Volume Resin Prices Enter 2019 on Downward Path

Significant declines in feedstock prices, general year-end slowdown, and resin export/import issues contribute to this trend.

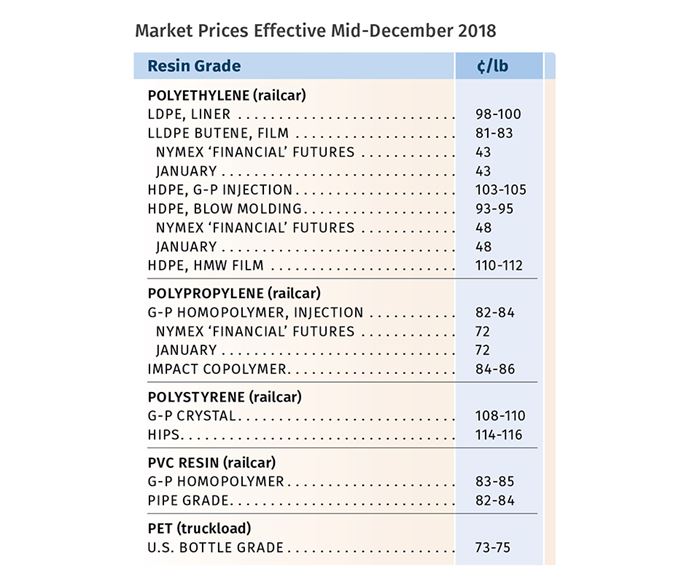

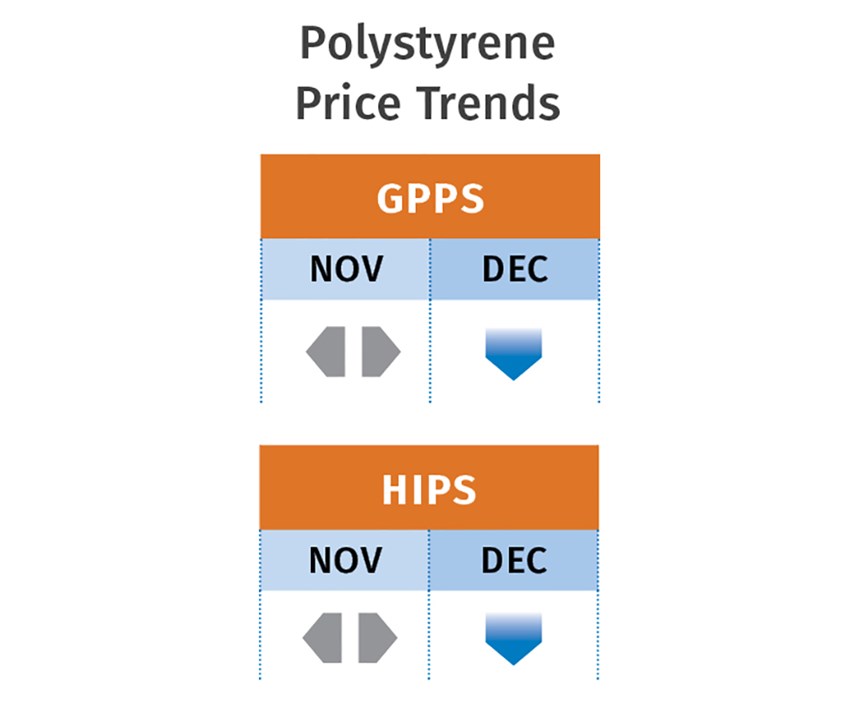

Prices of nearly all volume resins were flat, if not lower in December, with PP and PE showing the most dramatic declines going into the new year. Even the exception in the group, nylon 66, which saw prices spiking throughout 2018, was stabilizing. A drop in feedstock prices, starting with crude oil, was a contributing factor. And then there was a general seasonal slowdown in demand and, in some cases, a buildup in supplier inventories, as well as competition from lower-priced imports.

