What’s the True Cost of Buying A ‘Low-Cost’ Mold Overseas?

The head of a Canadian moldmaking company exposes the limitations of focusing solely on initial purchase cost when considering mold sourcing in China.

Have quality and value somehow gone out of style? As a moldmaker serving the automotive industry, we’re tasked to design and build our molds to work consistently at high levels of quality, lowest cycle-time, and maximum cost-effectiveness over the total length of a program, which is often several years. Our goals are the same as our OEM and tier 1 customers: produce high-quality parts at the best piece-part cost. But all too often the decision whether to source a mold from North America or China often rests on initial acquisition costs alone, and we believe this is a shortsighted approach.

Why do molds get sourced from China? For one thing, direct-labor costs remain extremely low in China. While Chinese moldmakers earn good salaries in China, that remains a small fraction of the wages we typically pay experienced and more productive North American moldmakers. And any upward adjustments in salary structure have been offset by the Chinese government’s policy of pegging the value of the renminbi currency unit at an artificially low level relative to the U.S. dollar, all part of a concerted effort by the Chinese government to compete for manufacturing business against North American firms.

After a greater than 10% rise in value during the 2011-2013 period, the renminbi has remained relatively stable in the area of 6.2 renminbi to the dollar for the past two years. Even with the recent slump in the renminbi’s value, the current level remains about the same as before. This is part of what continues to drive Chinese competitiveness. According to some observers, the recent acceptance of the renminbi by the International Monetary Fund (IMF) as a global reserve currency (along with the dollar, euro, British pound, and Japanese yen) will limit the Chinese government’s ability to manipulate its currency’s trading value. However, recent economic instability in China is keeping that value low.

The effect of outsourcing to Asia—primarily to China—on the moldmaking industry really can’t be understated. David Palmer, Chairman of the Canadian Association of Moldmakers was recently quoted in Canadian Plastics magazine: “As the automotive sector transplanted manufacturing to overseas locations, die and mold makers were left reeling, particularly in small, family-owned shops with five to 100 workers. An estimated 150,000 tooling jobs have been lost in North America since 2000 due to offshoring.”

A MOLDMAKER’S SOLUTION

In order to offer options for clients, Unique Tool and Gauge first began looking at China a little more than a decade ago and we saw three potential paths to success there: Either 1) set up shop in China, 2) do a joint venture, or 3) develop relationships with existing Chinese moldmakers and work with them. There were potential benefits, as well as significant drawbacks, to each strategy. We chose to develop relationships with a number of higher-quality mold builders, with a lot of effort and no small amount of pain along the way. It’s worked for us.

First and foremost, the ability to supply a good mold from China is no substitute for the continued focus and heavy investment in our North American operations. Also, the related costs and inherent difficulties in maintaining an effective supply chain across 10,000 miles are not to be undertaken lightly.

However, we have also seen the occasional moldmaker that has chosen to supply its customer base from China just to maintain top-line growth in a difficult economic environment. We’ve also seen the same company find its cost structure become unbalanced, and we know of shops that have gone under for this very reason.

While there seems to be a reshoring trend for molded parts in some industries, automotive tooling projects are a different situation altogether. Despite talk of rising labor costs in China, we still haven’t seen the number of mold jobs we quote being reshored in any significant numbers. In fact, the number of RFQs we see requesting “China or L.C.C.” (low-cost country) remains constant, or is even growing slightly.

However, to source a mold in China or elsewhere in Asia involves managing and dealing with the potential compromises that are an everyday fact of life in the Chinese market.

First, our experience suggests that mold design takes longer in China than it does here. When we source a mold in China, we always need to revise mold designs, sometimes several times until it’s correct.

Second, while mold construction is significantly faster in the Chinese shops we work with, we just about always find that, upon inspection, we need at least some rework to be done, and we will always conduct an initial mold trial prior to shipment to our location in Canada, where we then tear the mold down for inspection and then always conduct an additional mold trial to make sure the mold is right before it goes to the customer.

In both of these areas—design and build—we can trace the additional time needed due to manpower issues and practices. The simple fact is that the value of a competent individual employee isn’t recognized in China the same way it is here. Turnover is rampant, as workers come to urban areas in search of jobs and money and then leave those same urban areas and return to their rural home cities and towns when they’ve saved up enough money.

Our Chinese partners spend significant time and energy training and retraining a transient workforce. A factory worker in China remains an easily replaceable commodity. Our experience tells us that it’s rare to find a senior Chinese moldmaker in the workforce with more than five years of experience. The North American moldmakers we compete with, like us, all boast senior, highly skilled work forces, with experience levels three to five times what we normally find in China.

