Top of the Class: Meet 2015’s World-Class Processors

EXCLUSIVE BENCHMARKING SURVEY

Plastics Technology’s inaugural group of World-Class Processors—selected through an exclusive benchmarking survey—spans geographies, markets, processes, and materials. Diverse in size and capabilities, these companies have one key trait in common: efficiency. How do you stack up in comparison?

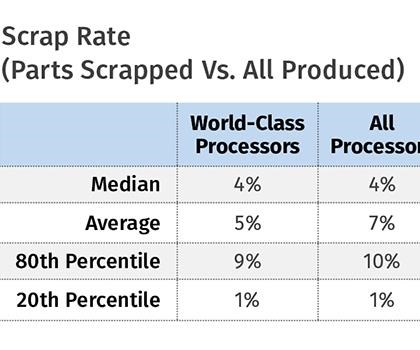

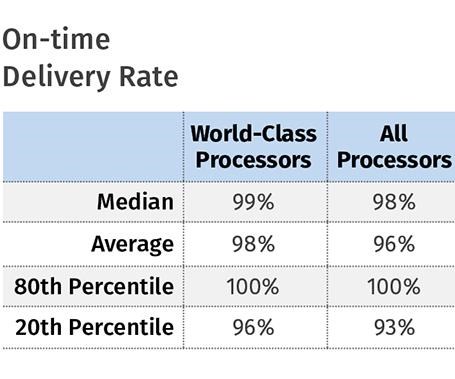

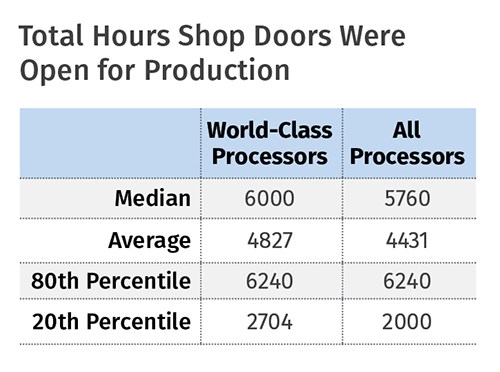

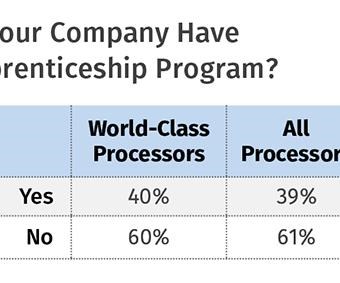

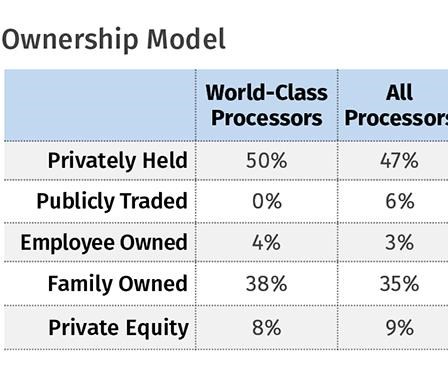

What makes up a world-class plastics processing operation? In an exclusive benchmarking survey sent to subscribers of Plastics Technology in the middle of last year, we attempted to find out. Drawing from a pool of 116 companies who responded to this inaugural survey (virtually all of them custom)—Plastics Technology designated 25 World-Class Processors on the basis of 11 different metrics covering operations, business performance, and human resources. Those measures included everything from scrap and on-time delivery rates to employee turnover and sales growth.

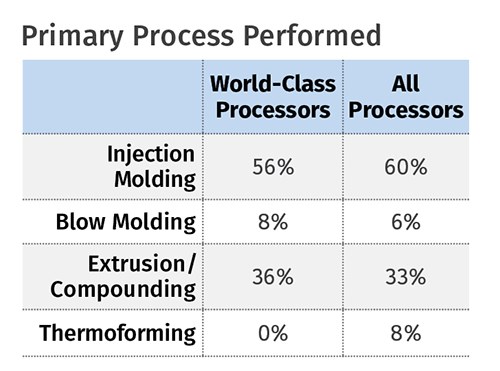

Performance of the responding companies in those 11 different metrics winnowed the field down to a select group that includes injection molders, blow molders, compounders, and extruders of film/sheet and pipe/profiles. The world-class group includes facilities in Mexico and Canada and 11 different states, with multiple firms from California, Michigan, and Wisconsin.

