Taiwan’s Plastics Machinery Sector Sets Sights Beyond China

Taiwan’s machinery industry is in the midst of a western and southern pivot, seeking and finding opportunities in North America and Southeast Asia, as it replaces shrinking business in China.

The country’s biennial plastics show, Taipei Plas, (August 12-16, 2016; Taipei Nangang Exhibition Center) reinforced the island’s shift away from its largest trading partner historically, as China’s plastic industry, and overall economy, retrenches.

“By diversifying our export markets, Taiwan can respond to the decline of Hong Kong and mainland China,” explained Alan Wang, chairman of the Plastics & Rubber Machinery Committee of the Taiwan Assn. of Machinery Industry (TAMI). TAMI is the co-organizer of Taipei Plas along with the Taiwan External Trade Development Council (TAITRA).

New President, New Policy

On Jan. 16, Taiwan elected Tsai Ing-wen as its new president; the country’s first female president and only its second from the Democratic Progressive Party. As a candidate, Tsai spelled out a new “Southward” policy as part of her party’s platform. The policy calls for Taiwan to look toward ASEAN countries and Southeast Asia for greater trade and cultural exchange.

In its official show press conference, TAITRA and TAMI officials spelled out what that outreach looks like at the show, including extensive pre-show trade promotion in 10 ASEAN countries, with very visible results. Compared to 2014, TAITRA said Indian buyers at Taipei Plas were up 22% to 309 while pre-registered Malaysian buyers have virtually doubled from 51 to 99.

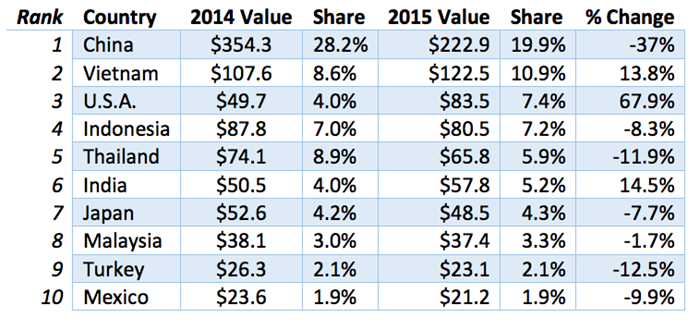

TAMI’s Wang noted that while China is still the largest market for Taiwanese plastics and rubber machinery, its value peaked in 2010 and has been in decline ever since. From 2014 to 2015, the export value fell 37.1%, while shipments to Vietnam (+13.8%), the U.S. (+67.9%) and India (+14.5%) all grew. For the first five months of 2015, Alex Ko, TAMI chairman, said exports to China and Hong Kong were down a further 59.2%.

A Chance to Finish 2016 Strong

For the first five months of 2016, Ko said Taiwan’s plastics and rubber machinery exports were down 8.7% year on year to $476.95 million, but he and others thought more recent data showed a reversal of that trend. China was still the top market to start 2016, but those immediately following it—Vietnam (12% share), Indonesia (7.6% share), and the U.S. ( 7.0% share)—were closing the gap.

TAMI’s Wang said in the second half, his association’s members were experiencing much better order activity, and despite starting the year with a contraction, he believed Taiwan’s plastics and rubber machinery industry could still finish 2016 on a positive note by December. Larry Wei, convener or TAMI’s board of industry supervisors and owner of extrusion and blow molding equipment maker Fong Kee International Machinery Co. Ltd. (FKI; Tainan City), noted that individually, many companies, including his, were doing just fine. In 2015, FKI’s business grew 10% and it was up another 15% in the first half of 2016.

This is due to the fact that despite the government only recently calling for a decoupling from China, many machinery companies had already looked to grow elsewhere, as Taiwanese machinery became too expensive for Chinese processors.

A Strong Event

Despite the contraction in China and its position between the massive Chinaplas and K shows on the calendar, Taipei Plas 2016 grew or maintained its stature, with 533 exhibitors, 2582 booths and 48,000-m2 of space. That’s compared to 530 exhibitors, 2670 booths, and 24,120-m2 of gross exhibit space in 2014. Organizers believed 2016’s total visitors, projected at 18,800, would eclipse 2014’s 18,643, but had not yet released final numbers. The show also set a record with 341 booths from foreign companies, up 36%. In total, 112 of the exhibitors came from overseas, with 34 from China and 332 from Taiwan.

Read Next

Taiwan Takes Its Place Among Machinery Elite

Overshadowed in geographic size and economic output by its neighbor to the east, Taiwan punches above its plastics weight class and is looking to become more self sufficient in its machinery offerings.

Read MoreTaiwanese Machinery Industry Making its Mark on the Global Stage

While Taiwan is small—for perspective Texas is nearly 20 times the island nation’s size—the country is invested in becoming a big player in plastics machinery.

Read MoreTaiwan’s ‘Time is Coming’ For All-Electric Machines

Taiwan’s plastics machinery market is a player on the global stage, except for one segment—all-electric machines. The recent Taipei Plas show suggests that’s about to change.

Read More