PE Film Market Snap-Shot: Institutional Can Liners

Monolayer blown-film constructions account for more than 92% of institutional trash bags, but use of multi-layer coextrusion is growing to allow incorporation of recycled content.

We’ve reported on stretch film and t-shirt bags in previous installments of this blog series, which provides snap shots of the results of 2017 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on the PE film industry. Here, we recap Mastio’s research on institutional can liners.

According to the Mastio research, approximately 1,556.1 million lb of PE resins were consumed by processors to produce institutional trash bags in 2017. With an average annual growth rate (AAGR) of 4.4%, Mastio projects this segment of the PE film business will increase to 1,782.3 million lb of PE resin consumption by 2020.

Widths of institutional trash bags range from 13 in. to 69 in., with the most typical width being 30.0 in., according to the report. Institutional trash bag lengths vary from 17 to 90 in., with 48 in. being the average length. Institutional trash bag capacities range from 4-90 gal, with 33, 40, and 45 gallons being the most common. Institutional trash bag film gauges range from 0.1 mils to 10 mils in the United States (U.S.) and 0.3 mils to 12.8 mils in Canada. Processors who participated in the study generally stated that there is not a typical gauge for institutional trash bags; film gauge depends on the application.

As with most of the bigger PE film markets, institutional can liners are dominated by a handful of large operations. According to Mastio, the five largest firms in this market—Novolex (Heritage Bag Co. Inc.); Berry Global Group Inc.; Inteplast Group Ltd.; Sigma Plastics Group; and Inteplast Group Ltd. (Integrated Bagging System (IBS) Div./Pitt Plastics Div.) combined to consume 1,173.2 million lb of PE in 2017, representing roughly 75% of the market. Mastio identifies Novolex as the market leader, at 22.8%, with Berry second at 21%.

MATERIAL TRENDS

According to the Mastio study, the resin most commonly utilized for institutional trash bags in 2017 was LLDPE. LLDPE provides added strength and tear resistance vs. LDPE, which makes the film less apt to puncture. LLDPE can be further downgauged without sacrificing strength. Various grades of LLDPE utilized in this market identified by Mastio include: LLDPE-hexene, LLDPE-butene, LLDPE-octene, mLLDPE, and LLDPE-super hexene.

HDPE was the second most utilized material in this market during 2017. HMW-HDPE and MMW-HDPE resins allow processors to manufacture institutional trash bags in thinner gauges that are about three times stronger and more durable than other trash bags constructed with LLDPE, LDPE, and/or MDPE. HDPE provides the highest level of puncture resistance of all PE resin material. However, HDPE requires more costly, specialized film extrusion equipment and is more difficult to extrude. Several film processors in this market lack the specialized film extrusion equipment needed to process HDPE.

LDPE-homopolymer resin is also utilized in this market, mostly in blends with LLDPE and in multilayer coextrusions, Mastio reports. One advantage of utilizing LDPE is increased bag clarity, which is important for bags used in recycling programs. Also, LDPE resin, when used alone or in blends, has increased processing ease.

PCR was the fourth most commonly utilized material in the production of institutional trash bags during 2017. The reported utilization of PCR included post-industrial scrap resins consisting of PCR-LLDPE, PCR-LDPE and PCR-HDPE. Cost savings and adherence to mandates of PCR content by a few states, such as California; have also contributed to continued use of PCR in this market.

Lastly, the addition of biodegradable resin, PLA polymers derived from corn and other renewable resources, are being utilized as additives to facilitate decomposition through composting of the left over institutional trash bags.

TECHNOLOGY TRENDS

Many participants in this market continue to introduce the use of biodegradable resins such as polylactic acid (PLA) and synthetic polyesters in the production of institutional trash bags, Mastio says. PLA is a corn-derived biodegradable plastic that is designed to biodegrade in any standard compost bin. Monolayer blown film constructions remain the principal design for institutional trash bags—according to Mastio more than 92% of institutional can liners are single-layer blown films, though multi-layer coextrusion technology allows film processors to incorporate the use of (PCR) and industrial scrap material as core layers in the production of institutional trash bags. Additionally, LLDPE manufactured with the metallocene single-site catalyst process (mLLDPE), when used in resin blends or in multi-layer film coextrusion, allows manufacturers to downgauge film without sacrificing film strength.

Recycling, as in many other PE film markets, is a concern for the majority of institutional trash bag manufacturers, Mastio reports. In the consumer trash bag market, many companies are purchasing PCR or recycling their scrap material internally to reduce the amount of waste going to landfills and to meet various state mandates for recycled resin content. Several participants in this market are incorporating PCR in volumes ranging from 10% up to 100% in their institutional trash bags. Increased use of PCR in this market is utilized in order to minimize costs in this highly competitive, low-margin market, and as a way of complying with various state laws mandating recycled content, notes Mastio.

MY TWO CENTS

Growth projections for institutional bags will likely track overall economic growth and population expansions…as one processor noted, “There will always be trash.” Imported bags are less of a threat nowadays. Of course, government regulations and threats of taxes always loom. Use of PCR and materials like PLA will likely increase in the years ahead. In this and many other so-called commodity PE film markets processors are not quick to pull the trigger on new equipment purchases. The average age equipment in this and other PE markets is 10+ years. When large companies merge, which has occurred in this market, they tend to shift equipment from one plant to another, which tends to tamp down new equipment purchases.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreA Recycling Plant, Renewed

Reinvention is essential at Capital Polymers, a toll recycler that has completely transformed its operation in a short period of time.

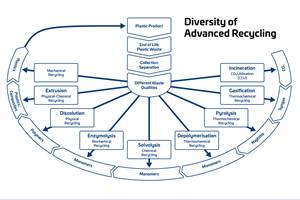

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

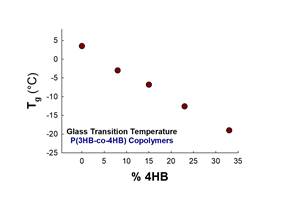

Read MoreFilm Extrusion: Boost Mechanical Properties and Rate of Composting by Blending Amorphous PHA into PLA

A unique amorphous PHA has been shown to enhance the mechanical performance and accelerate the biodegradation of other compostable polymers PLA in blown film.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)