports, along with soft demand in the construction and electronics sectors, with a bit of an uptick in automotive.

PC Prices Flat-To-Down

Polycarbonate prices in the second quarter were flat-to-down, possibly dropping 5¢ to 7¢/lb in more competitive situations in June-July, according to RTi’s Kallman. This came after falling 5¢ to 10¢/lb in December-January and 10¢/lb in the third quarter of 2022. While demand improved for the automotive sector, this was not the case with other sectors. Despite a long force majeure by Covestro during the second quarter, domestic supply was “excellent, and well-priced PC imports from Asia continued,” said Kallman.

Lower Prices of Nylon 6, 66

Nylon 6 prices continued to fall in the second quarter by 10¢ to 20¢/lb, after slumping 5¢ to 10¢ in the first quarter. Lower--cost imports remained very strong, according to RTi’s Chesshier, forcing domestic suppliers to lower their prices further. Since August 2022, nylon 6 prices have dropped in the range of 40¢/lb to as much as 70¢/lb depending on the supplier and grade. Chesshier ventured that prices could erode further if benzene prices continued to drop, but by a smaller amount. A key factor was slowed demand of all nylon 6 key markets, except for a bit of an uptick in construction.

Nylon 66 prices also continued to fall by about 10¢/lb in April, after sinking 5¢ to 10¢/lb in the first quarter, and 15¢ to 30¢lb in the third and fourth quarters of 2022, according to RTi’s Kallman. After flat pricing in May, he allowed for further downward movement of about 5¢/lb or more in June-July. “Feedstock costs have been dropping, and while automotive demand is a little better, not so for the construction and appliance sectors.”

Related Content

Prices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

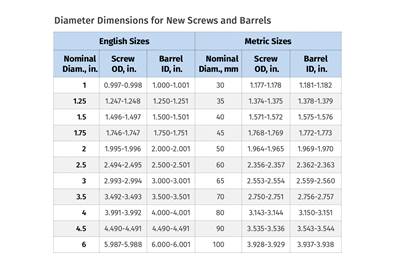

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More