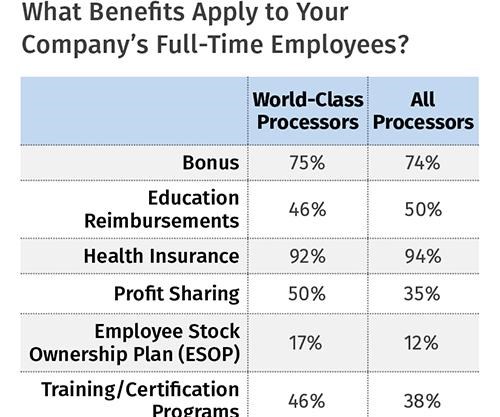

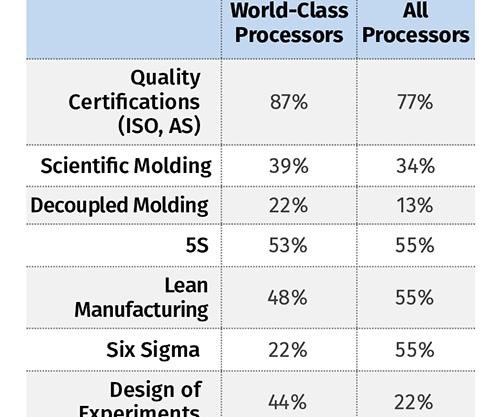

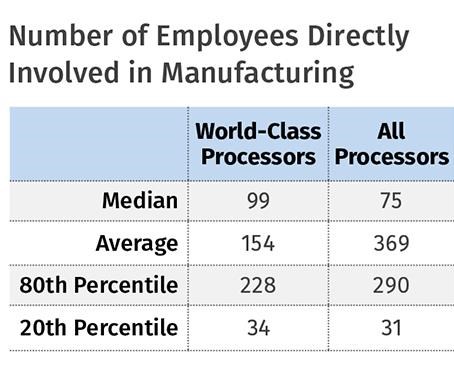

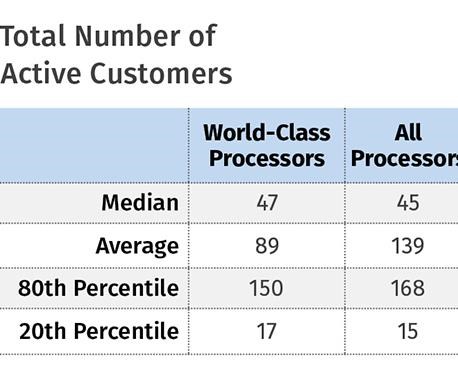

How do you stack up against this group? The charts presented in this article reflect the aggregated responses of companies designated as World Class Processors—the top 20% of those who responded—and compare them with the answers from all of the survey respondents. The charts reflect the companies’ performance in 2014. Those who responded to the survey received the full results.

Making the Cut

Plastics Technology’s 25 World-Class Processors are drawn from a diverse group of plants. Survey respondents hail from 28 states, plus Canada, Mexico, and Puerto Rico. Michigan leads the way with 11 entrants, followed by California (nine), and six each from Wisconsin and Ontario. The total number of primary processing machines among respondents ranges from one to 104, while total employees are from one to 13,300.

By process, 60% of respondents offer injection molding, with 9% extruding pipe/profiles; 8% providing thermoforming and film/sheet extrusion; 7% doing compounding, and 6% blow molding.

By end markets served, industrial (51% of respondents) and automotive (46%) are in the lead, with more than a third serving customers in electrical/electronics, medical/healthcare, and building/construction.

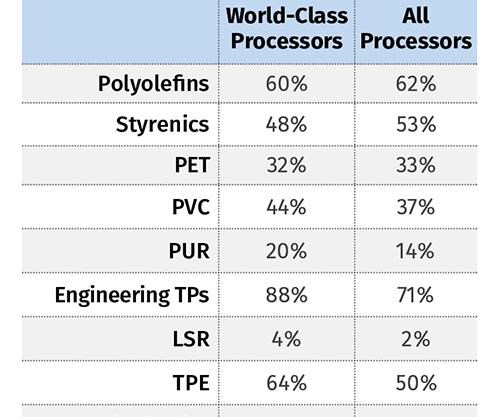

Engineering thermoplastics top the list of resins processed (71% of respondents), followed by polyolefins (62%), styrenics (53%) and TPEs (50%).

