Your Business Outlook - August 2002

Electronics Molding Is on the Rebound

Shipments of electronic devices should recover in early 2003 and could exceed this year's totals by up to 10%. Based on interviews with injection molders of electronics parts, Mastio & Company's latest North American Injection Molding Market Study forecasts average annual growth of 7% through 2006.

Shipments of electronic devices should recover in early 2003 and could exceed this year's totals by up to 10%. Based on interviews with injection molders of electronics parts, Mastio & Company's latest North American Injection Molding Market Study forecasts average annual growth of 7% through 2006. Resin consumption will have grown to 785 million lb from 556 million lb in 2001.

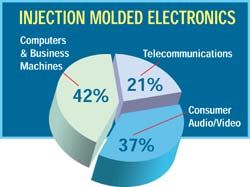

The electronics marketplace divides into three end-use categories: computers and business machines, consumer electronics, and telecommunications. The computer and business-machine segment represents approximately 42% of the injection molded electronics market, in terms of resin poundage. Consumer electronics, such as audio and video equipment, constitutes another 37%, and telecommunications represents the remaining 21%.

Last year saw a sudden decline in electronic shipments. Wireless phones, for example, dropped by about 300,000 units, and 2002 appears fairly flat. Shipments of desktop computers could be down as much as 1 million units.

Because of tremendous pressure for cost reduction, electronics production has shifted from the U.S. to low-labor-cost areas such as Mexico and China. Also, electronics firms have reduced capital expenditures for developing new products.

Computers hum

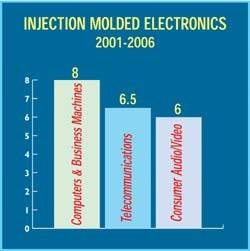

The computer and business-machine market offers molders the greatest opportunity, with a projected growth rate of almost 8%/yr to 2006. Molders in this market believe the PC segment is leveling off and will pick up in 2003. However, a closer look shows variability among product groups. Desktop computers are still projected to be down by almost 1 million units in 2002 from 34 million sold domestically in 2001, while laptops are forecasted to grow 10% from last year. PC shipments are projected to be 40% higher by 2006, for 8% annual growth.

On the other hand, Mastio is forecasting marginal domestic growth for printers and copiers. As mentioned above, many computer and business-machine processors have shifted molding and assembly to Mexico and the Pacific Rim.

Pagers and PDAs surge

The telecommunications market segment is poised for growth. The product life of cell phones is shrinking from 32 to 18 months, and molders believe it will shrink even further. Annual consumption of cell phones could increase by 70 million units by 2006.

Personal communication gadgets are the fastest growing injection molded telecommunications product. These include PDAs, wireless products, and pagers—especially "Blackberry"-type large, deluxe pagers used to read e-mail. Although North American consumption of such devices benefits primarily international molders, domestic processors should expect to see average growth in consumption of 6.5%/yr through 2006.

Exodus of TV producers

Virtually all consumer electronics are imported, with the exception of televisions. Some 95% of all radios are made in China, Taiwan, and South Korea. Almost all cameras and camcorders are imported from Japan, and most VCRs are made in Pacific Rim countries. Sales of these products is projected to grow; the fastest growing injection molded consu-mer-electronics product is the DVD player.

Over 50% of TVs are made outside North America. There are only two TV manufacturers remaining in the U.S. One processor noted there will be 100,000 fewer TVs produced in North America this year than in 2001. Even Mexican manufacturers of 13- and 19-in. sets are moving production to China. Digital and projection TVs have the most potential for growth. Overall, the consumer audio/video electronics segment is forecasted to grow 6%/yr to 2006.

Mastio & Company, based in St. Joseph, Mo., is a well-known consulting firm specializing in industrial-consumer opinion research and market trends in the plastics industry. For more information, call (816) 364-6200 or visit www.mastio.com/pt/outlook.html.

Read Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More