Global Petrochemical Growth to be Led by China

This despite economic slowdown and overcapacity says IHS Markit.

A newly completed analysis by Houston-based IHS Markit forecasts that China will continue to be in the lead of the global petrochemical marketplace—both in terms of consumption and production. Still growth is expected to moderate during the next few years.

The IHS Markit analysis predicts Chinese demand growth for key chemicals to be significantly below the historical double-digit growth rate or, at around 5-7% for at least the next four years. Said Paul Pang, IHS Markit’s v.p. of greater China chemical, “China has not been spared by the global economic slowdown, but the country will still drive growth in the worldwide chemical industry in the years ahead. China remains the largest growth market for chemicals, although we expect Chinese growth to moderate.”

Since 2000, China has been the key driver for global growth for both chemical demand and investment, said Pang. That year, China was insignificant in either chemical consumption or production, but after the country’s rapid expansion in consumer product manufacturing, its chemical demand grew rapidly from 2005 to 2012. Come 2015, China accounted for one-third of global demand for base chemicals, and now it is by far the largest consuming and producing country in the world. Still, since the economic slowdown starting in 2012, demand growth for chemicals has also shown signs of weakeness.

In the meantime, according to Pang, China continues to build up domestic production capacities from both conventional petrochemicals and unconventional chemicals. Chinese investors accounted for most of these unconventional investments during periods of high crude oil prices, when the profitability for unconventional chemicals was still attractive. However, the crude oil price collapse within the last two years severely squeezed the profitability of these unconventional investments, and spending has fallen sharply since.

Said Pang, “With conventional petrochemicals now profitable, we have seen more new petrochemical investments…several mega-sized integrated petrochemical complexes are either under construction or in planning. On the back of slower demand growth and aggressive capacity growth planning, China will become more self-sufficient. The percentage of import materials will decline, but the absolute import volume will continue to grow.”

Meanwhile, Brian Jackson, senior economist with the IHS Market China Regional Service, said that China’s economy this year will slow again because of a housing sector correction. “Mortgage policy easing turbocharged a cyclical rebound in the housing sector in 2016….but several quarters of rapid price growth and recent mortgage policy tightening will lead to contraction in the housing sector in 2017. Government plans to introduce a national property tax law near end-2017 will lengthen the period of correction and soften the eventual rebound. Another noticeable headwind in the two years ahead is an expected slowdown in automobile sales and production due to a higher consumer tax regime; the sector is China’s first largest in retail receipts and third largest in industrial value-added.”

Estimated GDP growth in China slowed in 2016 to 6.7% from 2015’s 6.9%, and IHS Markit forecasts growth will slow again this year, to 6.5%. IHS Market also recently downgraded the outlook for China’s GDP growth in 2018, to 6.2% from 6.4%.

While the slowdown in economic growth has reduced private-sector investments in China, the private sector within the country’s chemical industry is expanding, changing the sector structurally. Said Pang, “The Chinese chemical industry was dominated in the past by three SOEs (state-owned enterprises)…in the past five years, private companies and local provincial companies have expanded at a faster pace than SOEs and challenged their dominance. The market share of private companies and local provincial companies grew by 24% in 2010, to 41% in 2015, and it will grow further, to 47% by 2018.”

Certain sectors of China’s chemical industry are projected to grow more than others, according to IHS Markit. It expects investments in production-based conventional feedstocks and technologies to regain momentum post-2019, since private companies will likely invest more actively in integrated refining and petrochemical complexes. Also, China’s chemical sector is shifting from basic to specialty chemicals and IHS Markit expects sales of specialties in China to grow about 6.5%/yr between 2015-2020, to more than $175 billion, surpassing North America to become the largest specialty chemicals market.

The market outlook for China petrochemicals will be among key discussions at the upcoming IHS Markit 32nd Annual World Petrochemical Conference (WPC), March 20-24, at the new Marriott Marquis Houston.

(Pictured: Zhuhai 3 BP joint venture in China producing terephthalic acid (PTA), which began operations in July 2015.)

Related Content

DuPont Buys Medical Product Manufacturer Spectrum Plastics

Purchase price of $1.75 billion for leading supplier of extruded, molded, and 3D printed medical components.

Read MoreRecord Reshoring Rates in 2022

Reshoring and foreign direct investment (FDI) in the third quarter marked their highest ever level, eclipsing the previous record set in the second quarter of 2022.

Read MoreNew Cap for Child-Resistant Pill Bottles Is Senior-Friendly & Saves Resin

Exclusive lightweight cap design can be removed simply pushing down on the center. No gripping or twisting needed.

Read MoreKrones Acquires Netstal

Krones adds PET preform injection molding to its bottle blowing and filling capabilities, as well as cap molding and expansion into medical, food and other markets.

Read MoreRead Next

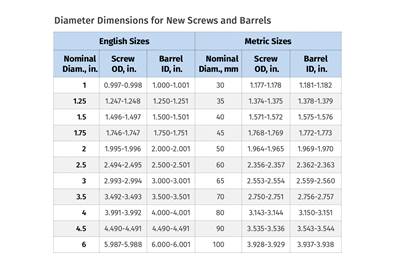

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More.png;maxWidth=970;quality=90)