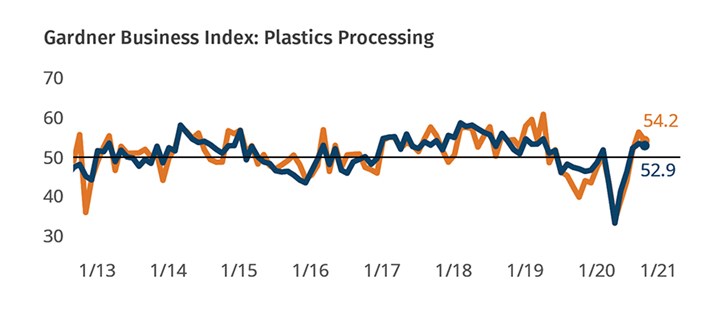

Processing Market Expands for Third Straight Month

New orders, production and employment sustain continuous industry expansion. With a reading of 52.9 in September, the index climbed each month in the third quarter.

The Gardner Business Index (GBI) for plastics processing —based on monthly surveys of Plastics Technology subscribers—finished September at 52.9, resulting in a third consecutive month of expanding activity. (Values above 50 indicate expansion; values below 50 signal contraction.) The Plastics Processing Index recorded its last full quarter of expansionary activity in the second quarter of 2019. Accelerating expansions in new orders and employment activity coupled with additional expansion in production kept the Index in growth territory through the end of the quarter. Conversely, backlog and export activity both reported accelerating contraction in September.

FIG 1 The plastics processing industry expanded during all three months of the third quarter. Strongly expanding domestic new orders, production and employment were critical for this third-quarter rebound after a trying first half of the year.

The GBI’s Custom Processors Index came in at 54.2. One important difference between the overall processing index and the custom processing during the quarter was the unique expansion of backlog activity in the custom sector.

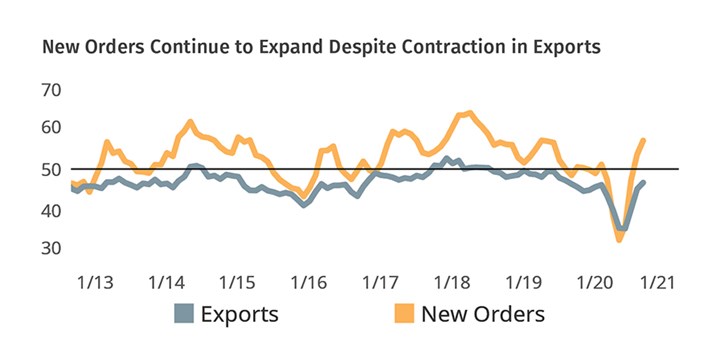

Both indices reported slowing supplier deliveries in September, with custom processors reporting the slowest supplier deliveries in over three years. The consequence of slowing deliveries could be reduction in production activity and lost sales opportunities. The disruption of supply chains as the world battles the spread of COVID-19 has been one of the unique challenges for to all manufacturers in 2020. COVID’s impact has affected both the demand for goods and the ability of firms to supply those goods that are in demand. In both instances, the net result is a constraint on economic growth.

FIG 2 Export activity contracted sharply in September while total new orders moved higher, setting a 16-month high. The contrasting movement in these measures speaks to the strength of domestic demand.

Editor’s Note: The Plastics Processing Business Index is unique in its ability to measure business conditions specific to plastics processors on a monthly basis. The challenges facing manufacturers today require leaders to have good data in order to make effective forward-looking decisions. It is particularly important at this time for our readers to complete the survey sent to them each month. Your participation will enable the best and most accurate reporting of the true impact that COVID-19 is having on the plastics industry.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

About the Author: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com.

Related Content

-

Automation in Thermoforming on the Rise

Equipment suppliers’ latest innovations exemplify this trend driven by factors such as labor shortages, higher-speed thermoformers and tighter quality control.

-

Interactive Training for Injection, Extrusion and Other Processes

Paulson has four in-booth stations demonstrating its various training solutions.

-

High-Temperature Syntactic Foam and High-Slip Plug Materials for Thermoforming

At K 2022, CMT Materials to launch new Hytac syntactic foam and a developmental higher slip plug materials with no PTFE.

.jpg;width=70;height=70;mode=crop)