Volume Resin Prices Mostly Up

At the conclusion of the first quarter, the price trajectory was upward, except for PP and nylon 6.

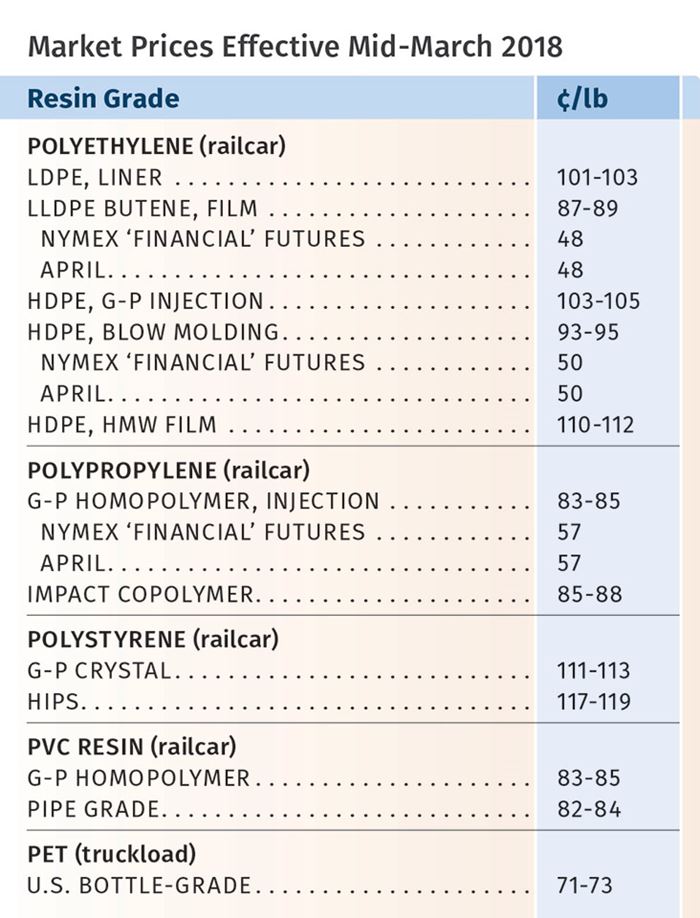

Tight monomer and/or resin supplies and, in some cases, higher feedstock costs, resulted in higher prices by the end of the first quarter for PE, PS, PVC, ABS, PET, PC, and nylon 66. The exceptions were PP and nylon 6; the former’s prices moved up a whopping 11¢/lb between December and January, though they are anticipated to drop by the same amount or more by this month; while nylon 6 prices remained flat through the first quarter, following a December 5¢/lb increase.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of the Plastics Exchange in Chicago, and Houston-based PetroChemWire (PCW).

