Taiwan Takes Its Place Among Machinery Elite

Overshadowed in geographic size and economic output by its neighbor to the east, Taiwan punches above its plastics weight class and is looking to become more self sufficient in its machinery offerings.

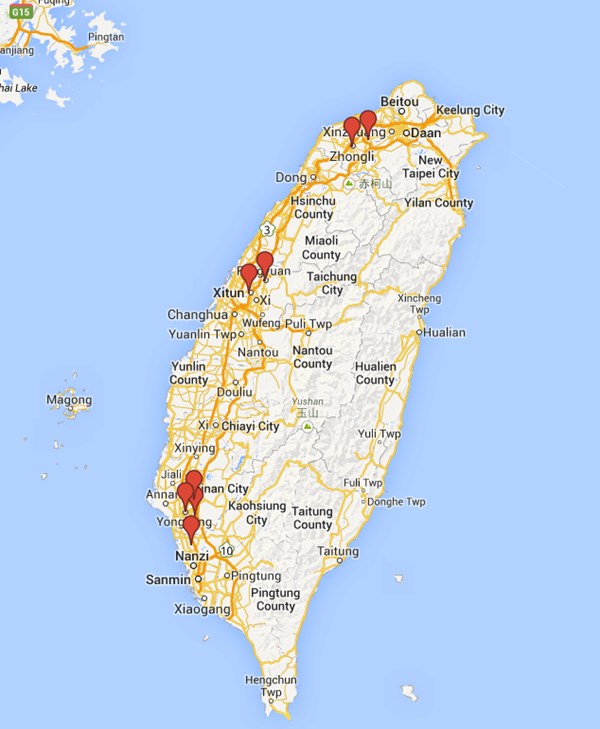

Slightly smaller than Switzerland in size, but boasting a population of 23.3 million, Taiwan’s previous emergence as one of the Asian Tigers has given the island nation outsized status in the plastics machinery marketplace. A tour of machinery suppliers, organized by the Taiwan External Trade Development Council (TAITRA), revealed long-established companies seeking a high-tech edge over rivals from Japan and China, as the nation as a whole seeks to become more self sufficient in advanced technologies of all kinds.

Upwardly mobile

Production of plastic and rubber machinery in Taiwan has increased for three straight years, going back to 2012, according to the Taiwan Association of Machinery Industry (TAMI). Output hit an all-time high of approximately $1.658 billion in 2012, up 62% from the market low in 2009. In 2013, Taiwan was estimated to be the fifth-largest rubber and plastics machine supplier and fourth-largest exporter in the world. In 2010, TAMI estimated there were 280 plastics and rubber machinery suppliers in Taiwan, employing 8,800.

David Wu, general manager at injection molding machine supplier Multiplas Enginery, and also chairman of TAMI’s Plastic & Rubber Machinery Committee, said the machinery market for the country has been growing at a rate of 5 to 8 percent per year, but was largely flat in 2013. Exports dominate production, with 82% of machines made in 2012 headed overseas. An increasing number of those machine shipments are headed to the U.S.

America was Taiwan’s eighth largest export market in 2012 [China, Thailand, Indonesia, Vietnam, India made up the top five] but deliveries to the states jumped 15.3% from 2011 to 2012. The U.S. is also the fourth largest importer of plastics and rubber machinery to Taiwan, trailing only, in order, Japan, Germany, and China.

Importers and exporters of machines, plastic products, and materials will converge on Taipei this fall for Taipei Plas. Founded in 1986, the biennial show, formally called Taipei International Plastics & Rubber Industry Show, will launch its 14th edition this September (Sept. 26-30; Taipei World Trade Center Nangang Exhibition Hall).

In 2012, the event drew attendees from 101 countries, covered more than 45,000 m2, and had more than 15,000 visitors. In 2014, show organizers are projecting the largest Taipei Plas ever, with an anticipated 8.9% increase in exhibitors, 2500 booths, and a 4% increase in visitors, with 16,500 attendees forecast.

Taiwan plastics road trip

Earlier this year, TAITRA organized a tour of several plastics machinery manufacturers located across Taiwan for the global plastics trade press. First up: Victor Taichung Machinery. Founded in 1954 as a manufacturer of machine tools, Victor Taichung Machinery celebrates its 60th anniversary in 2014. Victor Taichung, which has four plants in Taiwan, counts electronics manufacturers Foxconn and Hon Hai among its clients and ships between 1000 and 1200 machines to China annually, with that country accounting for 55% of its exports, according to Martin Li, manager overseas marketing division. The company’s roots were could be seen in its main lobby, with several of its early edition machine tools on display.

Blow molding builds business, looks to expand

Chum Power Machinery, located in Taichung, which is about a three-hour drive from Taipei, was founded in 1981 as a manufacturer of CNC machine tools, according to general manager, Grace Lee. The company began manufacturing PET stretch blow molding machines in 1989, opening the plant we visited in 2010.

In addition to 261 employees in Taiwan, the company has a plant and 140 employees in Shanghai. Given the company’s growth, Lee said Chum Power will move into a larger, to-be-constructed headquarters in Taichung within 3 years. Exporting machines to more than 100 countries, Lee said that more than 30% of Chum Power’s sales come from Africa and the Middle East. Africa, in particular, was a common, growing market for most the of suppliers we visited.

