Elevated Resin Prices Continue for Now

Steady improvement underway though challenges remain.

As this year’s fourth quarter got underway, it was evident that prices for all large-volume commodity resins were elevated. Our industry friends and expert sources at Resin Technology, Inc., Fort Worth, Texas, Houston-based PetroChemWire (PCW), and Michael Greenberg of The Plastics Exchange in Chicago concede that while there’s been a faster than expected recovery from Hurricane Harvey’s impact both in terms of production restarts and logistics, challenges remain including overall tight supplies and, of course, elevated resin prices. The question now: how long are they likely to last? Here’s a rundown on how they see things shaping up for PE, PP, PS, PVC, and PET:

PE: Prices moved up another 4¢/lb Oct. 1, following the 3¢/lb Sept. hike, and several suppliers were out with an additional 3¢/lb, effective October 15. Mike Burns, RTi’s v.p. of client services for PE, ventured suppliers would also implement that third price hike. He expected the implemented price increases holding firm into early 2018. PCW reported that one HDPE supplier moved the third increase to November 1. It also reported that stretch film manufacturers announced price hikes of 6-7% for mid-October.

The Plastics Exchange’s Greenberg reported that spot PE activity came in spurts, with prices easing by 1¢/lb overall, with the exception of injection grade HDPE, which “was super scarce even before the storm”. Also likely to be tight for the remainder of the year in blow molding grade HDPE.

PCW reported that injection grade HDPE crate availability was improving, partly because HDPE producers were devoting more line time to homopolymers amid hexene-comonomer shortages. “Among film grades, LDPE clarity and extrusion coating was the tightest along with LLDPE hexene—all products which are supplied by CP Chem’s Cedar Bayou plant, now expected to be shut until late fourth quarter, noted senior editor David Barry.

PP: Prices moved up generally by 7¢/lb in September, in concert with propylene monomer contracts. While suppliers aimed to get a 3¢/lb margin increase above the monomer increase, this did not seem evident in most cases, according to Scott Newell, RTi’s v.p. of PP markets. He expected another increase of 2-3¢/lb, maybe more, based on nominations for October monomer contracts. “That 3¢ margin increase is still out there and with things being on the tight side, there’s some potential for that increase going through.” Still, he ventured that by November, PP prices would either top out or even drop a bit, owing to some demand destruction from the higher prices.

Asked about PP imports, Newell noted, “The PP market is tightly balanced yet the outcome of Harvey wasn’t as bad as anticipated. I see a revival of interest in PP imports—and there are a few deals being concluded but they are small volumes. Don’t expect the increase in imports to reach the volumes of what we saw two years ago though.”

PCW’s Barry also expected suppliers’ margin increase to be spread over a couple of months. While he reported on flat to higher prices for spot PP, with very tight availability for most products, he also noted supply concerns appeared to be steadily waning, and that talk in the industry was of a return to normal market conditions by November. “Higher melt injection molding grades were in the tightest supply, particularly impact and random CoPP, while low-melt products were relatively balanced.”

Somewhat in contrast, Greenberg reported that he anticipated most processors to have seen a 10¢ increase in the Aug./Sept. time frame—indicating that suppliers were indeed successful with the margin increases. “The market seems poised for further gains….There is already a few cent cost-push increase that seems imminent for October and producers, who have finally expanded margins with a successful increase, will likely leverage the upward momentum and soon nominate an additional increase.”

PS: Prices, which moved up 3¢/lb in September, were expected to move up a bit further in October, as suppliers sought another 3¢/lb hike, according to both Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC and PCW. However, only half of that increase would be justified based on both benzene and ethylene prices not going up as much as anticipated and as demand slows seasonally, ventured Kallman.

PCW’s Barry reported that while spot PS prices held steady at September’s end, higher offers were expected for October as suppliers sought another increase. Also, PS import availability was somewhat reduced by tight styrene monomer supplies overseas, and domestic offgrade PS offers were scarce. Lower styrene monomer prices in Europe were putting a damper on U.S. monomer exports. U.S. monomer supplies are said to be on the tighter side of balanced.

PVC: While prices rolled over in September, all suppliers were out with a 5¢/lb price increase for October. RTi’s Kallman, noted that the potential Aug.-Sept. ethylene contract settlement of 3-5¢/lb would only support a 2.5¢/lb PVC increase. This along with a decline in PVC exports, led him to venture that a PVC increase in October of 2.5-3¢/lb was more realistic. He also ventures that PVC prices for November-December would be flat to down.

PCW’s Senior Editor Donna Todd signaled a similar view on a partial implementation of this increase. Although most everyone was back on line in terms of PVC and key feedstocks, PCW reported that the impact of Harvey was still being felt in PVC production. Formosa’s Point Comfort, Texas PVC units continued to operate at reduced rates because its VCM plant was still undergoing repairs. Restart had been delayed to mid-October, so that Formosa’s force majeure on PVC was still in effect. OxyVinyl’s VCM unit at Deer Park, Texas was still working up to full rates, while its La Porte VCM unit had returned to full rates. Both the Deer Park and Pasadena, Texas PVC units were running at full rates. Oxy’s PVC plants at Pedrickton, N.J. and Niagara Falls, Ont. were both working to restock VCM. Oxy’s force majeure on PVC was expected to remain in effect through October.

PET: Domestic bottle-grade prime PET prices in September averaged 65.5ȼ/lb, up 9.3ȼ/lb from August, according to editor Xavier Cronin. He noted that truckload business is typically 2-5¢/lb higher than railcars. On October 5, the PET price was 71¢.lb. Meanwhile, prices of imported prime PET, with an IV of 78 ml/gram or higher, in September averaged 58.4ȼ/lb, up 4.5ȼ from August. The price on October 5 was 62¢/lb.

Cronin noted that PET prices rose due to the shutdown of work at the Jumbo PET plant under construction at Corpus Christi, Texas by M&G Chemicals, and an anti-dumping petition filed on Sept. 26 against U.S. PET imports from five countries. Jumbo is about 85% complete but at a total standstill with no indication of when it might be operating. All of Jumbo’s PET was slated for the U.S.. Startup was originally targeted for 2016 and delayed several times with the most recent target of fourth quarter 2017.

According to Cronin, the ‘limbo’ state of the plant tightened spot PET availability, with spot prices rising to 68-70¢/lb for non-contract truckload delivering, up 10¢ from August. End-users and distributors are looking to stock up now to assure supply requirements for first quarter 2018 are met. Market sources report that PET suppliers are seeing more demand for fourth quarter 2017 and first quarter 2018 deliveries than is typical for this time period.

PCW’s Cronin also sees U.S. PET imports as “the wild card”. He noted that the U.S. is a coveted PET market due to strong demand year-after-year and, in general, reliable and timely payment. The imports this year through July have come from 39 countries and they were up 6% year-to-date. Distributors and end users are expected to book more U.S. PET imports than originally planned due to the Jumbo limbo.

Supply from Asia and South American countries remains abundant. Mexico remained the top source of U.S. PET imports (43% of the total through July—up 21% from the same 2016 timeframe). Imports from South Korea, number six in import volume increased by 76% in that time frame. Imports from Taiwan, number two in volume, dropped by 3% this year.

Related Content

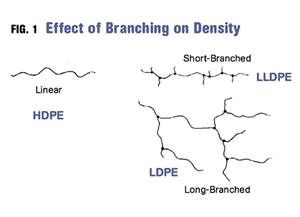

Density & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More