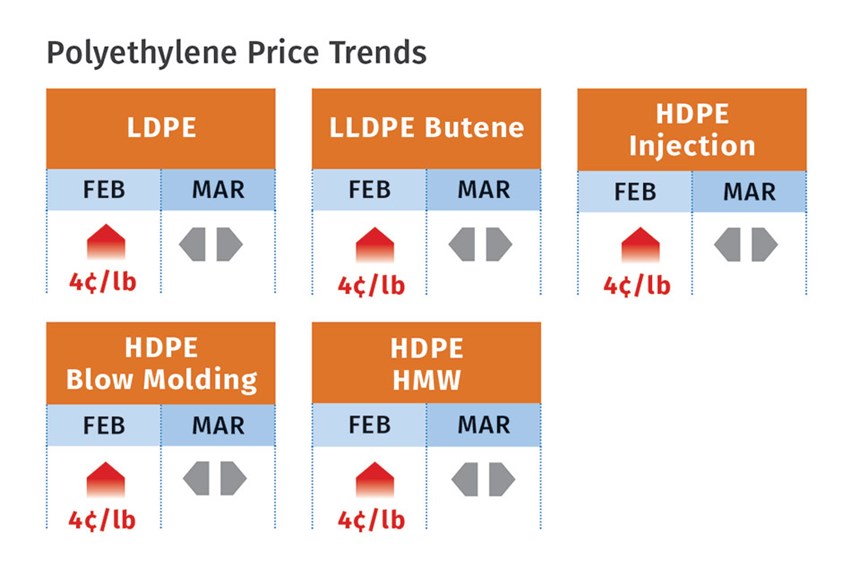

PE PRICES UP

Polyethylene prices moved up 4¢/lb in February, and film processors increased prices to cover the latest increase, noted Mike Burns, RTi’s v.p. of client services for PE. Meanwhile, suppliers were still posting a March 3¢/lb increase. Since July 2017, prior to Hurricane Harvey, PE contract prices have increased by 11¢/lb, according to Burns. He anticipates that higher oil prices, which have firmed up global PE prices, will continue to be a significant factor behind the sustained PE price hikes.

With regard to the March increase, The Plastic Exchange’s Greenberg reported that processors remained optimistic that as new PE production becomes more visible, it will help put a cap on pricing. Similarly, Burns ventured that PE prices may have peaked with a rollover in both March and April. PCW reported the PE spot market as tight for most grades, with firm prices, and projected that domestic prime material direct sales would slow in March as suppliers aimed to implement another 3¢/lb.

RTI’s Burns characterized demand as good and noted that while the American Chemistry Council’s data showed supplier inventories to be high, resin availability did not appear to match the data. He expected PE prices generally to remain firm through the second quarter due to higher global PE prices

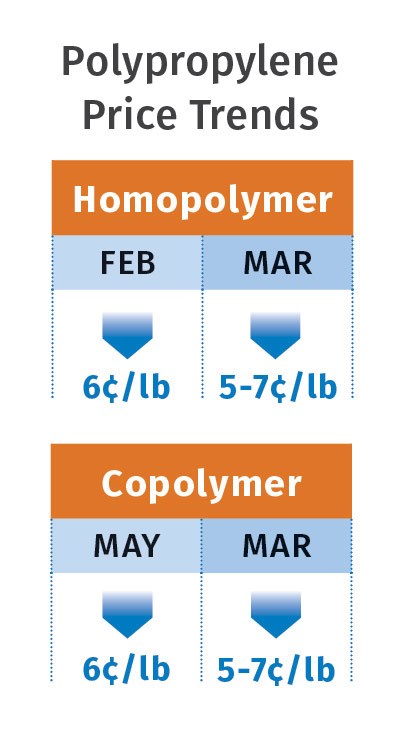

PP PRICES DROP

Polypropylene prices dropped in February by 6¢/lb in step with propylene monomer. Further decreases were expected for March, according to RTi’s v.p. of PP markets, Scott Newell. He predicted a potential drop in the neighborhood of 5-7¢/lb, based on anticipated lower March monomer contract settlements, and noted that U.S. spot monomer prices are now the lowest in the world.

The reversal in the pricing trajectory followed increases of 11¢/lb in December and January, which resulted in demand destruction. Newell expected a significant rebound in demand across the PP polymer chain as early as last month. He expected PP imports to drop back to limited volumes, noting that domestic supplier inventories were in good shape, and he anticipated that PP production rates would ramp up. At the same time, both Newell and PCW ventured that monomer prices could bottom out this month. Newell projected April PP prices to be flat, despite Braskem’s announcement of a 5¢/lb increase for April 1. “This is a margin-expansion increase that will be tough to implement it. I don’t see it as a slam dunk. In suppliers’ best-case scenario, they might get a couple of cents.”

PCW characterized PP spot activity as limited, with lower prices as the market looked for better clarity on March monomer values. The Plastic Exchange’s Greenberg reported that as a result of the February collapse in monomer prices, buyers and sellers of PP had developed widely varying price expectations. “Processors have clearly backed away from the market, seeking minimal supply to fill in gaps, while they wait for prices to fall further.”

