Volume Resin Prices Down-to-Flat Going into First Quarter of 2020

Prices of polyolefins, PS, PVC could bottom out; PET, nylon 6 could drop further while flat to modestly down trajectory projected for ABS, PC, and nylon 66.

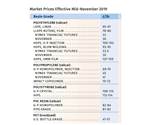

The price trajectory for nearly all volume resins is down-to-flat as we move from December to first quarter of the new decade. Prices of PE, PP, PS and PVC are likely to bottom out this month, while prices of PET and nylon 6 could drop further, and flat or modestly down prices are projected for ABS, PC, and nylon 66.

Driving factors include lower feedstock costs, supply outpacing demand as well as an overall global slowdown in demand along with lower global prices.

Here’s a look at how our industry colleagues with pricing expertise view things for each of the major commodity volume resins. They include purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, senior editors from Houston-based PetroChemWire; and CEO Michael Greenberg of the Plastics Exchange in Chicago.

PE: Prices dropped 3¢/lb in November and there is some potential for another price drop in December, according to Mike Burns, RTi, v.p. of PE markets, PCW’s senior editor David Barry, and The Plastic Exchange’s Greenberg. Meanwhile, suppliers had pushed up their November 4¢/lb increase to December, and at least one supplier so far, Dow, has announced a new 5¢/lb hike for January 1. Says Burns, “The historical first-quarter upward pricing pressure may be challenged this year due to overcapacity and lower global prices that domestic suppliers need to keep matching in order to export.”

These industry sources generally see PE prices bottoming out this month. PCW’s Barry noted that cold weather-related issues may offer suppliers a slim chance to push through some or all of their fourth quarter 2019 4¢/lb price hike. All three sources note that spot market material has been offered at significant discounts, but also concede that U.S.-Canada PE operating rates had dropped to around 85% in third quarter and into the fourth, which could have some effect on curtailing availability.

PP: Prices dropped 2.5¢/lb in November in step with propylene monomer, which dropped to 35¢/lb. Both Scott Newell, RTi’s v.p. of PP markets and PCW’s Barry anticipated that additional non-monomer price concessions on the order of .5-1.5¢/lb were reportedly underway. Another 1-2¢/lb decrease for December was projected for the monomer with the potential of yet another additional 1¢/lb decrease for PP. While these industry sources ventured that PP demand might continue to ‘struggle’ in this first quarter, they largely expected prices to be flat, noting that monomer prices were approaching their lowest levels.

The Plastic Exchange’s Greenberg characterized spot PP activity as good going into December, but with the flow of offers diminishing as spot prices slid down by 3¢/lb. Meanwhile, plant production rates had been reduced in fourth quarter and new production slated to come on stream from two facilities had been pushed back to sometime this quarter.

PS: Prices dropped 3¢/lb in November, in step with that month’s benzene contract settlement of $2.23/gal, down from October’s $2.60/gal, which previously was considered the lowest of 2019, according to both Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets and PCW’s Barry. They had projected the November drop and see potential for another 2¢/lb decline this month.

Spot benzene prices ticked upwards following the November contract settlement but than fell a bit to mirror the contract price. Chesshier says that were this to continue, December benzene contract prices are likely to be a rollover and PS suppliers will likely aim to hold on to their margins and not lower prices. As for January, these sources say the price trajectory will depend in the primary driver—benzene prices. Barry cites industry data through October that showed domestic demand down by over 5%.

PVC: Prices of November PVC are largely projected to have dropped 1¢/lb, with potential for the same this month, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd. Todd reports that the suppliers’ October 3 ¢/lb price hike was the first time in 2019 that suppliers “failed utterly to enact a price hike.”

Prices last year rose 2¢/lb in June, then dropped 1¢/lb in August, leaving suppliers with a net 1¢/lb, though the projected drop in November and/or December would take pricing to flat if not down for 2019. Todd reported that at least one supplier threatened announcing a “big” price increase for Jan. 1, 2020, when a drop was being projected for the November-December, timeframe. Kallman ventures pricing would be at a standstill going into first quarter citing such key factors as global slowed economy, potential for lower ethylene prices, and new PVC capacity from Westlake Chemicals.