These were the views last month of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES DOWN

Polyethylene prices dropped 3¢/lb in November and additional decreases of 2-3¢/lb were being offered to some customers going into December, according to Mike Burns, RTi’s v.p. of PE markets. The big change was crude oil dropping from $76 to $50/bbl. Both Burns and PCW senior editor David Barry said the North American PE market has to adjust, particularly because of its need to export. Both noted that the spread between domestic and export prices has been significant— for example, exported LLDPE butene grade fell below 40¢/lb—a 10-year low.

Burns noted that PE supplier inventories are 1 billion lb higher than a year ago. Barry added that PE exports typically have been high in December, and then the market tightens up—but this was not the case in 2018. He noted factors such as concern about a slowdown in the global economy, coupled with the huge amount of new North American PE capacity that has come on stream—with more to come, such as Sasol’s 1-billion lb/yr LLDPE plant in Lake Charles, La., in an already saturated market.

The Plastic Exchange’s Greenberg characterized much of November’s PE spot market as anemic, until the end of the month, when the market sprang to life. “Buyers were driven back to the market for different reasons. Some needed to procure minimal spot material to keep their plants running; while others, pleased with the recent price decline, ordered a bit more to both use and add to their coffers.” He, too, saw potential for even lower prices in December.

As for the new year, PCW’s Barry noted that first quarter could be like 2018’s fourth quarter, with slumping prices unless oil prices turn around and change the PE cost structure globally. But RTi’s Burns noted that PE prices will start the year 5-10¢/lb lower than the industry had anticipated, so suppliers would aim to stop any further erosion. He also expected that strong domestic demand growth of over 7% in 2018 would continue through 2019.

PP PRICES DROP BY DOUBLE-DIGITS

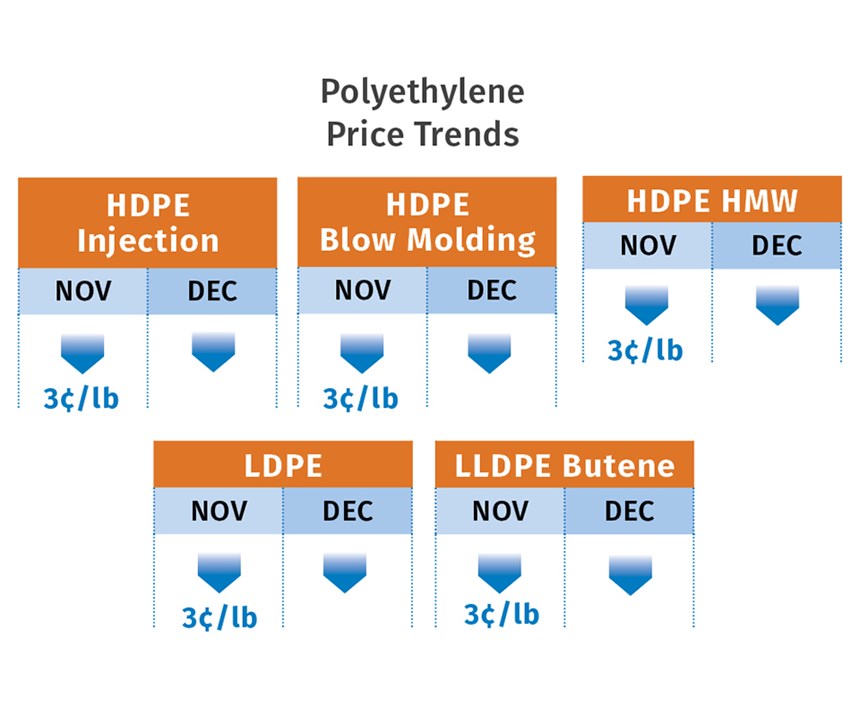

Polypropylene prices fell 10¢/lb in November, in step with propylene monomer and with strong potential to drop further in December, according to Scott Newell, RTi’s v.p. of PP markets. Moreover, all industry sources anticipated monomer contracts to settle at least 5¢/lb lower in December. While, he expected PP prices to follow, Newell noted that PP suppliers had issued margin increases of 3¢/lb for last month. “Our current expectation is that some of that 3¢/lb margin has the potential to go through. We have been the highest priced in the world for both monomer and PP, and demand destruction took place. At the same time, propylene monomer supply has grown significantly—PP prices are now correcting.”