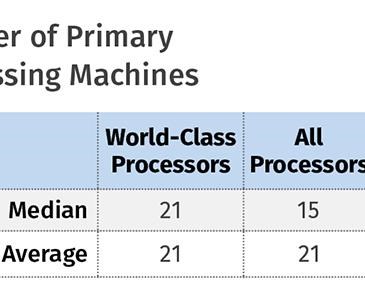

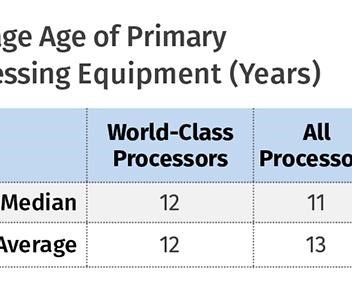

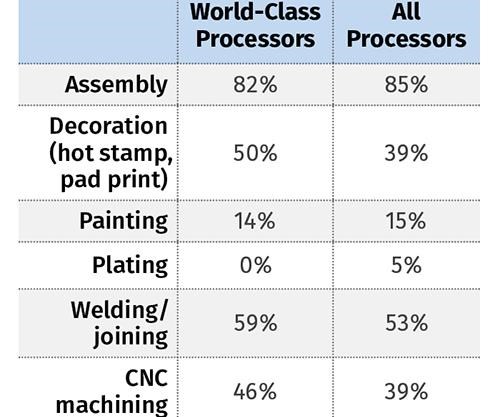

The preceding figures are for all respondents. In comparison, our World-Class Processors average 21 primary processing machines with an average age on that equipment of 12 years. In terms of secondary operations, about 82% offer assembly, with more than 59% providing welding and joining and half offering decoration. Industrial products are the top market (76%) for this group, followed by automotive (60%), building and construction (56%) and consumer goods/housewares (48%). Nearly 90% of the World-Class Processors run engineering thermoplastics, with 64% processing TPEs and 60% utilizing polyolefins.

Of the injection molders, the vast majority operate presses with clamp force up to 500 tons; 90% provide insert molding and 60% offer two-shot molding. On the automation front, 100% use sprue pickers, while 60% use Cartesian-style robots and 40% articulated-arm robotics.

Managing What You Measure

When Craig Porter first joined custom injection molder PlastiCert Inc., Lewiston, Minn., he saw the company’s efforts at benchmarking as mostly “shooting-from-the-hip type stuff.” Today, tracking key metrics is part of PlastiCert’s operating philosophy, informing what it has done and will do. On a monthly basis, Porter, PlastiCert’s president, posts results in a range of key categories in common areas of the facility. “It sounds kind of corny, but it’s the old adage: ‘How do you know where you’re going if you don’t know where you’ve been?’” Porter told Plastics Technology in a follow-up interview.

In the 12 years since joining PlastiCert, which ranked among our World-Class Processors, Porter said benchmarking has ultimately helped establish a baseline of how the company performs in relation to a standard. “We had standards in the system—for example, in terms of how long we thought it should take to make a part—but nobody ever really reviewed whether or not we performed to the standard. Were we above or below? Should we be revising the standards? You don’t know what you don’t know, and we needed to find that out.”

Porter’s stance on using metrics to hold the company to a performance standard was echoed by other members of the World-Class Processors group. Kevin Jensen, general manager of custom injection molder Wadal Plastics, Medford, Wis., was succinct in his company’s reasoning for tracking metrics, noting that doing so alerts them if “something needs attention.”

Steve Simmons, president of custom sheet manufacturer Highland Plastics, Shepherd, Mich., sees metrics as a means to achieving better operations for this World-Class Processor. “The purpose of tracking these metrics is to allow us to benchmark our performance against ourselves and to identify areas that require improvement.”

For Joe Minor, plant manager at electronics injection molder Command Electronics, Schoolcraft, Mich., measuring performance has shown the company where it can do better. “Our purpose in tracking these metrics is to evaluate and challenge ourselves to make improvements,” Minor says. “Benchmarking helps us to work on continuous improvement and to try to find the best possible standard practices to follow.”

What MAKES THEM World Class?

In compiling data from our benchmarking survey to identify the World Class leaders, most results are not all that surprising (such as lower scrap rates for top-ranked companies), but there were surprises (longer average setup time for product/mold changes among the World Class group).

