PE Film Market Snapshot: Pouches

This high-end film market has room to grow for the technically savvy.

We’ve reported on stretch film, t-shirt bags, institutional can liners , consumer can liners, and shrink film, and produce film in previous installments of this blog series, which provide snap shots of the results of 2017 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on the PE film industry. Here, we look at his analysis of pouches.

There are several different types of flexible plastic pouches, Mastio’s research revealed. However, the pillow pouch and the stand-up pouch are the most common designs in the PE film market. A pillow pouch lies flat and is sealed on two or three sides. The stand-up pouch is characterized by its ability to remain freestanding as a result of its design. There are three different stand-up pouch designs. One is a bottom-gusseted Doy-Pack style. There is also a stand-up flat-bottomed pouch first patented (patent expired 2005) by Jebco Packaging Systems, Inc., in Atlanta, Georgia. Lastly, there is a stand-up pouch with gussets on the bottom and two sides that was licensed by Hosokawa Yoko Company Ltd. of Tokyo, Japan.

The retort pouch is another increasingly popular design. According to Food & Drug Packaging, it was invented by the United States Army Natick R&D Command, Reynolds Metals Company, and Continental Flexible Packaging, who jointly received the Food Technology Industrial Achievement Award for its invention in 1978. Retort pouches are commonly used by the U.S. military for field rations, and they are referred to as Meals, Ready-to-Eat (MREs).

During 2017, approximately 176.6 million lb of PE resins were consumed in the production of pouches, Mastio indicates. With an average annual growth rate (AAGR) of 5%, PE resin consumption is expected to increase to 204.6 million ln by the year 2020. Of this total amount, PE food pouches represented an 83.5% market share and non-food PE pouches represented a 16.5% market share.

During 2017, the four largest producers of PE pouches in North America were Sealed Air Corp. (Cryovac Div.); Bemis Co., Inc. (Bemis North America Div.); Winpak Ltd. (Winpak Films, Inc. Div.); and Fres-Co System USA Inc. Collectively these companies consumed 94.2 million lbs. of PE in the production of pouches for a combined 53.3% share of this market.

MATERIALS TRENDS

Pouch film differs by end-use application. PE pouches can be used to package items from many market areas including beverages, condiments, food, household cleaners, pet food, and personal care products. Foil, nylon, polyester, and polypropylene (PP) films and substrates are combined with PE film to yield a pouch with suitable barrier and strength properties for each application. Therefore, a uniform and tear-resistant pouch film is suited to the product it will ultimately contain.

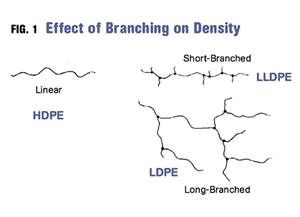

In 2017, the principal PE resin used to produce pouches was LLDPE, Mastio’s study reveals. They are widely utilized in this market for added puncture resistance and impact strength in lower gauges than is possible with LDPE. LLDPE manufactured using the metallocene single-site catalyst process (mLLDPE) allows processors to further downgauge films while maintaining or increasing film strength. Additionally, films with coextrusions of mLLDPE material have lower heat seal initiation temperatures when compared to LDPE-ethylene-vinyl acetate copolymers (LDPE-EVA copolymer), translating into faster line speeds. Faster heat seals are necessary when using vertical, form, fill and seal (VFFS) processing in the production of pouches. mLLDPE resins are stated to have excellent organoleptic properties, which is very important for pouches utilized for hot-fill or retort packaging of food products. Other grades of LLDPE resin that are utilized in this market include LLDPE-octene, LLDPE-butene, and LLDPE-hexene.

LDPE-homopolymer and LDPE-EVA copolymer resins are used where clarity and seal strength are important, as well as the ability to withstand extreme temperatures. Medium molecular weight-high density PE (MMW-HDPE) resin enables even further film downgauging than LLDPE resin in applications where clarity is of lesser importance or color additives are incorporated. HDPE resin also offers increased barrier and environmental stress crack resistant (ESCR) properties.

DESIGN TRENDS AND INNOVATIONS

In 2016, NOVA Chemicals Corp. developed a versatile all-PE multilayer structure design for use in the popular standup pouch package format. Recyclable pouches could be the next frontier in sustainability. The pouch offers several benefits, such as exceptional moisture barrier performance, runs on standard lines without productivity loss, the ability to be co-extruded or laminated for surface or reverse printing, and compatibility with reclosable zippers and other open/close fitments.

In 2015, Seventh Generation Inc. switched to a pouch packaging design for dishwasher-detergent pods that offers 100% recyclability. It is a resealable stand-up pouch made entirely from PE, and the RecycleReady Technology for the packaging was developed by Dow Chemical Company. Seventh Generation, Inc. and its partners achieved the sealability, toughness, stiffness and aesthetics required for the pouch—plus recyclability.

Seventh Generation Inc. is committed to achieving zero waste by 2020, and sustainable pouch packaging is a key element in its strategy. The back of each pouch is printed with the How2Recycle store drop-off label. This graphic explains to consumers that clean, dry pouches can be recycled at plastic-bag and film drop-off locations at supermarkets and other retail stores.

FILM EXTRUSION TECHNOLOGY

During 2017, the blown film extrusion process remained the primary process for this market (89%) PE resins were also utilized in the cast film extrusion process. Multi-layer coextrusion film remains as the most popular film structure (87%) although a few companies still make monolayer films for this market. More film layers result in a longer shelf life, thus many pouch film customers require utilization of multi-layer film because of the additional barrier properties and the ability to downgauge film. Three- to five-layer film structures are most common, however, many film extrusion companies can make pouches anywhere from two- to nine-layers.

MY TWO CENTS

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)