As a consequence, it’s little surprise to anyone that when a firm bids directly against Chinese shops, it can’t compete. However, if we build the tool there, utilizing our program-management system, we do become more competitive, although there are several hurdles to overcome.

Let’s begin with the issue of materials. In China, the high-quality materials North American moldmakers use as a matter of course are either subject to a value-added tax, or are typically not readily available. Complex supply-chain issues are an everyday occurrence, as the world-class materials we specify and utilize might take up to a month by boat to reach China from our European suppliers.

If we don’t specify all the materials in complete detail, there will typically be problems. A Chinese equivalent to P-20 steel costs a great deal less than the mold steels that we would normally specify. However, the quality will be different and in all likelihood will not be up to par. As a consequence, we need to control tightly all material inventories and obtain certifications at every step of the way, so that cheaper materials are not substituted. We audit the certifications and we conduct metallurgy tests. Material substitution is more common a problem than you would think.

The Chinese approach to mold design is different as well. We, like our North American competition, design for functionality and ease of maintenance while in service for the long term, which may be five years or more. A typical Chinese mold is not designed for ease of service. A Chinese mold is also typically built for a production environment characterized by lower volumes and shorter in-service requirements. China believes in full employment for its society, so firms there are able to throw many additional people into the production mix to design and build a tool. More people usually equals more parts, which translates into more problems.

The end result is that it’s often more difficult and time-consuming to service a Chinese mold here in North America.

CONSIDER ALL THE COSTS

I might add that molds directly sourced in China are not constructed with optimal cycle times in mind. The combination of design philosophy, inferior materials, and reliability concerns all translates to increased cycle times, which is unacceptable in the North American injection molding environment.

Our experience has also shown that Chinese moldmakers take more hours to complete the same job, but that time disparity is more than offset by the aforementioned low labor costs. The direct consequence is that there are significant cost advantages for a Chinese molder, since direct labor makes up such a large percentage of the cost of a new mold.

Do Chinese moldmakers guarantee their work? No, they don’t, and in all candor, why would they? They know the aggravation, cost and time to send a mold back from North America to be fixed in their shop isn’t worth the bother for their North American customers.

We, of course, guarantee our work, as do other North American mold builders who work in China. In practical terms, what that most often means is we are forced to do one or more trials in China before we accept the mold, and we still take the mold apart for inspection and conduct an additional trial here in North America before we ship to the customer.

Do Chinese moldmakers operate with different payment terms? Yes, they do. They want to full payment prior to shipment. Payment options are limited. Contrast this with North American moldmakers who are used to working with their customers in an environment where flexible payment terms are the norm.

Automotive tier 1 companies and their tier 2 molders continue to classify moldmakers as suppliers of commodities. They combine this practice with a perplexing approach to sourcing that splits initial mold cost and the cost to service that mold during production operations into two distinct and separate categories that are not analyzed in concert with one another. Thus, they wind up focusing on counting their savings on mold acquisition instead of focusing on the finished piece-part cost over the life of the program.

OEMs, along with our tier 1 and tier 2 molder customers, should consider that they’re not really in the mold-purchasing business, but rather that they’re in the business of producing good parts at a good price. The North American moldmaking community has a strong, vested interest in the success of their products throughout the entire product life cycle, and that, more than anything else, explains the real difference between the cost of a mold built here and one sourced from China.

Related Content

Hot Runners: A View from the Bottom Up

Addressing hot-runner benefits, improvements, and everyday issues from the perspective of decades of experience with probably every brand on the market. Part 1 of 2.

Read MoreHow to Mount an Injection Mold

Five industry pros with more than 200 years of combined molding experience provide step-by-step best practices on mounting a mold in a horizontal injection molding machine.

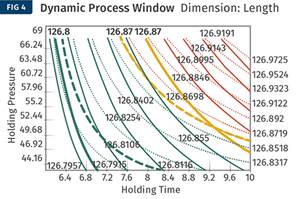

Read MoreOptimizing Pack & Hold Times for Hot-Runner & Valve-Gated Molds

Using scientific procedures will help you put an end to all that time-consuming trial and error. Part 1 of 2.

Read MoreHow to Start a Hot-Runner Mold That Has No Tip Insulators

Here's a method to assist with efficient dark-to-light color changes on hot-runner systems that are hot-tipped.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)