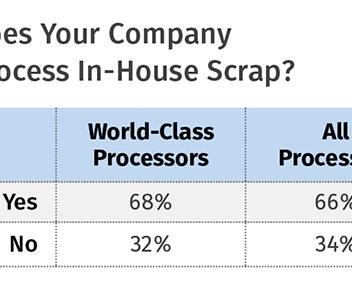

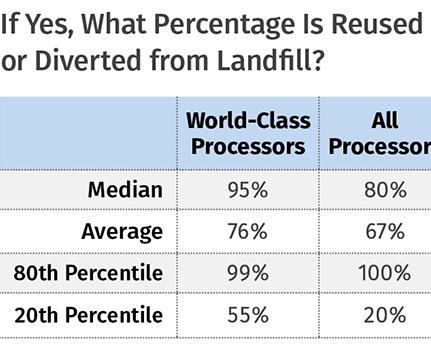

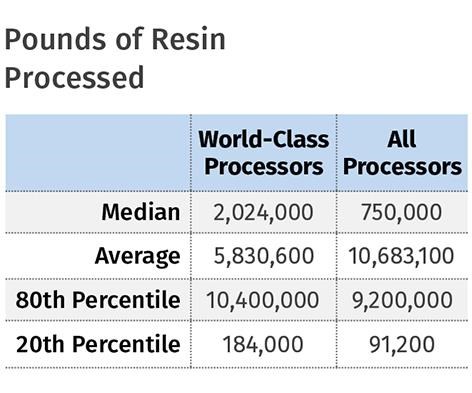

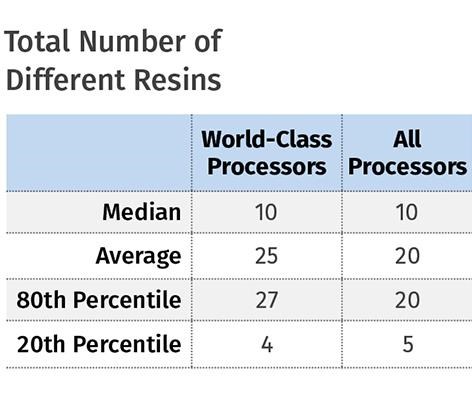

• World-Class Processors run fewer pounds of materials overall, but used more different kinds, including more reclaimed in-house scrap.

• They also have significantly fewer total active customers, suggesting a focus on quality of client vs. quantity.

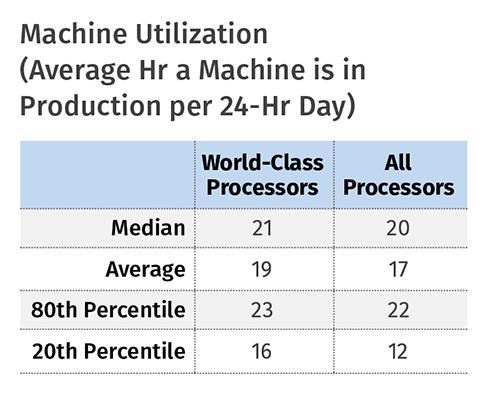

• Also, they log more production hours in the shop and slightly greater machine utilization.

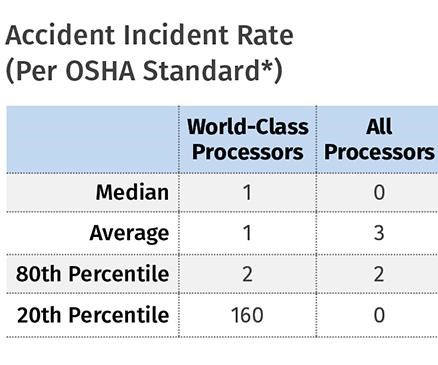

• On-time deliveries are higher and accident rates are lower.

• They also have a significantly lower number of total employees, though direct manufacturing employees were roughly the same, indicating lower overhead.

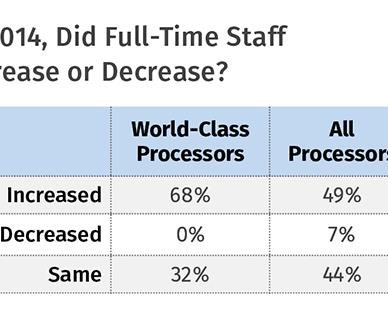

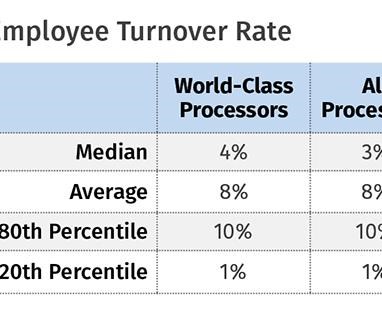

• There is no difference in employee turnover rate, although World-Class Processors finished the year with more employees than they started the year with.

