R&E Tax Credit: A "Smart" Incentive for Industry 4.0 Companies

International CPA and business advisory Clayton & McKervey shareholders make case for improving your financial performance with R&E tax credit.

We were recently approached by CPAs Tim Finerty and Sarah Russell—shareholders at Clayton & McKervey, a Detroit-based international certified public accounting and business advisory firm—regarding the Research & Experimentation (R&E) tax credit, also known as the R&D tax credit.

The two authors noted that while the R&E tax credit has given businesses a powerful tool to strategically improve their bottom line, it is often overlooked or unclaimed. In reality, they note, there has never been a better opportunity for “smart” manufacturers in the Industry 4.0 era to explore and capitalize on these cash savings. Tax savings can be extensive. For companies who have adopted an Industry 4.0 approach, it’s worth it to take a second look at their qualified research activities to make sure they are receiving all the tax savings available to them. Here is further clarification.

The R&E benefit is available for the development or improvement of products, processes, techniques, formulas, inventions or software and is a dollar-for-dollar credit against the taxpayer’s federal income tax liability, which means companies may get a twofold benefit—the deduction in the year the expenditure is paid, as well as by claiming the tax credit.

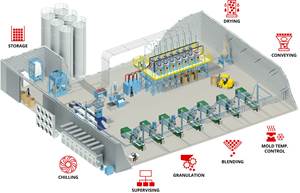

Excellent candidates for the R&E tax credit are businesses related to technology, industrial production and design, but also some machine shops, tool and die shops, and custom machine manufacturers. That’s why S-corporations, start-ups and partnerships in the business of improving industrial production processes should consider the R&E tax credit. Unfortunately, many of these businesses are prematurely thinking about converting to a C-Corp structure under the new tax law instead.

Before a change in structure, additional factors should be considered, such as whether the business qualifies for the pass-through deduction; if the business generates research credits; whether the business will pay dividends to its owners; and the long-term exit strategy of the business. Because R&E credits generated by a business can be used to offset any income generated from that same business activity, converting to a C-Corp may not be the best solution.

Examples of Qualified Research Activities (QRAs) under the R&E credit include:

- Providing custom control and automation solutions for various applications

- Developing new functionality or performance to meet customer specifications

- Development of schematic drawings for integration of system components

- Designing and developing cost-effective and innovative operational processes

- Developing new tool-specific fixturing or other tooling

- Improving processes through robotics or other types of automation techniques

- Experimenting with new alloys or other materials

- Testing new mold/die designs through sampling or trial

- Providing product and system solutions, including design engineering and mechanical fabrication

- Performing evaluations and system test

- Implementation of automated systems

There may also be Qualified Research Expenditures (QREs) if companies can substantiate how the expenditures are connected to the qualified activities, including:

- Qualified Wages of Employees performing, supervising and supporting qualified activities

- Supplies used to fabricate prototypes/items consumed during the conduct of research

- Contract Research–65 percent of fees paid to outside consultants/subcontractors/ engineers/software developers

- Estimates are allowed, however documentation of how the estimates were determined must be provided and reasonable methods must be used

Related Content

Five Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

Read MoreA Cost Saving Modular Approach to Resin Drying Automation

Whether implementing a moisture-sensing closed-loop system for a single dryer, or automating an entire plant, technology is available to take the guesswork and worry out of resin drying. Using a modular approach allows processors to start simple and build more capabilities over time.

Read MoreHow Was K 2022 for Blow Molding?

Over a dozen companies emphasized sustainability with use of foam and recycle, lightweighting and energy savings, along with new capabilities in controls, automation and quick changeovers.

Read MoreEnsuring Repeatability: The Key to Effective Injection Molding Automation

One of automation’s key promises is repeatability: the same movement to the same location, time and time again. But to achieve that, all elements involved — robot, machine, EOAT, mold — must be in and stay in alignment.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)