Chinese plastics machinery industry makes gains

What happens when China’s 1.3 billion people offer more to the global economy via their consumption as customers than their production as low-cost laborers?

Companies of all stripes had long positioned themselves to seize the opportunity presented by the most populous nation on earth becoming a consumer of goods, not just a producer. Automotive OEMs, for instance, would shift from sourcing parts from the country for cars sold elsewhere to building and delivering cars in China for the Chinese consumer.

In plastics machinery, that tipping point has been reached, but instead of the country importing more machines to supports its growing consumer demand, China is giving the growing business to home-grown suppliers, while those same suppliers export more equipment around the globe.

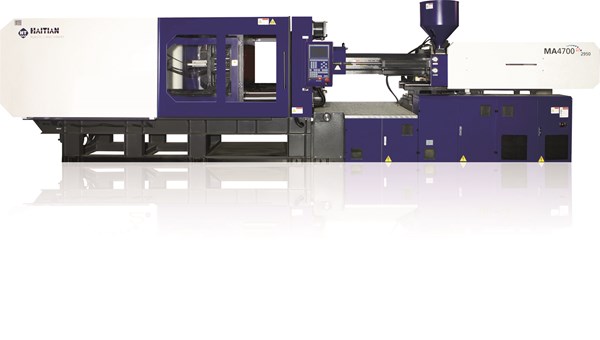

Haitian Plastics Machinery—by volume, the top seller of injection molding machines in the world—raked in record earnings and profits in 2013. Sales, which rose 13.7% to $1.2 billion, actually marked the highest ever level in exports for the company, according to Helmar Franz, Haitian’s chief strategic officer.

Franz, who is also a member of the Chinese Plastics Machinery Industry Assn. (CPMIA), discussed Haitian’s results, and trends in the broader Chinese plastics market, at last month’s Chinaplas in Shanghai.

While China’s exports of injection molding machines have increased every year since 2009, its imports have shrunk each of the last four years, according to CPMIA data cited by Franz.

Imports of plastics machines in 2013 were lower both in terms of units and value, dropping 4% to 10,052 units and 15% to $1.82 billion in value. Exports of plastics machines in 2013, however, jumped 94% in volume, to 135,213 units, with their value up 7% to $1.72 billion.

Historically, Franz noted that the market had exhibited a 70:30 split in equipment sales between imported machines vs. Chinese. During the 2008-2009 global economic crisis, Franz noted that Chinese processors turned to domestic machine suppliers, and they have not looked back.

In 2013, 77% of machines were bought locally and Korea was the only country that supplied more machines to China in 2013 than it did in 2012. In 2012, China was a net exporter of machines for the first time ever, with that new status holding in 2013.

The ratio of imported machinery to domestic, going back to 2008, seems to have shifted permanently.

Per CPMIA (import : domestic)

2008 : (51:49)

2009: (29:71)

2010: (28:72)

2011: (28:72)

2012: (27:73)

2013: (23:77)

| Top Countries | '09 | '10 | '11 | '12 | '13 |

| Japan | 423 | 749 | 775 | 710 | 595 |

| Germany | 373 | 512 | 627 | 617 | 582 |

| Taiwan | 111 | 242 | 236 | 288 | 188 |

| South Korea | 61 | 100 | 112 | 116 | 123 |

| Italy | 74 | 121 | 134 | 109 | 95 |

| 2009 | 2010 | 2011 | 2012 | 2013 |

| 575 | 996 | 912 | 872 | 735 |

| 2009 | 2010 | 2011 | 2012 | 2013 |

| 370 | 637 | 840 | 921 | 951 |

Related Content

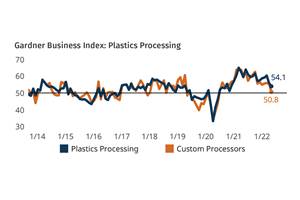

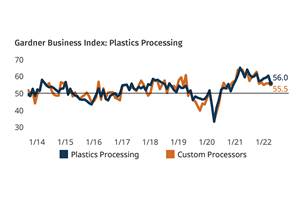

Plastics Processing Growth Slows Slightly

May reading for plastics processors is, for the most part, a continuation of what we saw in April.

Read MorePlastics Processing’s Ups and Downs

Overall index dips, but custom processors hold steady. Employment up, backlogs down.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

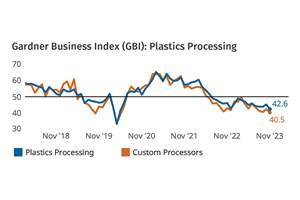

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More