PET: Prices were steady as December rolled in at 45-50¢/lb, and they are expected to stay at that level through the Holidays, with very little spot market activity, according to PCW senior editor Xavier Cronin. He characterizes demand as weak and supply as abundant.

Railcar business for first quarter 2020 business was booked at the low end of the December price range. At the same time, imported PET business was seen as low as the low 40¢/lb range for supersacks delivered to Southern California. Vietnam emerged in 2019 as the third top source of U.S. PET imports, after Mexico and Canada. Cronin ventures that PET prices in January could tumble down a few cents with demand for single-use PET bottles and containers typically weak during the cold-weather months.

ABS: Prices were flat through most of fourth quarter, which mirrored most of the previous two quarters and are expected to continue as such entering 2020, according to RTi’s Kallman. He characterizes pricing as being already in a ‘good place’ for processors, with fairly tepid demand and a well-supplied market, including a healthy dose of imports. One caveat noted is the degree of impact on butadiene prices following the explosion of the TPC Group’s plant at Port Neches, Texas, on November 27. It has a significant yearly production of nearly 370 million lb/yr. Prices reportedly had already moved up 2-3¢/lb by December. However, styrene monomer prices had been dropping.

PC: Prices were flat to modestly down (under 5¢/lb) in some cases through most of fourth quarter after some erosion in the third. RTi’s Kallman ventures that prices may drop going into first quarter as costs of key feedstocks are expected to be lower going into 2020 than 2019. That, along with ample domestic supply and well-priced imports and lower global demand, are key factors.

NYLON 6: Prices in fourth quarter have been weaker than the previous two quarters, with reported price concessions taking place as suppliers aim to maintain or gain market share, according to RTi’s Chesshier. Demand in automotive is waning due to the move toward electric or hybrid vehicles which is making nylon 6 easy to replace with materials such as PP where heat resistance is not required. Chesshier ventures that nylon 6 prices had further potential to drop in January, noting that demand is lower across key markets, there is new global supply of both caprolactum and nylon 6 coming on stream, and nylon 6 imports are down as domestic suppliers have been keeping prices in check.

NYLON 66: Prices are flat to modestly down (under 5¢/lb) through fourth quarter but a downward trajectory going into first quarter is likely, according to RTi’s Kallman. He ventures that demand would be challenged going into 2020, but not as much as that seen in 2019. The slowdown in demand for automotive appeared to have slowed a bit through third quarter 2019: U.S., down, 1%; Europe, down .7%, and China, down 9.4%. (That was an improvement over the first half for the year: U.S., down 2%; Europe, down 3.1%, and China, down 12.4%.)

Westlake Chemical announced capacity expansions for polyvinyl chloride (PVC) and vinyl chloride monomer (VCM) production at two plants in Germany (Burghausen, Gendorf) and one in Geismar, Louisiana (pictured).

Related Content

Solve Four Common Problems in PET Stretch-Blow Molding

Here’s a quick guide to fixing four nettlesome problems in processing PET bottles.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreWisconsin Firms Unite in Battle Against Covid

Teel Plastics opened new plant in record time, partnering with AEC & Aqua Poly Equipment Co. to expand production of swab sticks to fight pandemic.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MoreRead Next

2019 Ends with Lower Prices for Commodity Resins

Global demand slowdown and oversupply end the year with a buyers’ market.

Read MoreLower Prices for Five Volume Commodity Resins

Global demand slowdown and in some cases oversupply are ending the year with a buyers’ market.

Read MoreDownward Pricing Pressure for Commodity Resins this Quarter

Slowed demand, sufficient supplies, lower global prices could serve to push down prices of most commodity resins.

Read More

.png;maxWidth=300;quality=90)