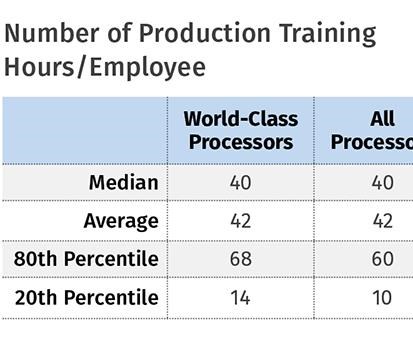

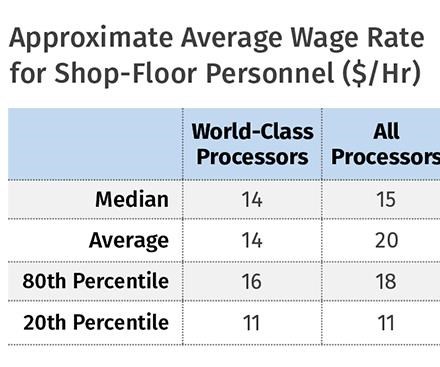

• Somewhat surprisingly, average wages are lower at World-Class Processors and training time is equivalent.

Processing & Business Strategies

Nearly 90% of our World-Class Processors have some kind of certification, ISO or otherwise, and more than 50% apply lean manufacturing techniques. Fully 75% of them offer some value-added services, led by inventory stocking/logistics (78%), shipping/packaging/labeling (78%), and product design (72%). In a clear break from their colleagues, 74% of World Class Processors use process or production monitoring software, vs. only 50% of the broader group. Both, however, utilize ERP to a large extent, with World-Class Processors and everyone else eclipsing 60% usage.

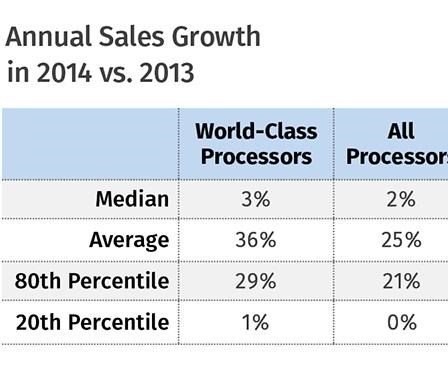

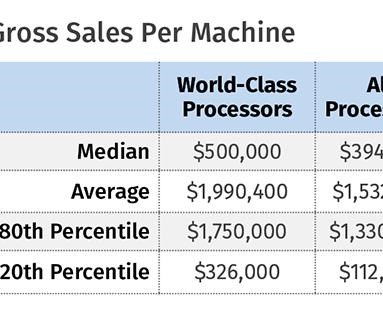

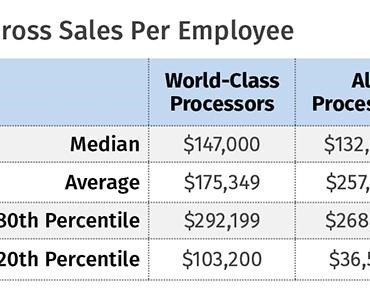

World-Class Processors reinvest more revenue into capital equipment but spend less overall on machinery and more on resins. They see a greater return on those investments, with substantially higher sales growth and sales per machine, although they have lower average sales per employee, though the median is higher.

The role of labor in production has been an area of emphasis for PlastiCert’s Porter, with metrics keeping him abreast of how the company is doing, as well as the workers themselves. “It’s about knowing what your targets are,” Porter says of benchmarking, “How fast you should be doing this job versus how fast you are doing it. It’s more about giving workers the knowledge of not just what’s expected of them, but what they did in the past so they can gauge themselves by it.”

For Simmons at Highland Plastics, workers can continually measure where operations stand using a daily shift summary review culled from 12 production reports over the preceding 24 hours. “This summary report enables us to identify production deficiency trends and address them,” Simmons says, “often before they manifest themselves in unscheduled production downtime.”

Beyond identifying potential problem areas, these numbers push World-Class Processors’ employees to a higher self-imposed standard. “People inherently want to be good at what they do,” Porter says. “Putting the numbers out there—in one way, you’re kind of telling them, ‘This is what you’ve got to do.’ But in actuality, some of the people see the numbers and say, ‘Well I can beat that,’ and you end up getting into a more competitive-type situation where they’re trying to one-up the person that did the job before them.”

Related Content

Design Optimization Software Finds Weight-Saving Solutions Outside the Traditional Realm

Resin supplier Celanese turned to startup Rafinex and its Möbius software to optimize the design for an engine bracket, ultimately reducing weight by 25% while maintaining mechanical performance and function.

Read MoreImpacts of Auto’s Switch to Sustainability

Of all the trends you'll see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

Read MorePEEK for Monolayer E-Motor Magnet Wire Insulation

Solvay’s KetaSpire KT-857 PEEK extrusion compound eliminates adhesion and sustainability constraints of conventional PEEK or enamel insulation processes.

Read MoreSPE Automotive Awards Applaud ‘Firsts’ and Emerging Technologies

The 51st annual SPE Automotive Innovation awards gave nods to several ‘firsts’ and added alternative vehicle systems category.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)