Harvey Impact Delays Startup of Some New Ethylene Capacity

While several plants have restarted or are in restart mode, logistics continue to be an issue, though improvement there is also underway.

Check out the latest post-Harvey analyses on availability of some key feedstocks and resins from IHS Markit with PetroChemWire (PCW) weighing in.

● Ethylene: Around 10% of U.S. ethylene production remains offline and total U.S. ethylene consumption capacity is in a similar range. The new ethylene units that were slated to come online over the next six months are expected to be delayed, with CP Chem potentially seeing significant delays at Cedar Bayou, Texas. IHS Markit is still evaluating the timing of new units.

Texas as a whole has more ethylene capacity compared to derivative capacity, which put relatively more ethylene production at risk compared to derivative capacity. Because more ethylene production was affected vs. derivative consumption, the ethylene market may see a temporary tightening of supply and hence higher prices that approach affordability levels. A large capacity unit for alpha olefins is still down which could impact many players ability to produce co-monomer PE. A deeper dive into start up and ramp up timing for the ethylene chain would indicate a pull of inventory from the high reported levels of second quarter, but the actual amount of pull is a difficult call.

● Propylene: The amount confirmed of propylene production assets offline continues to drop with assets offline only representing 6% of the total U.S. PGP/CGP capacity and 7% of the total U.S. RGP capacity. An estimated 22% of the assets are in start-up mode with reduced rates. With the exception of two crackers, all propylene assets are expected to be at pre-storm levels by the end of the month.

Consumers of propylene derivatives have observed a stronger rate of recovery and now seem to be limited by propylene supply. Multiple producers are either on force majeure or asking customer base for voluntary allocation. The spot markets have initially reacted to the storm’s impact with the PGP September 45-day weighted average price showing an increase of over 7¢/lb from the August 45-day weighted average price.

● Polyethylene: PE producers continue to restore production capacity. As of Sept. 20, the only facilities that remain offline are the CPChem Cedar Bayou site and Dow Seadrift location. While the Dow facility is expected to return to pre-hurricane production levels in the near term, the CPChem site is expected to remain offline for a more extended period of time. Also impacting the industry is continued supply disruption associated with co-monomer production at the CPChem Cedar Bayou facility.

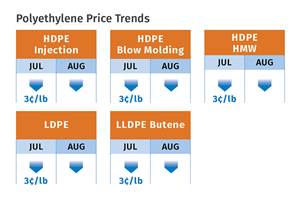

Price increase announcements also continue to develop as a result of ongoing tight supply conditions. At least two producers have announced their intent to increase PE resin prices by an incremental 3¢/lb, effective Oct. 15. The referenced increase is in addition to the 4¢/lb increase that is currently pending (a 3¢/lb was implemented by end of August).

PCW reported that all, but about 10 million/lb/day of PE production that has shut was restarted and part of the remaining capacity was expected to restart by week’s end. Five suppliers either declared force majeure or placed customers on allocation. The most heavily impacted PE production facility was CPChem’s Cedar Bayou plant, with restart not expected until November. Cedar Bayou is an important source of commodity blow molding grades of HDPE (from the CPChem/Ineos venture) as well as more specialized resins for coating and rotomolding. It also supplies normal alpha-olefins, which are used as co-monomers with ethylene in the production of LLDPE and HDPE copolymer grades. It was unclear how much the loss of that key piece of co-monomer supply would affect the PE industry as PE producers may be able to find alternative supplies.

● Polypropylene: As of Sept. 20, all PP plants affected by the storm are up and running. The majority of plants are at normal rates but there continue to be issues in rail car lead times as many buyers are being told to expect transit times to average 30 days for new shipments, which is typically 10 days more than normal. Bulk trucks and truckloads out of the gulf coast are difficult to procure due to lack of truck supply and come at a very high cost.

PP resin imports are expected to start arriving in the second half of October through the end of the year to help the market in the near term. However, while pricing for spot resin has spiked 15-20¢/lb above pre-storm levels, PP prices are expected to decline later in the fourth quarter once supply normalizes. There are reports of impact copolymer being the tightest grade available with some allocation levels less than 50%. But these cases tend to be specific where buyers do not have other approved products. Contract market price expectations continue to point toward an elevated number in September in the 6-8¢/lb range and margin expansion is likely to be implemented in the near term with leverage being held on the supply side.

● PVC: PCW reports that PVC production was returning at reduced rates at Point Comfort. Restart of Formosa’s Point Comfort VCM unit that had been down for repairs prior to the storm was expected to be delayed by about two weeks. OxyVinyls reported that it was producing PVC at full rates at Deer Park and is running at Pasadena as of Sept. 20. Its VCM unit at Deer Park was in the process of coming back on line. Its La Porte VCM unit was running at reduced rates but was expected to achieve full rates by the end of this week. Its PVC plants in Niagara Falls and Pedrickton were running at reduced rates on shipments of VCM from Houston. Formosa declared force majeure on all of its PVC products and all dry blend rigid PVC compound on Aug. 29. OxyVinyls announced force majeure on PVC on Aug. 31. Ditto for Olin, which declared force majeure on VCM shipments from its Freeport plant.

● EO/MEG/PET/PTA: Dow at Seadrift remains shut down and the company declared force majeure on ethanolamines and glycol ethers from that plant, but not glycols at this time. Huntsman’s three EO units in Port Neches are still down with intended restart of two in the next few days. The third reactor had a catalyst change underway when Harvey arrived and will be down through September. No force majeure restrictions at this time. No other EO/EG units are known to be shut down. Equistar is enforcing force majeure limits on EO, glycols, glycol ethers at 50-60% of recent historical volumes. Price increases of 6¢/lb on glycol ethers announced by Eastman effective immediately, other producers posted effective Oct. 1.

PTA and PET units in the Southeast U.S. were not directly affected by Hurricane Irma, which tracked far enough south to avoid serious wind and rain, but are incurring additional expenses to get delivery of PX/PTA due mostly to supply chain logistics. The industry has announced PET price increases of 6-7¢/lb for September.

● Styrene: The styrene industry has returned to nearly normal operating conditions. All producers, with the exception of LyondellBasell have returned to regular operations, with both of the Ineos Styrolution units now at max rates. LyondellBasell’s force majeure with 80% allocation will continue for an indeterminate period, believed to be until the end of September. Logistic issues are steadily being resolved.

● Butadiene: Recovery on this market is well under way. IHS Markit ventures that, with one exception, all of the U.S. butadiene producers that were impacted are running or in start-up mode. Still everything is not normal as yet…logistics remain an issue with both barge and rail traffic running below full capacity, though that recovery is also on the way.

● Cyclohexane: The restarting process is underway at all four operating facilities in the U.S. The Corpus Christi area has about one week head start and should be expected to return to normal operations before the Houston and Port Arthur areas.

Related Content

Formulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)