PCW’s Barry said he was on-the-fence about whether suppliers would be able to get any margin increase, citing plenty of low-cost PP imports and ample spot PP spot material available domestically, contradicting the tightness claimed by suppliers. He ventured that PP prices would be flat to higher in the first quarter, based on historical buying trends, which predict strong demand from processors who managed their year-end inventories, particularly at lower prices.

Newell noted that with domestic PP prices coming down, PP imports will not look as attractive in 2019. “PP prices had the potential to move quite a bit lower than what the industry may have expected due to new market dynamics—oil at $50/bbl, which made heavy feeds like propylene become more attractive to produce, adding to an already built-up monomer supply.”

Characterizing PP spot market activity as very robust going into December, Greenberg reported, “The sharp and swift market correction has shut down the import arbitrage; therefore, we expect much fewer speculative pounds inbound during December, which could eventually lead to a lack of PP supply early in the New Year.”

These sources also see the potential for price volatility arising from oil price movements and cold-weather plant disruptions.

PS PRICES DOWN

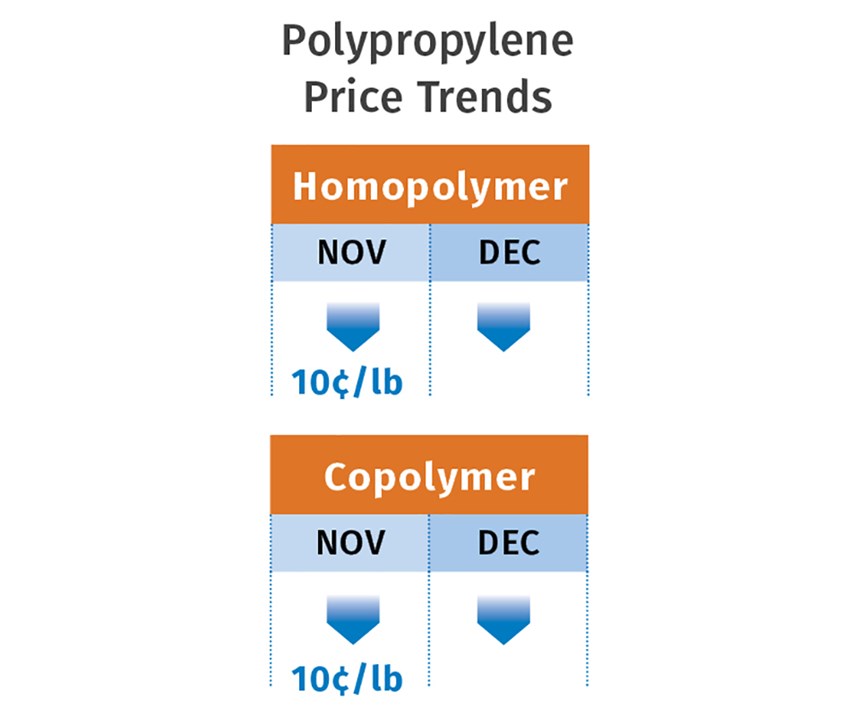

Polystyrene prices held even in November, but there were industry reports the suppliers were offering price concessions of up to 7¢/lb in December. According to PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, price discounts should have been even greater, considering the double-digit price decline of both benzene and butadiene feedstocks, along with a drop of at least 7¢/lb that was expected for styrene monomer.

Barry reported that based on falling benzene costs, spot prime PS prices were expected to fall at least 5¢/lb in December. Based on a 30/70 formula of spot ethylene and benzene, implied styrene monomer production costs were 26¢/lb in early December, down from 33-34¢ in October. Actual spot monomer prices dropped by 62¢/lb to 39¢/lb in that time frame. Chesshier anticipated that PS prices in January would be flat, but the first quarter could see some upward pricing pressure driven by feedstock prices rebounding—e.g., benzene is seen as underpriced—along with the ever-present possibility of unplanned feedstock outages.

