Single-Serve Beverage Capsules Market Trends

AMI’s newest industry report discusses timeline of brand compatible coffee capsules and trends.

AMI’s newest industry report discusses timeline of brand compatible coffee capsules and trends.

That the coffee capsules market is here to stay is a given but the transformation of the market with competitive brand compatibles emerging is in full swing as noted by an authoritative comprehensive “deep-dive” analytic report of the global Single Serve Beverage Capsules (aka coffee capsules) industry. Released just last month by Bristol, U.K.-based AMI Consulting in cooperation with Plastic Technologies, Inc., Holland, Ohio. Here are the key points and issues addressed:

• No longer a niche market, the capsules industry has developed into a complex value chain over the years. Back in the mid-to-late 1990s, this segment represented a classic example of an oligopoly—limited to a couple of Italy-centered systems for traditional espresso brewing, (e.g. Lavazza Espresso Point).

• Relatively recently (2000s), as the capsules format became more popularized, brands such as Dolce Gusto (by Nestle), Tassimo (by Kraft, now Jacobs Douwe Egberts) and A Modo Mio (by Lavazza) found their successful, high-margin niches on the market.

• The year 2012 heralded the start of a dramatic market transformation, driven by the change of legal circumstances; the expiration of Nespresso and Keurig design patents, which brought about disruptive changes in the supply chain, creating new opportunities for both end-users and converters to tap into the growing market segment. Notwithstanding some legal battles, these circumstances triggered the development of Nespresso-compatible brands and own label products that could now rely on the Nespresso machines installment base, but offer a more competitive retail price for the capsules. Barriers to enter the capsules segment became lower (both from filling and molding perspectives).

• On the other hand, the supply chain of capsules is rapidly losing its oligopolistic nature and the former dominance of major suppliers has been challenged as the market is expanding. A more fragmented supply chain affects the overall profit pool and the way consumers make their choices. Needless to say, that transformation had an adverse effect on the premium image of the segment: the average price was lowered and the quality of some capsules available on the market poorer (based on OTR and performance in brewing machines). The potential machine malfunction (or misuse) in correlation with compatibles introduced some operational challenges for Nestle and its machine partners having to do with machine servicing (i.e. increased service costs).

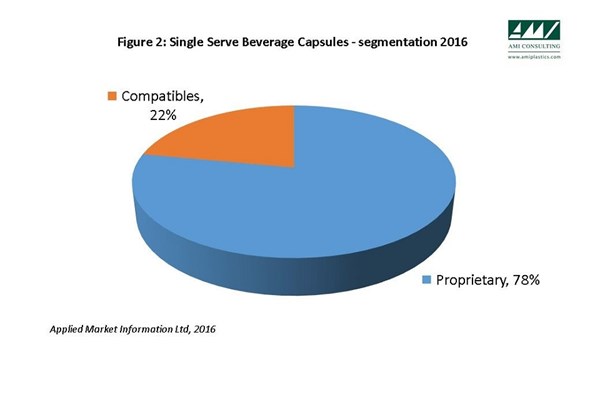

• The AMI consultants estimate that all plastic compatible capsules (across all systems) accounts for 22% of the Single Serve Beverage Capsules market worldwide by unit volume. The Nespresso system is the world’s largest selling, with volume of about 17 billion units—that included both aluminum capsules and plastic Nespresso compatibles.

• The development of new compatible offerings is now in favor of the Nescafe Dolce Gusto system (another Nestle brand). The market penetration of Dolce Gusto compatibles is still low at the moment, but it is expected to strongly grow in the comping years.

Related Content

-

Solve Four Common Problems in PET Stretch-Blow Molding

Here’s a quick guide to fixing four nettlesome problems in processing PET bottles.

-

ABC Technologies to Acquire Windsor Mold Group Technologies

The Tier One automotive supplier with compounding and blowmolding machine capabilities adds the 50-yr-old molder and moldmaker.

-

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.