PE Film Market Snapshot 2020: Institutional Can Liners

Market is about 1.37 billion lb strong now, and is expected to grow by 2.6% through 2022.

This is the fourth in a series of blogs based on 2019-2020 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for processors of polyethylene film. There will be 10 articles in all, two a week. The first five will offer Mastio’s analysis—based on interviews with processors conducted direct by the Missouri firm—with film processors representing the five largest PE film markets. The second batch of five will be focused on the five fast-growing PE film markets.

The first of these blogs analyzed the stretch film market. The second focused on consumer/institutional product liners. The third discussed T-shirt bags. This blog will look at the institutional can liner market, based on Mastio’s findings.

Commercial and industrial businesses, hospitals, offices, restaurants, fast- food chains, hotels, motels, schools, and state or county agencies utilize institutional trash bags or can liners. A few large end-users of institutional trash bags purchase directly from the original film and bag manufacturers. However, most institutional trash bags are purchased through wholesale packaging distributors.

The Numbers

During 2019, approximately 1.37 billion lb of PE resins were consumed in the production of institutional trash bags. With an average annual growth rate (AAGR) of 2.6%, this market is expected to increase to 1.48 billion lb of PE resin consumption by 2022.

Widths of institutional trash bags range from 13 in. to 69 in., with the most typical width being 30 in. Institutional trash bag lengths vary from 17 in. to 90 in., with the average length being 48 in. Institutional trash bag capacities range from 4 to 90 gal, with 33, 40, and 45 gal being the most common.

Institutional trash bag film gauges ranged from 0.0025 to 9 mils in 2019. Many producers have stated that there is not a typical gauge for institutional trash bags as the film gauge depends on the specific application.

The Players

In 2019, the five largest producers of institutional trash bags were as follows: Novolex; Berry Global Group Inc.; Sigma Plastics Group; Inteplast Group Ltd. (Pitt Plastics Div.) and Inteplast Group Ltd. (Integrated Bagging System Div.). Collectively, these companies processed 962.7 million lb of PE resins in the production of institutional trash bags for a combined market share of 70%.

The Resins

The resin most commonly utilized for institutional trash bags in 2019 was LLDPE. LLDPE provides added strength and tear resistance over LDPE, which makes the film less apt to puncture. LLDPE can be further downgauged without sacrificing strength. Various grades of LLDPE utilized in this market include: LLDPE-butene, LLDPE-hexene, LLDPE-octene, mLLDPE, and LLDPE-super hexene.

HDPE was the second most utilized material in this market during 2019. High molecular weight-HDPE (HMW-HDPE) and medium molecular weight-HDPE (MMW-HDPE) resins allow processors to manufacture institutional trash bags in thinner gauges that are about three times stronger and more durable than other trash bags constructed with LLDPE, LDPE, and/or medium density PE (MDPE).

HDPE provides the highest level of puncture resistance of all PE resin material. However, HDPE requires more costly, specialized film extrusion equipment and is more difficult to extrude. Several film processors in this market lack the specialized film extrusion equipment needed to process HDPE materials.

LDPE-homopolymer resin is also utilized in this market, mostly in blends with LLDPE and in multilayer coextrusions. One advantage of utilizing LDPE resin is increased bag clarity, which is important for bags used in recycling programs. Also, LDPE resin, when used alone or in blends, has increased processing ease.

Growth in this market is due to population growth and by taking market share from competitors

PCR was the fourth most utilized material in the production of institutional trash bags during 2019. The reported utilization of PCR included post-industrial scrap resins consisting of PCR-LLDPE, PCR-LDPE and a blend of PCR-LLDPE and PCR-LDPE. Cost savings and adherence to mandates of PCR content by a few states, such as California, have also contributed to continued use of PCR in this market.

Processing Trends

In 2019, the only reported process to produce institutional trash bags was the blown film extrusion process. Monolayer film constructions remain the principal design for institutional trash bags. According to Mastio’s research, 92% of this market is still producing single-layer bags. Multilayer coextrusion technology allows film processors to incorporate the use of PCR and industrial scrap material as core layers in the production of institutional trash bags. Additionally, LLDPE manufactured with the metallocene single-site catalyst process (mLLDPE), when used in resin blends or in multi-layer film coextrusion, allows manufacturers to downgauge film without sacrificing film strength.

The Future

While some participants stated that market growth is affected by the gross domestic product (GDP), the majority of participants in the institutional trash bag market stated that growth in this market is due to population growth and by taking market share from competitors. There are two or three big companies in this market, and a limited amount of business to compete for, so price competition is a threat. They further stated that most companies that utilize this type of product will always need trash bags. Since there are currently no other feasible alternatives, growth should remain modest, but constant, regardless of the economy.

Recycling, as in many other PE film markets, is a concern for most institutional trash bag manufacturers. In the institutional trash bag market, many companies are purchasing post-consumer resin (PCR) or recycling their scrap material internally to reduce the amount of waste going to landfills and to meet various state mandates for recycled resin content.

Several participants in this market are incorporating PCR in volumes ranging from 10% up to 100% in their institutional trash bags. Increased use of PCR in this market is utilized in order to minimize costs in this highly competitive, low-margin market, and as a way of complying with various state laws mandating recycled content. Additionally, there is an increasing pressure from municipalities to ban plastic bags in many PE film markets.

Related Content

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreFully Automated Extrusion Process Enables Use of Composites for Manufacturing Pressure Tanks

Amtrol was looking for a more cost-effective means to produce thin-wall liners for a new line of pressure tanks. With the help of a team of suppliers, they built one of the world’s most sophisticated extrusion lines.

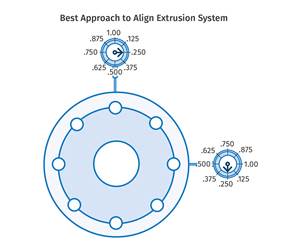

Read MoreExtruder Alignment: Important, but Only Half the Equation

The other half? Aligning and supporting downstream equipment. Here are best practices.

Read MoreCooling the Feed Throat and Screw: How Much Water Do You Need?

It’s one of the biggest quandaries in extrusion, as there is little or nothing published to give operators some guidance. So let’s try to shed some light on this trial-and-error process.

Read MoreRead Next

PE Film Market Snapshot 2020: Consumer/Industrial Product Liners

Monolayer structures still dominate this market.

Read MorePE Film Market 2020 Snapshot: Stretch Film

Stretch film accounted for 2.4 billion lb of PE of resin consumption in 2019, making this sector one of the largest and fastest growing markets within the PE film industry, according to Mastio’s research. The top five players hold about 80% of the market.

Read MorePE Film Market Snapshot 2020: T-Shirt Bags

Coronavirus concerns have made some governments reverse bans on the books, but the T-shirt market is projected to be flat through the next three years.

Read More.png;maxWidth=970;quality=90)