Coronavirus and Oil Price Collapse Could Delay Second Wave of Planned Olefin/Polyolefin Projects

ISIS Chemical editor shares insights on projected slowdown of U.S. and global chemical investment wave.

A host of companies across chemicals and oil and gas are slashing capital spending (capex) in an effort to preserve cash in the wake of the coronavirus and the collapse in crude oil prices, according to Joseph Chang, global editor for U.K.-based ICIS Chemical Business (U.S. office in New York City), a leading global petrochemicals market intelligence provider. As a result, the U.S. and global chemical investment wave looks to slow considerably in the years ahead. Delays are more than likely to be seen for the second wave of U.S. olefin/polyolefin crackers underway or planned between end of this year and end of 2024.

According to Chang, major oil companies will also cut capex plans for 2020 and beyond in response to the collapse in oil prices. Importantly, many of these companies had aggressive plans for petrochemical capacity expansion, as they shifted their focus away from transportation fuel and towards chemicals for future growth. While oil companies have not yet specifically mentioned cuts to chemical projects, all investments should see an impact.

Chang cites Kevin Swift, chief economist of the American Chemistry Council (ACC) speaking on a March 19, ICIS webinar on the economic outlook. He noted that major U.S. chemical projects under construction—namely new olefin/polyolefin production—should continue, the fall in Brent crude oil prices and the shrinking of the Brent/U.S. Henry Hub natural gas ratio from the 30s to the mid-teens, “Puts into question the economics long term…and this creates an awful lot of uncertainty, and decision-makers don’t like uncertainty.”

On March 18, Shell announced the temporary suspension of work on its 1.3 billion lb/yr ethylene cracker and HDPE/LLDPE and HDPE units under construction in Monaca, Pennsylvania to prevent the spread of the coronavirus. No timeframe was given for when work would resume.

Dow had already taken down its capex plan to $1.5 billion for 2020 from $2 billion in 2019. However, on a March 16 appearance on CNBC’s Mad Money program with Jim Cramer, CEO Jim Fitterling said the company would struggle to meet even the lowered capex target because of limitations on the movement of contractors and engineers given the coronavirus outbreak. After having paid down around $2 billion in debt in 2019, Dow would like to pay off another $500 million to $1 billion in debt in 2020, said Fitterling. At the end of 2019, Dow had net debt of $14.6 billion.

Dow is in the process of starting up its Texas-9 cracker expansion adding 1 billion lb/yr of ethylene capacity in Freeport, Texas, by mid second quarter. Among other project plans are a 2.6 million lb/yr ethylene expansion in Western Canada by first quarter 2021 and a 2.6 billion lb/yr PE plant on the U.S. Gulf Coast for 2022 second quarter start-up.

ExxonMobil said on March 16, that it is considering significant cuts to capex and operating expenses. The company is building a 3.6 billion lb/yr joint venture ethane cracker complex with SABIC in Corpus Christi, Texas, which also includes two PE production units and a monoethylene glycol (MEG) unit. Planned start-up is for second quarter 202, though there are still no details as to which types of PE would be produced or their volume. As previously reported, this would mark SABIC’s entry in the North American PE production market.

SABIC rendering of complex under construction with joint venture partner ExxonMobil in Corpus Christi, Texas.

Total/Borealis/NovaChemicals have a 2.2 billion lb/yr complex under construction that includes a new Borstar PE plant and expansion to an existing PE unit in Port Arthur, Texas, with a slated startup at the end of this year.

Other planned U.S. cracker projects slated for start-up further down the road in 2023-2025, where final investment decisions have yet to be me made include:

▪ FG LA LLC (Formosa) which is planning for a 2.4 billion lb/yr complex that includes LLDPE and HDPE units in St. James Parish, La., with startup slated for 2023.

▪ PTTGC/Daelim, which is planning for a 3.2 billion lb/yr complex that includes HDPE, HDPE/LLDPE, and LLDPE/mLLDPE units in Belmont County, Ohio, with startup slated for 2024.

▪ Chevron Phillips Chemical/Qatar Petroleum, who are planning a 4.4 billion lb/yr complex with HDPE production somewhere in the U.S. Gulf Coast, with startup slated for 2024.

▪ Motiva (Saudi Aramco), which has said it will be build a PE complex in Port Arthur, Texas for startup at the end of 2024.

Chang reports that North American midstream energy companies are also busy taking down capex plans. Canada-based midstream energy and petrochemicals company Pembina Pipeline is chopping 2020 capital spending by between Canadian dollar (C$) 900 million to 1.1 billion ($625 million to $764 million) to a level of C$1.2-1.4 billion.

A number of projects will be deferred, including Pembina’s investment in the Canada Kuwait Petrochemical Corp. (CKPC) petrochemicals joint venture, which involves building an integrated propane dehydrogenation and polypropylene (PDH/PP) complex in Alberta. Company officials previously indicated a second quarter 2023 in-service timeline for the complex.

A number of other midstream energy companies have also announced plans to cut capex, reports Chang. “Major cuts to capex plans for oil and gas, and midstream energy companies are a long-term problem for the U.S. petrochemical industry, as access to abundant and low-cost natural gas liquids (NGL) feedstocks is its lifeblood. The U.S. shale gas cost advantage has spurred hundreds of billions of dollars in chemical investment. With the crash in crude oil prices, which has severely diminished this advantage, the investment boom is clearly under threat.”

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

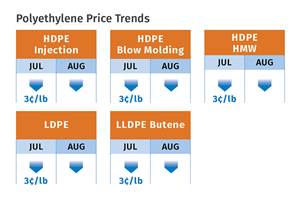

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)