Plastics Processors Report Quickening Expansion

Expansion among both captive and custom processors is driven by expanding orders, production, and employment.

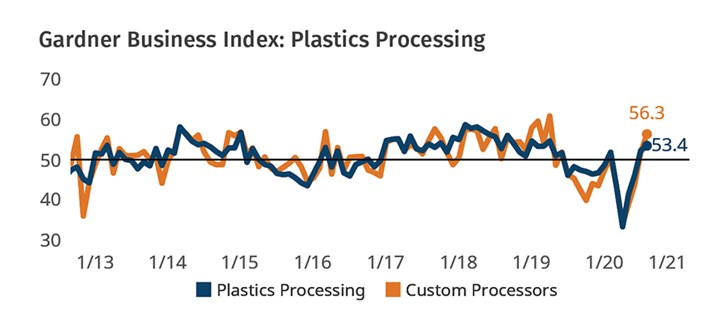

The Gardner Business Index (GBI) for plastics processing—based on monthly surveys of Plastics Technology subscribers—expanded for the second straight month in August, ending at 53.4. Custom processors fared even better, with a 56.3 August reading (Fig 1). Among the components of the Plastics Processing Index, new orders (Fig. 2) and production both showed quickening expansion for a second straight month and were joined by employment, which expanded for the first time since the outbreak of the Coronavirus. All index components reported higher readings in absolute terms for the month. (Index values over 50 indicate expansion, below 50 indicate contraction.)

FIG 1 Plastics processing reported its second consecutive month of expanding business activity in August; the Index was propelled by expanding new orders, production and employment.

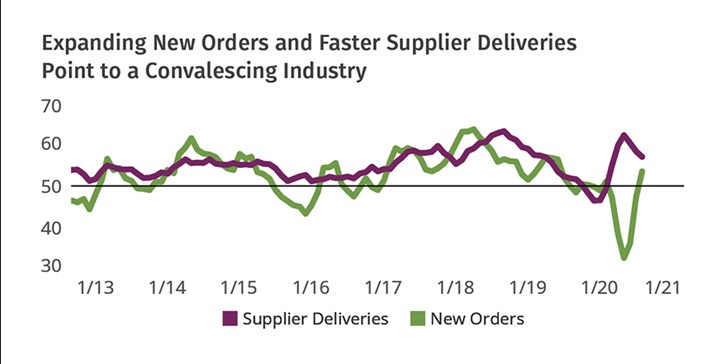

Unlike the textbook example of a recession, the economic impact of COVID-19 on the plastics processing market has been unprecedented because of its shock to both demand and supply. While in a classic recession there is a reduction in the demand for goods, which lowers sales; the pandemic also has reduced sales because even when there is willing demand for a product, disruptions in the supply chain meant there may not be product to sell. Whether lost sales are due to a shift in demand or a lack of available supply, the impact to the economy is the same. As supplier delivery readings continue to normalize and new orders continue to move higher, it appears that the industry is taking the right and necessary steps for a successful near-term recovery.

FIG 2 Improving demand and supply chains are bolstering plastics processors’ return toward economic growth. Lower supplier deliveries indicate faster delivery times. August’s supplier delivery reading was only two points above its historical average.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

The Path to Pellet Perfection

In underwater pelletizing, numerous variables in the equipment, process and material affect pellet shape, consistency and quality factors such as fines. Defining the “perfect” pellet depends on the conditions of end use, and achieving that ideal requires understanding of the causes of imperfections.

-

How to Configure Your Twin-Screw Extruder: Part 3

The melting mechanism in a twin-screw extruder is quite different from that of a single screw. Design of the melting section affects how the material is melted, as well as melt temperature and quality.

-

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

.jpg;width=70;height=70;mode=crop)