Mexico’s Auto Market Accelerates, Brings Plastics Along

Mexico’s booming automotive industry inevitably became part of the conversation with exhibitors at the country’s largest plastics trade fair, Plastimagen.

That’s understandable when you consider the explosion of activity in the sector in recent months and read related coverage. In August, The Wall Street Journal reported the country’s ascension in the global ranks of vehicle production as it overcame a Latin American competitor: “Mexico's Auto Industry Overtakes Brazil's.”

Mexico's export-driven production of cars and light trucks jumped 7.5% in the first seven months of 2014 to nearly 1.86 million vehicles, compared to the same period a year earlier.

That story noted how Honda and Mazda started up assembly plants this year, with a new Audi site to come online in in 2015, while a joint Nissan and Daimler facility is in the works. A September report from Forbes was more to the point: “America's Car Capital Will Soon Be ... Mexico”.

That article cited Mexico’s free trade agreements (FTA) with 44 countries as a major impetus for its boom (the vast majority of the country’s vehicle production is exported beyond Mexico’s shores), and it noted recent investment announcements by Infiniti in conjunction with Mercedes-Benz, as well as BMW and a massive Hyundai-Kia factory in the works.

By 2020, Mexico should be number six [in auto production] behind China, the U.S., Japan, India and Germany with an annual production of 4.7 million vehicles.

This summer, Kia and BMW announced plans for $1 billion plants in Mexico, and in September, Forbes reported that Toyota was looking to add a full assembly plant in Mexico, its first in the country.

A McClatchy report also cited Mexico’s openness to trade as a key driver, but it placed the number of FTAs at 45:

There’s another key factor. President Enrique Pena Nieto, in announcing in August that the South Korean automaker Kia would build a $1 billion plant outside Monterrey, noted that Mexico has free-trade agreements with 45 nations. The United States, in contrast, has free-trade accords in force with only 20 countries. Brazil has only eight free-trade agreements.

Regardless of what prompted the OEMs to set up assembly plants, where they go, their suppliers follow, and where their suppliers go, they need to install new machines.

“We see market growth, especially in automotive and packaging,” Imre Szerdahelyi, head of corporate communications and marketing at KraussMaffei told Plastics Technology. In addition to a Netstal machine running a closure at its stand, the company exhibited an automotive component applying its FiberForm technology.

Mold component supplier DME noted that overall business was down slightly, although the fourth quarter seemed to be finishing strong, with automotive leading the way.

For injection molding machine supplier Haitian, which is represented in Mexico by China Plastic Machinery, automotive takes up the majority of its sales in terms of dollar value. José Antonio Barroso, general manager of China Plastic Machinery noted that when Japanese car makers come to Mexico, for instance, they arrive with 20 to 25 suppliers, and set up a manufacturing campus, to his company’s benefit.

“Fortunately, all machines were sold during exhibition,” Barroso said following Plastimagen. “Right now, the market is really hot.” In response to the market’s success, Barroso said Haitian will be increasing machinery inventory in country for immediate delivery.

For Japanese injection molding machine supplier JSW, automotive represents the biggest growth market, followed by containers, according to Charles Greenwell, Western Regional Sales Manager. Bill Hricsina, international business manager for auxiliaries supplier Conair called automotive “huge” for his company, with additional growth in medical and packaging.

WittmannBattenfeld showed its faith in the market with the show’s largest booth, covering approximately 450 square meters and featuring its full slate of offerings, including auxiliaries, robots and injection molding machines. Matt McCabe, international key account manager, sees a big push for automation in the sector, with automotive customers targeting larger machines like its Macro line that can be complemented by bigger robots. German OEMs, and their suppliers, are boosting the Austrian headquartered equipment supplier, according to McCabe, with his company anticipating 5 to 7 years of “steady, continued growth” in the country.

Guillermo Fasterling, general manager of injection molding machine supplier Arburg’s Mexican operation said that automotive makes up 50% of the German company’s business in country, with Mexico showing growth of 10 to 20% over the last three to four years. “Mexico’s automotive industry has seen very strong growth,” Fasterling said.

At Japanese injection molding machine supplier Nissei, the goal in the coming year is to sell more machines into the automotive sector, according to Patricia Murakami. To that end, the company showed an 80-ton hybrid press molding a seat-belt cover from ABS at Plastimagen. “Our main market was housewares,” Murakami said, “but for last three years, automotive and mobile phone accessories are growing faster.”

Related Content

K 2022 Preview: Engineering Materials for Sustainability and E-Mobility

Materials that are sustainable yet offer equal performance to their fossil-based counterparts will be prominent at K 2022.

Read MoreNew Technology Bonds Aluminum With Polyamides

With many benefits for numerous potential applications, including in the burgeoning electric vehicle market, Celanese’s Zytel Bonding Technology achieves stronger bonds than overmolding or welding.

Read MoreMolder Repairs Platen Holes with Threaded Inserts

Automotive molder ITW Deltar Fasteners found new life for the battered bolt holes on its machine platens with a solution that’s designed to last.

Read MoreLFT-D Thrives in Automotive and Other Durables

Teijin Automotive acquires its 10th direct long-fiber thermoplastic system as demand for this technology soars.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

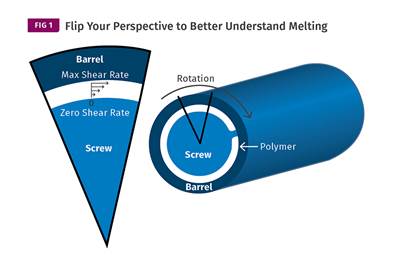

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)