New Lease Accounting Rules: Is Your Plastics Processing Business Ready?

As plastics processors ride the wave of recent record growth to contemplate new technology and machinery for their businesses, they should also consider upcoming changes to lease accounting rules.

These new rules, released in 2016 by the U.S. Financial Accounting Standards Board, take effect for public companies this December, and for private companies the following December.

The new regulations require that a portion of operating leases appear on every business balance sheet. Initially, some observers thought the new accounting rules might threaten revenue or profitability. In reality, the final rules impose less stringency than anticipated, and the benefits of leasing remain strong, including for industrial and manufacturing businesses, which account for 5% of equipment financing new business volume in the United States, according to the 2018 Survey of Equipment Finance Activity.

This means “business as usual” has shifted—but only slightly—and mainly from an accounting perspective.

Changes in Operating Leases

First, it’s important to know that the overall impact of the changes to operating leases will be nominal for businesses. Compared to the accounting treatment of a traditional loan or purchase transaction, leasing is still a prudent equipment acquisition strategy:

- An asset value is booked equal to the present value of rental/lease payments as “right-of-use” (ROU), and an offsetting liability entered as “obligation to pay.”

- Because the liability is considered non-debt (other debt), it may not jeopardize debt-limit covenants.

- Operating leases are residual-based structures. Consequently, the asset and liability recorded will likely be less than the cost of the asset. This yields a lower on-book balance than does financing with a traditional loan.

Positive News

While any changes to how leases are accounted for may seem overwhelming and confusing, the final guidelines are much less impactful than many options originally proposed. Here are some answers to frequently asked questions:

“I’m paid a bonus based on our return on assets (ROA), so we might as well just secure a loan and borrow the money to acquire our equipment.”

Assets on an operating lease will be booked on the balance sheet now, resulting in a straight-line expense on the income statement. Therefore, when compared to a loan, a lease yields better earnings benefits, especially in the initial years of its term. (As illustrated in the graphic.)

“I have a great credit rating. What happens if I capitalize operating leases on my balance sheet?”

Most bank lenders and credit analysts already take footnoted operating lease obligations into account when assessing debt and liquidity ratios.

“If leases appear on my balance sheet, won’t I violate debt limitation covenants from other loan contracts?”

According to FASB and the Uniform Commercial Code (UCC), an operating lease is not a debt. Operating lease liabilities will now be listed in a non-debt category, such as “Other Liabilities.”

Net Benefits of Equipment Leasing

While the new guidelines indeed incur some changes to accounting practices as outlined above, it’s important to recognize the role they play in the equipment acquisition strategy.

Leasing continues to be a judicious business decision, offering a host of advantages that remain unchanged. Here’s a breakdown of the benefits of financing:

Alternative capital source

- Preservation of cash and lines of credit

- Fixed rate vs. a floating rate revolving line of credit

Cash flow savings

- 100% financing

- Financing for training and installation costs

- Skip or seasonal payments

- Lower monthly payments with flexible end of lease options

Tax advantages

- Lease payments considered an expense on your income tax return

- Unusable MACRS benefit may be traded for lower payments

Flexibility

- Payment/lease structures to fit varying business needs

- Simplified add-ons / upgrades

- Reduced obsolescence risk

Plan Proactively in Three Steps

The benefits of equipment leasing remain as strong as ever, however businesses are still faced with the challenge of complying with new rules. Here are the top three actions your shop can take to stay ahead of the curve and mitigate the impact on your administrative efforts:

- Evaluate your current lease obligations and determine which contracts will be affected.

- Understand the accounting requirements of reporting current and future asset acquisitions.

- Complete a lease vs. loan analysis and verify which provides a lower after-tax cost of use.

Selecting the Right Partners

To transition successfully to a new era of lease accounting rules, both your financial advisor and equipment provider must be exceptionally well informed and experienced. Start by seeking counsel from both internal and expert sources, including your financial team and auditors. Next, talk with a trusted equipment lease professional. With dependable guidance and industry expertise on every aspect of equipment leasing, plastics processors will be poised to meet their business goals.

About the Author: Toni Larson is senior vice president of industrial equipment for Key Equipment Finance. Reach her at toni.larson@key.com.

Related Content

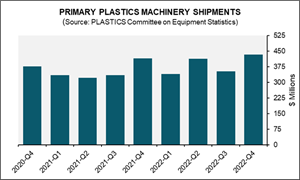

Plastics Machinery Shipments Rose in 2022’s Final Quarter

The Plastics Industry Association’s (PLASTICS) Committee on Equipment Statistics (CES) reported that injection molding and extrusion machinery shipments totaled $432.7 million in Q4.

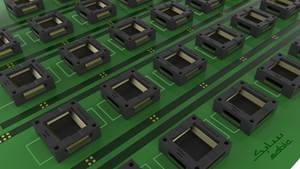

Read MoreHigh-Flow PEI ‘Captures’ Burn-In Test Socket Manufacturer

S. Korea’s Sensata is one of the first BiTS makers to adopt SABIC’s new Superflow Ultem.

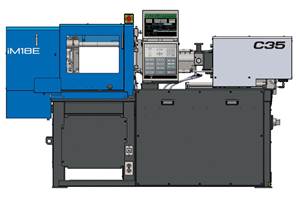

Read MoreCompact Hybrid Injection Molding Machine Launched

Sumitomo Heavy Industries Ltd. (SHI) has introduced the iM18E, promising the smallest footprint in 20-ton machines.

Read MoreCelanese to ‘Shine’ at CES 2023 with Expanded Portfolio of Materials

With it acquisition of DuPont’s engineering resins, Celanese’s resin solutions for automotive electrification, e-mobility and consumer electronics are plentiful.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)