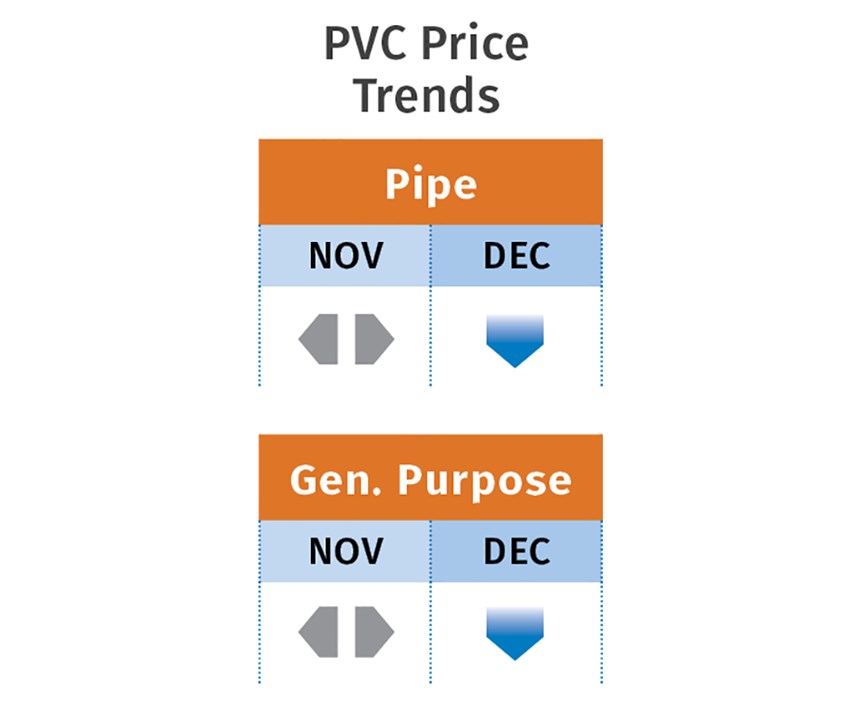

PVC PRICES FLAT TO DOWN

PVC prices were flat in November, but suppliers called for a 2¢/lb increase for December. Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, and PCW senior editor Donna Todd both saw this hike as unlikely to succeed.

Todd reported that the price hike was viewed very unfavorably by resin buyers. “For one thing,” she said, “December price increases—the last of which occurred in December 1988—don’t work. Demand is at the lowest point of the year, meaning processors have no incentive to pay more for resin they don’t need.”

Characterizing the price-hike announcement as a “bargaining chip,” Kallman did not expect the increase to be realized. While spot ethylene prices rose very slightly in November, ethane prices were dropping, and late-settling November ethylene contracts were expected to remain flat or drop by 1¢/lb or so. “There are no supporting feedstock costs for a PVC price hike, along with falling global ethylene prices due to low crude-oil prices,” Kallman said. He ventured that PVC contract prices this month would be flat and more likely down as negotiations concluded. He expected some upward pressure in February and March due to planned plant shutdowns.