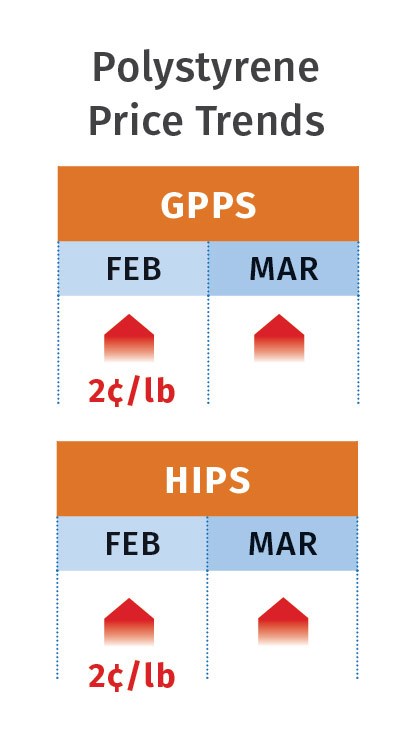

PS PRICES HIGHER

Polystyrene’s price moved up 2¢/lb in February, and suppliers issued increases of 4¢/lb for March 1. The key drivers behind the latter, according to both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS and PVC, were tight styrene monomer supplies and higher butadiene costs. Both observers also expected this upward pricing trend would last through March and into at least part of April.

They expected most of the new increase to be implemented. Kallman noted that while March benzene contracts settled down 5¢/gal and could drop farther, February styrene monomer contracts settled 5¢/lb higher and were expected to move up again in March due to planned and unplanned production outages. There were also reports that the tightness was leading to monomer imports from Europe. Depending on the recovery of the monomer market, Kallman said prices may peak this month, with some potential for further upward movement.

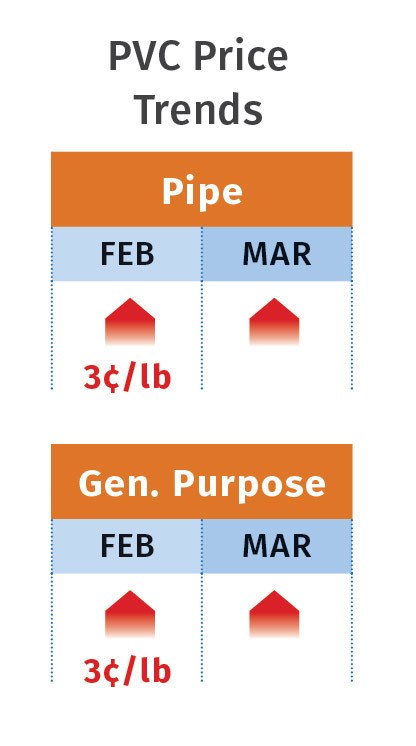

PVC PRICES UP

The February 3¢/lb PVC increase was fully implemented, according to both RTI’s Kallman and PCW, and suppliers were intent on pushing through a March 4¢/lb price hike. Moreover, there was talk from at least two suppliers that they would likely come out with an April increase.

PCW cited an industry source that projected that the March increase would get split in half between March and April. Kallman noted that it was unlikely that even half would be implemented in March. He cited a 2.75¢.lb reduction in February ethylene contract prices, which translated to a 1.4¢/lb cost reduction for PVC. He ventured that April PVC prices would be flat to higher, depending on domestic demand if the construction season has a strong start, as well as export demand and whether all planned PVC production shutdowns are completed. PCW noted that after years of using ethylene pricing to justify PVC price increases, suppliers are now aiming to shift buyers’ attention to supply and demand, plant downtime, high export pricing, and rising freight costs.

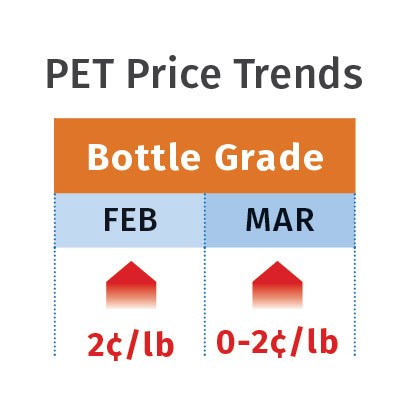

PET PRICES MOVING UP

PCW reported that domestic bottle-grade PET resin on March 7 was at 71-73¢/lb for railcars, bulk trucks and truckloads delivered to the Midwest, flat or a couple of cents higher than in January and February at 71¢/lb. Imported PET with an IV of 78 or higher was at 67-69¢/lb delivered duty-paid (DDP) to the West Coast, and 69-70¢/lb DDP to the East Coast, up 2-4¢/lb from February. Some offers were as low as 61-63¢/lb FAS (Free Alongside Ship) to New York-area ports with transit time of 6-8 weeks from locations in Asia.

