Prices for Polyolefins, PS, PVC and PET Trending Flat to Higher

Going into second quarter, the resin pricing trajectory is unsettled by a virus outbreak.

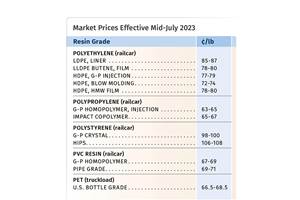

By mid-February, prices of PE, PS and PVC were up, while PP and PET had potential to move up a bit as well. In general, prices appear to have bottomed out and are more on par with global prices. As we move toward the second quarter, it is not fully clear how domestic demand will fare, though there is some cause for optimism despite some key uncertainties. Included are: to what extent will domestic resin pricing be affected by the coronavirus outbreak in China.

Yet another uncertainty is the potential impact of the Feb. 12 fire at ExxonMobil’s major refinery in Baton Rouge, La. An ExxonMobil spokesperson told PT that operations continue at the refinery and chemical plant. Asked how this might impact PE availability and pricing, the response was, “As a matter of practice, we do not comment on the operational status of specific units. We continue to meet contractual commitments and expect to meet all customer commitments. We apologize for any inconvenience and concern this incident may have caused. We will continue to keep you updated with information as it becomes available.”

Here’s a look at how our industry colleagues with pricing expertise view things for each of the top five commodity volume resins. They include purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, senior editors from Houston-based PetroChemWire; and CEO Michael Greenberg of the Plastics Exchange in Chicago..

PE: Prices moved up last month by 4¢/lb, despite what appeared to be a rollover for most of January, according to Mike Burns, RTi, v.p. of PE markets; PCW’s senior editor David Barry; and The Plastic Exchange’s Greenberg.

Suppliers are seeking another 4-5¢/lb for this month. Burns ventures suppliers will aim to use every reason for the February price increase—which all three sources ventured would ‘spill into’ March--and noted that the impact of the virus will significantly change markets in the February-March time frame. “Without global demand and export opportunity, inventories will continue to grow and outpace demand,” Burns said.

The Plastic Exchange’s Greenberg recently put it this way: “A 9¢/lb jump seems unpalatable at this time. Suppliers began pushing for the additional gains, but there was plenty of pushback from buyers, citing the need to first move the 4¢/lb (January) increase downstream, which is a stark change in light of the longer-term downtrend. Other processors were still happy to work off their sharp December purchases choosing to wait and see before paying up for more material.”

PCW’s Barry also reported that ExxonMobil’s Baton Rouge olefins plant remained operational and that there appears to be no impact on PE supply resulting from this fire.

Barry also cited PE spot prices as firm amid limited availability for both the export and domestic markets. “Some suppliers indicated that spot offers would remain thin for several more weeks, until mid-Mach, due to planned maintenance” He also noted that LDPE film grades appeared to be especially snug and characterized suppliers’ PE margins as improved because of falling feedstock costs, coupled with the successful implementation of a 4¢/lb price hike. He also noted export buying interest was weaker as market participants monitored the impact of the novel coronavirus epidemic.

PP: Polypropylene prices remained mostly flat last month, in step with that January’s propylene monomer contracts, but falling spot monomer prices were largely expected to result in a drop of 1-2¢/lb drop in PP, in step with February monomer contracts. Meanwhile, PP suppliers are seeking margin-enhancing increases of 3-4¢/lb, effective March 1, in addition to any change in monomer pricing, in an attempt to recoup some of the losses of previous months, according to Scott Newell, RTi’s v.p. of PP markets; PCW’s Barry; and Plastic Exchange’s Greenberg. Newell does not expect much volatility in pricing, noting that the latest PP production utilization rates were in the low 80s with supplier inventories still adequate, and PP imports trending lower. Adds Barry, “PP import volumes have dropped by almost half from 2019 because PP prices are on par with global prices.”

Greenberg recently reported that PP and propylene monomer costs have been well related. “We have seen them begin to de-couple from the absolute lock step that had persisted for years. This change was apparent these last few months when resin prices fell more than monomer, and we are now starting to see this pricing trend reverse as producers begin to regain a sense of pricing power.”

Greenberg reported that in unusually early settlement, February propylene monomer contracts settled 1¢ to 32¢/lb, but in contrast, the spot PP resin market firmed further. “Suppliers have been slowly raising asking prices seemingly to help enable an official 3-4¢/lb margin increase slated for March. Considering that PP prices got overdone to the down-side, while recent turnarounds and supply chain issues have limited production and resin inventories, we believe the increase has some merit and we view the market with a bullish prospective.”

Barry confirmed that PP spot prices were higher amid tighter supply due to planned and unplanned outages. “Rising PP spot prices have created a disconnect between U.S. export pricing and overseas markets, and export volumes appeared to be much lighter this month. Domestic demand was described as moderate, and there were concerns about the impact of the novel coronavirus on global supply chains, at least for the next month or two.”

