PE Film Market Snapshot 2020: Candy

With an AAGR of 11.8%, PE resin consumption is anticipated to reach 52.9 million lb in this market by 2022.

This is the tenth and final in a series of blogs based on 2019-2020 research conducted by Mastio & Co., St. Joseph, Mo. on key markets for processors of polyethylene film. The first five offered Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets: stretch film, consumer/institutional product liners, T-shirt bags, institutional can liners and consumer trash bags.

The second batch of five focus on the five fastest-growing PE film markets. We’ve already hit on bubble-wrap market, converter film , deli bags and wrap and the envelope and magazine overwrap market. Here, we examine the PE market for candy.

Candy is commonly referred to as confectionery and can be divided into three groups: chocolate, non-chocolate (sugar confectionery) and gum. The main ingredients in chocolate are chocolate liqueur, cocoa butter, sugar, and milk. Though most candy is made of almost 100% sugar, there are several varieties of candy that combine sugar with other ingredients, such as cocoa products, dairy products, fruits, and nuts.

Some of the required properties for candy packaging film include clarity, good processability, good seal strength, and moisture and oxygen barriers. Printing is also very important in candy packaging. With so many products on store shelves, packaging graphics and colors are extremely crucial for capturing consumers’ attention. In the past, the average candy package featured four to six colors. Today, eight-color graphics are common for candy packaging.

Candy bag sizes vary from manufacturer to manufacturer, and bag sizes can range from 2.5- to-16 oz. bags, with some bulk candy bags as large as 96 oz. Candy film thickness varies depending on the application, and typical gauges range from 0.5 to 4 mils.

The Numbers

Producers of PE candy packaging consumed approximately 37.8 million lb of PE for this market in 2019. With an average annual growth rate (AAGR) of 11.8%, PE resin consumption is anticipated to reach 52.9 million lb in this market by 2022.

The confectionery market is very diverse, and the U.S. is the largest market accounting for more than 70% of the confectionery volume share. Candy is made in all 50 states and more than 1000 facilities across the U.S. The top five candy manufacturers represent approximately a 75% share of the market.

The uniqueness of the confectionery market is that each supplier makes distinctly different items catering to the diverse tastes and demands of the consumer.

The Players

Mastio profiled seven producers that extrude PE film for the candy packaging market. Some producers are expecting slow to no growth rates while three film extruders are expecting higher than average growth. Jindal Films Americas, L.L.C. (Jindal Films America Div.) anticipates the highest AAGR at 25% as it adds capacity and responds to sales growth.

Jindal Films Americas, L.L.C.; Packaging Personified, Inc.; and Berry Global Group, Inc. (Engineered Materials Div.) were the three largest manufacturers of PE candy packaging in 2019 representing a collective PE resin consumption of 24.2 million lb.

The Resins

The most common PE resins utilized for candy packaging films were LLDPE and MMW-HDPE. LLDPE resins are utilized due to their dart impact strength and tear resistance. Film producers in the candy packaging market utilize LLDPE resins including: LLDPE-butene, LLDPE-hexene, LLDPE-octene, and LLDPE resin manufactured with the metallocene single-site catalyst process (mLLDPE). mLLDPE resin is typically blended with LDPE resin for increased strength, sustainability, puncture and tear resistance, and sealing properties. MMW-HDPE resin was utilized in the production of candy packaging due to its strength and excellent barrier properties.

LDPE-homopolymer, LDPE-EVA copolymer grades, nylon, and EVOH copolymer are also commonly utilized for candy packaging because of their high barrier properties. LDPE resins usually have a higher clarity level than LLDPE resins.

Processing Trends

PE film for the candy packaging market was produced with the blown film extrusion and the cast film extrusion processes. During 2019, the blown film extrusion process was more common; nearly 61% of the PE film produced for candy was blown.

Monolayer PE films are commonly laminated to other substrates, such as PP, nylon, polyester, foil, cellophane, or paper. Laminated films offer stronger barrier properties and provide for a stiffer bag vs. monolayer film alone. During 2019, three- to five-layer coextruded films were most common; Mastio’s research revealed that about 61% of PE film for candy was multi-layer.

The Future

Mastio reports that many companies are helping the environment by recycling materials and reducing wastewater discharge. For example, several companies have shifted toward utilizing water-soluble inks when printing graphics. Many companies have also become involved in source reduction by decreasing the amount of materials utilized to package their products. All of the participants are actively working on increasing sustainability within their companies and are educating their employees to become more aware of the importance of minimizing the negative impacts on the environment, according to Mastio.

In the candy wrapper market, packaging graphics and colors are extremely crucial for capturing consumers’ attention.

Related Content

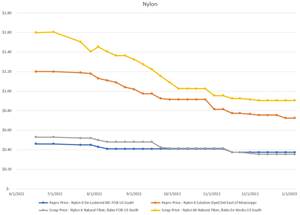

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

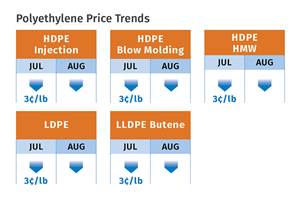

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

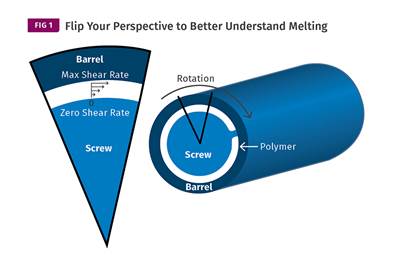

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More