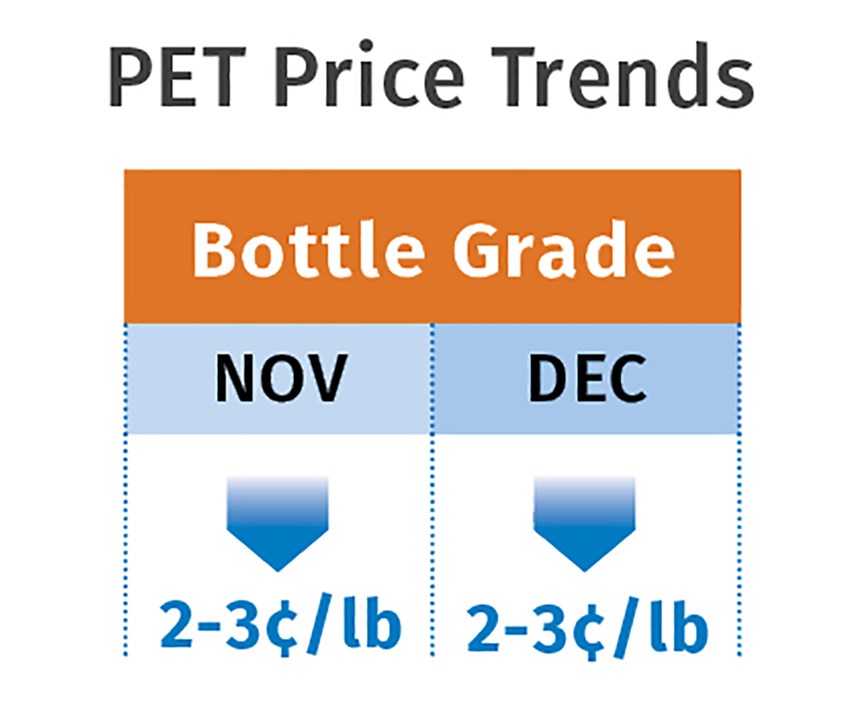

PET PRICES HEADING DOWN

Prices for domestic bottle-grade PET were in a wide range of 68¢ to 75¢/lb in early December, for domestic and import, truckload and bulk truckload (48,000-lb), according to PCW senior editor Xavier Cronin. The lower end was for higher-volume deliveries, including railcars (190,000 lb) to Midwest locations. This compared with the narrower range of 70-72¢/lb through most of November.

Cronin reported that PET prices were poised to drop 2-3¢/lb in December as the cold-weather season in most of the U.S. kicked in, and demand for soft drinks and water in PET bottles dropped off. At the same time, there was increased demand for both PET and HDPE for bottle production in California due to the wild fires that devastated the state in November. This was expected to increase prices for PET in West Coast markets by January as inventories at bottle-producing plants are used up.

Meanwhile, PET from Malaysia was at 75¢/lb to U.S. East Coast and West Coast ports. PET was again available from the five countries—Taiwan, South Korea, Indonesia, Pakistan and Brazil—for which anti-dumping duties were lifted. PET from South Korea was available for delivery to the U.S. West Coast by February, although demand from Europe was drawing some Korean PET to that region, given higher prices offered by some E.U. countries and lower shipping costs compared with the U.S.

ABS PRICES DOWN

ABS prices continued flat through November, but a “sea change in all key feedstock costs” was expected by RTi’s Kallman to result in lower prices starting in December. He a decline of 3-5¢/lb per month over a two-to-three month period.

In addition to a 69¢/gal drop in benzene prices from November to December, butadiene prices came down about 22¢/lb globally since October. Ditto for acrylonitrile, which declined about 10¢/lb. Moreover, prices of Asian ABS imports had dropped substantially, making an adjustment to domestic ABS prices necessary.

PC PRICES FLAT-TO-DOWN

Polycarbonate prices were trending down in the last two months of the year and double-digit decreases were expected this month as new-year contracts were being negotiated, according to RTi’s Kallman. This would shave off quite a bit from the 2018 first quarter price hikes of up to 14¢/lb. “The market has gone from well-balanced to oversupplied due to an influx of lower-priced Asian imports and ample domestic availability,” he said.

PRICES OF NYLON 6 LOWER; NYLON 66 STABILIZING

Nylon 6 prices moved up by a couple of cents in the fourth quarter, with suppliers partially successful in implementing their September 5¢/lb increases, according to RTi’s Chesshier. The decline in benzene prices prevented full implementation. “The market dynamics are on the side of processors with prices of key feedstocks dropping, including caprolactam, along with a balanced supply/demand situation.” Chesshier anticipated that processors would seek price concessions in December, which would materialize by this month at the latest.

Nylon 66 prices, after spiking in the range of 25-40¢/lb in the first and third quarters of last year, continued to move up in early fourth quarter but stabilized thereafter, according to RTi’s Kallman. Prices in the last two months of the year and into this month were likely to remain flat, with the possible exception of some processors hit with delayed price hikes. Relative stability was attributed to a drop in key feedstock prices; the start of a general improvement in supply of both intermediates and resins, particularly in North America; a certain degree of conversion from nylon 66 to alternatives; and a global slowdown in automotive. Kallman ventured that there was some potential for the market to appear more balanced as early as midyear.

Related Content

The Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

Read MorePrices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More