Reshoring: Is the Surge Sustainable?

Sure seems that way, as companies big and small look and act to bring manufacturing back to the U.S.

I have written repeatedly that if the U.S. did not learn its lesson from having a long, winding, vulnerable supply chain as a result of everything that has gone down since Covid-19 … it never would.

Are we learning now, or is the current buzz about “reshoring” just a lot of anecdotal hub-bub that will simmer once the supply chain starts to untangle? Seems like the former.

I recommend checking out an article posted by Ryan Beene on Bloomberg News July 5. Beene’s report reveals that U.S. manufacturers are pulling production out of Asia. This is not anecdotal. Beene’s piece, headlined American Factories Are Making Stuff Again as CEOs Take Production Out of China, notes that “construction of new manufacturing facilities in the U.S. has soared 116% over the past year, dwarfing the 10% gain on all building projects combined, according to Dodge Construction Network.”

The article continues, “There are massive chip factories going up in Phoenix: Intel is building two just outside the city; Taiwan Semiconductor Manufacturing is constructing one in it. And aluminum and steel plants are being erected all across the south: in Bay Minette, Ala. (Novelis); in Osceola, Ark. (U.S. Steel); and in Brandenburg, Ky. (Nucor). Up near Buffalo, all this new semiconductor and steel output is fueling orders for air compressors that will be cranked out at an Ingersoll Rand plant that had been shuttered for years.”

“OEMs need to account for the entire value proposition offered by their supplier and not make decisions based solely on purchasing price.”

Data from the Reshoring Initiative supports the thesis that reshoring is real. Its 2021 study showed the private and federal push for domestic supply of essential goods propelled reshoring and foreign direct-investment (FDI) job announcements to a record 261,000, bringing the total such jobs announced since 2010 to over 1.3 million. And for the second year in a row, reshoring exceeded FDI by 100%, in contrast to 2014 through 2019, when FDI exceeded reshoring. Additionally, the number of companies reporting reshoring and FDI set a new record of over 1800 companies. The Data Report discusses the trend and how reshoring will continue to be key to U.S. manufacturing and economic recovery.

Photo: Getty Images

For the past two-plus years, machinery suppliers to the plastics industry have been extraordinarily busy filling orders from processors of all kinds. Processors that might typically order two machines a year have been doubling up. Home delivery of food and other items is propelling demand for flexible packaging. Processors are not only building plants to accommodate additional manufacturing, but warehouses as well, suggesting perhaps that just-in-time manufacturing strategies are being revisited.

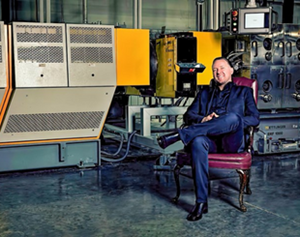

For Jay Baker, CEO of Jamestown Plastics, a family-owned custom thermoformer with plants in New York and Texas, this couldn’t have happened fast enough. In an interview with Plastics Technology, he said, “We roared through the pandemic because we were deemed an essential business. Obviously, we are a huge proponent of ‘Made in the U.S.’ We have seen some reshoring projects and we are hoping it accelerates, but our feeling is some customers are still tip-toeing around it. OEMs need to account for the entire value proposition offered by their supplier and not make decisions based solely on purchasing price.”

Baker continues, “We have had many discussions with customers about this, trying to make them understand that they need to place a value on sales that might be lost by having products made on the other side of the world. There is tremendous value for companies to have long, multilayered relationships with their suppliers. That’s been overlooked for a long time, and those companies lose the opportunity to exchange ideas and tap into depth of knowledge of suppliers that are nimble, innovative and really understand manufacturing.”

Related Content

Foam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreA Recycling Plant, Renewed

Reinvention is essential at Capital Polymers, a toll recycler that has completely transformed its operation in a short period of time.

Read MoreHow to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More (2).jpg;maxWidth=970;quality=90)

(2).jpg;maxWidth=300;quality=90)

(1).jpg;maxWidth=970;quality=90)