Articles

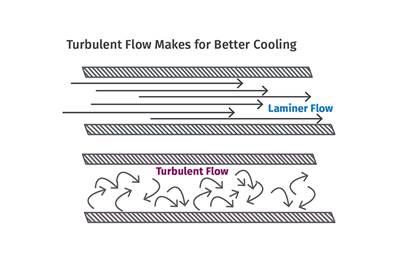

Maximize the Cooling Capacity of Your Extrusion Line

Maximizing output in extrusion requires a thorough understanding of not only the cooling requirements of the extruder but of the extrudate as well.

Read MoreGet the Most Out of NPE2024 With Map Your Show

NPE2024 has partnered with Map Your Show to make it easy for you to plan your week.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreImpacts of Auto’s Switch to Sustainability

Of all the trends you'll see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

Read MoreIn the Zone: Materials Science

The Materials Science Zone at NPE 2024 is the place to discover new innovations in materials science and regulatory compliance.

Read MoreConnect With Other Plastics Members at NPE2024

Plastics members get exclusive access to the Plastics Member Lounge at NPE2024.

Read MoreNPE2024 Features Medical Industry Sessions

Learn about trends in sustainability, materials, collaboration and more at the NPE2024 Medical Industry Sessions.

Read MoreUnraveling the Science and Myth Associated With Moisture Analysis— Part 1

The first task in moisture measurement is to purchase an instrument that is based on sound fundamentals. Then, before it goes into use, method development must be undertaken for all polymers that are going to be processed in the plant.

Read MoreIndustry Experts Offer Insights at NPE2024 Packaging Sessions

Learn from industry experts about the latest trends and innovations in packaging at the NPE2024 Packaging Industry Sessions

Read MoreNPE2024 Consumer Products Industry Session Highlights Trends, Innovations

Hear from industry experts about the latest trends in consumer products at the Consumer Products Industry Sessions.

Read MoreVisit the International Attendee Lounge at NPE2024

If you’re attending NPE2024 from outside of the U.S, be sure to stop by the International Attendee Lounge to connect with other attendees from around the world.

Read MoreFastest Growing Market for Polyethylene Film

This week, using the research Mastio & Co. has conducted, we talk about the fastest-growing market in the polyethylene film industry: e-commerce.

Watch

.png;maxWidth=300;quality=90)