Hybrid and hydraulic opportunities

Fu Chun Shin Machinery (FCS; Tainan City), which recently began selling injection molding machines into the U.S. via representation by Maruka, promoted hybrid technologies during the visit, but company officials were also keen on hydraulically powered machines. FCS representatives noted demand for the traditional drive design exists in Southeast Asia, India, and South America, with North American orders split evenly between hydraulic and electric machines.

In 2014, the company said it would introduce a new generation of electric machines, characterizing the line as a fully Taiwan made product. On that basis, FCS believes it can offer a pricing advantage over Japanese machine competition.

In 2012, the company’s biggest market was Brazil, with $2.5 million in business, while in 2011, Thailand was the company’s top export market with more than $4 million in sales. In 2014, Africa looks to be the top market, with the company booking a $2 million order for Angola.

Fellow injection molding press maker and Tainan City resident, Jon Wai Machinery, began business in 1971 and currently has operations in Taiwan and China. Total manufacturing space covers more than 400,000-ft2 with approximately 300 employees, according to marketing director, Robin Pan.

The company has capacity to build around 1,400 machines/year, with sales and service in about 30 countries, and $60 million in turnover. Pan listed a series of firsts for Taiwanese press makers, including the first two-color press (1977); first proportional hydraulic control (1978), and first microprocessor control (1979). In 1996, the company made its first PET preform machine, with the first 2-platen machine in 2005.

Chen Hsong Group is well known in Asia and globally, founded in 1958 by Dr. Chen Chiang, with an initial public offering on the Hong Kong stock exchange in 1995, and company wide annual production capacity of approximately 15,000 injection molding machines.

In 1980, the company founded a subdivision, Asian Plastics Machinery (APM) in Taiwan. At one time, Chen Hsong had molding machine manufacturing in Hong Kong, Taiwan and China. Today, there is only warehousing in Hong Kong. Plastics Technology toured APM’s production facility in Chung Li, which covers 16,000-m2 and has annual machine capacity of 1800 presses.

In 2015, after successfully re-launching a line of 2-platen presses, Chen Hsong will re-launch an all-electric line. Aron Chao, sales director at APM, said the redesign will occur from Taiwan, with the company hoping to find a partner work on the project, just as it collaborated with Japan’s Mitsubishi on its 2-platen redesign.

“We will try to find a partner, from Europe or Japan, but that's not fixed yet,” Chao said, adding that regardless of the market, all-electric machines represent a growing portion of sales and Chen Hsong wants to participate.

Multiplas Enginery Co. Ltd. is best known for its vertical injection molding machines, but the company’s new factory in Taiwan will allow it have a greater focus on horizontal machine technology. David Wu, Multiplas’s general manager, stressed that foray into horizontal technology, and the company’s R&D roots during a pre-Taipei Plas tour.

Founded in 1988, with a 8000-m2 plant in Taoyuan, Taiwan, the company is building a new 30,000-m2 factory 30 minutes away in Tainan. It also has a 25,000-m2 plant in Kunshan, China. Wu said Multiplas is the number one patent holder for injection molding technology in Taiwan, and the two rows of framed patents covering a wall in its Taoyuan headquarters would seem to support that claim.

Wu said growing demand in the automotive and smart phone markets were currently driving business, of which 90% remains vertical, helping keep the company’s niche.

“A lot of injection molding machine manufacturers won’t make vertical presses,” Wu said, “because every machine is essentially a custom order.”

Film stars for Kang Chyau

Kang Chyau Industry, which launched in in 1988, now has more than 25 years of experience in blown film, selling approximately 4600 machines during that time, with deliveries to Asia, Africa, and Latin America. The company will also participate in Taipei Plas seeking new overseas customers. According to Eric Chang, sales manager, 90% of the company’s sales are for export, making international shows like Taipei Plas key showcases. Its newest product is a recycling line for industry scrap. The company designs die heads, screws/barrels and air rings, then outsources fabrication. During Plastics Technology’s visit, a three-layer blown film line was undergoing testing prior to shipment to Venezuela.

Related Content

All-rPET Bottles with Glued-in Handles Save Material

At K 2022, KHS is showing a 2.3 L PET bottle with glued-in handle that offers 10% material savings and other advantages over clip-in handles. Bottle and handle are both 100% rPET.

Read MoreCoca-Cola Europacific Transitions to Tethered Caps and Lighter PET Bottle

Sidel is converting all Coca-Cola PET bottling lines in Europe to meet new EU packaging regulations by July 2024.

Read More‘Ultrafast’ Machine for Large PET Bottles

Sidel’s new EvoBLOW XL stretch blow molder makes up to 10 L PET bottles at up to 18,000 bph.

Read MoreHow Was K 2022 for Blow Molding?

Over a dozen companies emphasized sustainability with use of foam and recycle, lightweighting and energy savings, along with new capabilities in controls, automation and quick changeovers.

Read MoreRead Next

Reshoring, Taiwanese style

One of the first waves of offshoring to China is ebbing back, as Taiwanese companies rethink manufacturing on the mainland.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)