PS: Prices moved up 3¢/lb last month, in most cases, and a rollover is being projected for February, according to both Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets and PCW’s Barry. Both characterize the market as having seasonally soft demand with adequate supply.

According to Barry, the fire at ExxonMobil’s Baton Rouge, LA refinery gave at least a temporary boost to benzene values, but it was unclear whether this would be sustained enough to change the PS cost picture significantly. The implied styrene cost based on a 30/70 ratio of spot ethylene/benzene was at 29.8¢/lb up 0.9¢/lb from the first week in February, and down 2.4¢/lb over the past four weeks.

Says Chesshier, “You’ve got feedstock prices retreating—both styrene monomer and ethylene, and no demand. But, monomer prices and PS prices are rising elsewhere due to higher benzene and styrene prices abroad.” She also ventures there’s potential for upward pressure on PS prices in March as refineries changeover from winter-to-spring fuel which tightens benzene, coupled with fewer benzene imports, and the seasonal uptick in demand in second quarter.

PVC: By all accounts, PVC prices last month appear to have moved up 3¢/lb as suppliers implemented the first of this year’s price nominations, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd. Both concede that there was a total reduction of 2-3¢ lb in PVC prices in fourth quarter 2019. Meanwhile, another 3¢/lb increase was at play for February. Some in the industry had initially expected a further price uptick for March.

Kallman ventures suppliers could get another 1-2¢/lb from the February initiative, citing stronger that normal January demand and the potential for earlier seasonal demand in the construction sector by end of this quarter. Still, he sees this month’s price initiative as a ‘tougher go’ for suppliers and ventures that PVC prices in March could also be flat. This based on the potential impact of a protracted coronavirus which will hurt suppliers’ exports business and would result in downward pressure on domestic prices.

Todd recently reported that by mid-month, suppliers had yet to issue a March increase. “With the success of the PVC price hikes being predicated on tight supply due to turnarounds, strong export demand and high export prices, converters wondered how long these higher prices could be sustained. On the export side, the big question is when Chinese demand will come back. According to an article by OPIS News, CitiBank warned in a report to commodities clients on Wednesday that it is too soon to believe that the worst of the novel coronavirus effects has passed. That report integrates and analyzes some very granular data on Chinese traffic that points to more tough times ahead.

PET: Prices were steady going into this month from early January prices, in the mid-to-high 40¢/lb delivered Midwest and South, with offers for East Coast delivery at 48¢/lb. Offgrade PET was in the mid-40¢/lb railcar delivered Midwest, steady from mid-January.

PCW Senior Editor Xavier Cronin characterized spot market activity as heavy within the first week of January as buyers for U.S. end users locked in monthly deliveries, and in some cases for all of the January-February time frame. Weak PET demand in China added to the supply glut that affects markets in the U.S., Europe and other parts of Asia.

Cronin expects PET resin prices are likely to fall 2¢/lb to 5¢/lb within this month due to the ongoing supply/demand dynamic of bloated supply outpacing demand from manufacturers of single-use PET bottles, containers and packaging. He ventured that prices in March would creep up a few cents higher from February as bottle, container and packaging manufacturers aim to meet rising demand for single-serve drinks, water and other beverages that typically arrives with warmer weather in springtime.

PET resin prices are expected to fall 2¢ to 5¢/lb.

Related Content

Ineos Nitriles Launches Biobased Acrylonitrile

The company’s Invireo is said to deliver a 90% lower carbon footprint compared to conventionally produced acrylonitrile.

Read MoreNova Makes Senior Leadership Changes

The company’s aim is to bolster sustainability ambitions

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreRead Next

Resin Buying Strategies: Resin Prices Soften

Despite further increases in prices of commodity resins in March and April, all indicators point to lower pricing, except perhaps for PVC, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas (resinpros.com). Improvements in the supply of ethylene and propylene monomers were a key factor in lower prices.

Read MoreResin Buying Strategies: Resin Prices May Have Peaked

Though prices of major commodity resins were still rising in March, there were indications that they may have peaked, according to purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas.

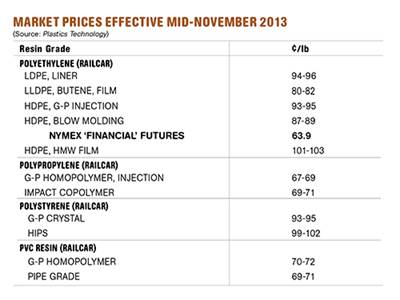

Read MoreMid November Commodity Resin Prices Flat to Soft

Prices of the four major commodity thermoplastics are projected to be a bit lower or remain flat (especially in the case of PE) as the year comes to an end.

Read More

.png;maxWidth=300;quality=90)