Global Bioplastics Market to Grow 20%

Emerging low-carbon circular economy, stronger policy support for the bioeconomy, and increased consumer awareness drive expansion.

Demand for bioplastics is going nowhere but up. This is indicated by the increasing number of both players and materials that have emerged and on which we have been reporting. Moreover, the European Bioplastics association released its annual market data update at its 12th European Bioplastics Conference in Berlin in late 2017, which predicts the global market for bioplastics will grow by 20% over the next five years.

The results of the latest market study indicated that global bioplastics production capacity is set to increase from 2.05 million m.t. in 2017 to approximately 2.44 million m.t. in 2022. “The transition to a low-carbon and circular economy, stronger policy support for the bioeconomy, and an increased consumer awareness for sustainable products and packaging are driving the expansion,” said Francois de Bie, the association’s chairman.

Innovative biopolymers such as PLA (polylactic acid) and PHAs (polyhydroxyalkanoates) are the main drivers of this growth in the field of bio-based biodegradable plastics. PHAs are an important polymer family that has been in development for a while and that now has finally entered the market at commercial scale, with production capacities that are estimated to triple in the next five years.

These polyesters are 100% biodegradable, and feature a wide array of physical and mechanical properties depending on their chemical composition. Similarly, production capacities of PLA are also projected to grow by 50% by 2022 compared to 2017. A very versatile material, PLA features excellent barrier properties and is available in high-performance PLA grades that are an ideal replacement for PS, PP and ABS in more demanding applications.

Bio-based, non-biodegradable plastics, including the drop-in solutions bio-based PE and bio-based PET, as well as bio-based nylons/PA, currently make up for around 56% (1.2 million m.t.) of the global bioplastics production capacities. The production of bio-based PE is predicted to continue to grow as new capacities come online in Europe in the coming years. Intentions to increase production capacities for bio-based PET, however, have not been realized at the rate predicted in previous years. Instead, the focus has shifted to the development of PEF (polyethylene furanoate)—a new polymer that is expected to enter the market in 2020. PEF, on which we have recently reported, is comparable to PET but 100% bio-based.

Packaging remains the largest field for applications accounting for almost 60% (1.2 million m.t.) of the total bioplastics market in 2017. The data also confirm that bioplastics are already being used in many sectors including textiles, consumer goods and applications in automotive, and transport sector, and the agriculture and horticulture sectors.

Regarding regional capacity development, Asia remains a major production hub with more than 50% of bioplastics currently being produced there. One-fifth of the production capacity is located in Europe. This share is projected to grow up to 25% by 2022, with the European Commission’s commitment to the transition to a circular economy model expected to accelerate the momentum of growth and development of the bioplastics industry in Europe.

The market data update 2017 was compiled in cooperation with the German research institute nova-Institute. The data for the global production capacities of bioplastics is based on the market study “Bio-Based Building Blocks and Polymers” by nova-Institute (2018).

Related Content

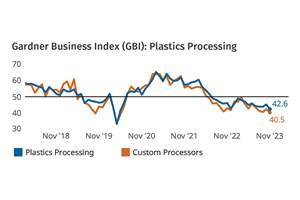

Plastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

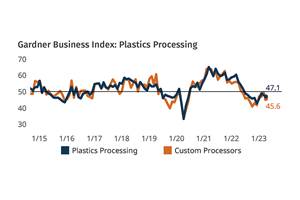

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

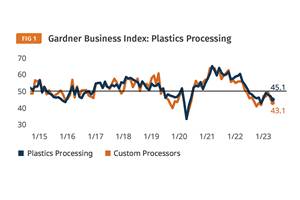

Read MorePlastics Processing Contraction Continues

Contraction dominated the GBI index for overall plastics processing activity and almost all components, collectively suggesting a slowdown.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More