For April, PCW expected domestic PET prices to rise 1-3¢/lb from March, due to a drop in imports from five countries that accounted for about 42% of all imports in 2017. This drop is the result of anti-dumping duties expected to be imposed on these countries at the end of March. The countries are South Korea, Indonesia, Brazil, Pakistan and Taiwan—which was the number-two source of PET imports after Mexico last year. Antidumping duties were imposed on PET imports from China, India, Oman and Canada in 2014.

Supply has been limited due to M&G Chemicals idling PET plants in Apple Grove, W. Va., and Altamira, Mexico, in October when M&G subsidiaries filed for bankruptcy protection. On March 6, it was announced that the bankruptcy court auction of M&G Polymers’ unfinished Project Jumbo PET plant in Corpus Christi, Texas, and other assets was scheduled for March 19. The plant is about 80% finished and has a design capacity of about 2.4 billion lb/yr. Expected to be the world’s largest PET plant, the earliest it is expected the come online is the second quarter of 2019.

ABS PRICES CLIMBING

Prices of ABS moved up 5¢/lb in January, and suppliers issued price hikes of 6-7¢/lb for March 1. RTi’s Kallman expected suppliers to be successful in pushing through the latest increases by this month. Despite a drop in benzene contract prices, resin increases were driven by a 5¢/lb hike in styrene monomer in February, with more expected in March, along with a 13¢/lb increase in butadiene and higher global ABS prices. Demand is expected to be steady throughout the year.

PC PRICES UP, THEN FLAT

Suppliers of PC resin were forceful in implementing increases of up to 14¢/lb in January. Independent compounders, meanwhile, were passing through similar double-digit increases on their PC compounds in February and March, according to RTi’s Kallman. The move was driven by a tightened market due to production issues for intermediaries.

Still, prices of PC resin and compounds were expected to be flat this month, given lower benzene and propylene prices. Kallman characterized the global PC supply/demand situation as tight due to both planned and unplanned outages, including major capacity expansions in Asia being slowed. He expected demand to continue to be good, driven by automotive, electronics and construction.

NYLON 6 FLAT; NYLON 66 UP

Following a 5¢lb increase in December, nylon 6 prices were flat in January and February and were expected to remain flat in March and April, according to RTi’s Kallman. One supplier issued a 10¢/lb increase for April 1. Noting that there did not appear to be industry support for this initiative, Kallman also said, “We have improved domestic production following two force majeure actions. I don’t much expect further upward price movement.” He foresees generally flat prices with possible downward movement in the middle of the second quarter.

Nylon 66 prices moved up 5-10¢/lb in January and again in February. March was expected to be flat for base resin, with some carryover of the increases for compounds, according to Kallman. Driving the price spikes is a market that went from a “bit tight to quite tight” due to unplanned outages in production of intermediates, one domestic force majeure and three in Europe. Kallman said PC prices this month would be flat to higher. He anticipated upward pricing pressure if the market remains tight and cited strong demand expected from automotive as well as construction, electronics and appliances, along with generally strong global GDP growth expected this year.

Related Content

Scaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

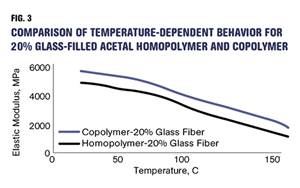

Read MoreHow Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

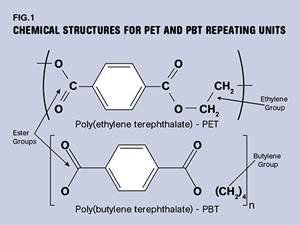

Read MorePBT and PET Polyester: The Difference Crystallinity Makes

To properly understand the differences in performance between PET and PBT we need to compare apples to apples—the semi-crystalline forms of each polymer.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More

.png;maxWidth=300;quality=90)