Western Companies Step Up Patrols of Their IP In China

Western chemical companies have long cried foul when it comes to Chinese IP theft, but these days, they’re lawyering up and taking perpetrators to court.

“The greatest transfer of wealth in history.”

That’s how General Keith Alexander, Commander of the United States Cyber Command and Director of the National Security Agency, describes the theft of intellectual property, according to a May 22 report from Commission on the Theft of American Intellectual Property.

Thus far in 2014, it seems that chemical and plastics companies, for one, are saying “enough,” particularly when it comes to IP theft by China, a country they’re increasingly partnering with as a means of gaining access to the massive local market.

This week, polyester manufacturer, INVISTA, announced that it had resolved a lawsuit against a Chinese engineer for what it called “misappropriation and infringement of trade secrets” relating to its purified terephthalic acid (PTA) technology, PTA being a key ingredient to PET, among other things.

INVISTA said that an employee of a Chinese engineering design company “misappropriated some of INVISTA’s proprietary information,” during one of INVISTA’s technology projects for a Chinese licensee. INVISTA in turn filed a lawsuit through the Beijing Intermediate People’s Court against the individual. The Wichita-based company won a number of concessions from the alleged IP thief, including that person:

- Agreeing not to work in any job or activity in which he could use or disclose his knowledge of INVISTA’s PTA technology,”

- Immediately and permanently ceasing any use or disclosure of INVISTA’s PTA technology

- Returning INVISTA’s trade secret materials and disclosing all sources for the materials

INVISTA is not alone in accusing Chinese firms of stealing intellectual property, nor is it alone in pursuing legal recourse. On March 21, INEOS sued several Sinopec subsidiaries for what it called “misuse of trade secrets” relating to its acrylonitrile business.

In that case, INEOS, which claims its acrylonitrile business is No. 1 globally with a value of $3 billion and 5,000 employees worldwide, accused the perpetrators of “prolific building of Acrylonitrile copy plants in China,” an action it claimed “will destroy its business.”

INEOS says that Sinopec Ningbo Engineering Company has broken a long established technology agreement which, together with trade secret misuse by other Sinopec companies, has enabled development of a series of new world scale Acrylonitrile plants without INEOS agreement or consent.

This case garnered press attention at the time because SINOPEC is a state-owned business, and INEOS’ action could have been taken as in indirect indictment of the Chinese government.

INEOS, however, quickly noted that it enjoyed “otherwise excellent relationships with Sinopec and with China,” and that it had “every confidence that China has now developed an excellent system to protect intellectual property consistent with the fact that China now files more patents than any other count.”

It’s easy to appreciate the business pickle INEOS found itself in. On the company’s web site, the press release announcing the lawsuit against SINOPEC was sandwiched between two other releases detailing new partnerships with the state-owned company.

On March 5, Bloomberg reported on the case of Walter Liew, a consultant working with DuPont found guilty of selling titanium dioxide secrets to a Chinese chemical manufacturer:

Walter Liew, 56, a consultant who rose from a farm in Malaysia to earn $28 million from contracts with a Chinese company, was found guilty by federal jurors in San Francisco of 22 counts of economic espionage, trade secret theft, witness tampering and making false statements. He sold the secrets to China’s Pangang Group Co., a Chengdu-based chemical company building a 100,000 metric-ton-per-year plant to produce titanium dioxide, a white pigment with a global annual sales of $14 billion, prosecutors said.

These are not isolated examples.

China does not have a monopoly on IP theft, but, as the IP Commission report states, it has created an environment highly conducive to the practice, with not only the tacit acceptance of the government, who in theory would police that matter, but at times, its participation:

National industrial policy goals in China encourage IP theft, and an extraordinary number of Chinese in business and government entities are engaged in this practice. There are also weaknesses and biases in the legal and patent systems that lessen the protection of foreign IP. In addition, other policies weaken IPR, from mandating technology standards that favor domestic suppliers to leveraging access to the Chinese market for foreign companies’ technologies.

At times, the litigiousness of Western society, and in particular, the U.S., is lamented, but more legal actions in these cases in China, and a pursuit of justice by the Chinese courts, would be a good thing here. For Western companies to take the chance on investing in China, they’ll need to feel the rule of law applies to all parties, even ones with direct or indirect ties to the Chinese government.

Related Content

Resins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreTracing the History of Polymeric Materials: Aliphatic Polyketone

Aliphatic polyketone is a material that gets little attention but is similar in chemistry to nylons, polyesters and acetals.

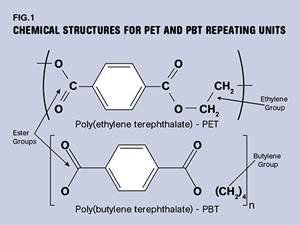

Read MorePBT and PET Polyester: The Difference Crystallinity Makes

To properly understand the differences in performance between PET and PBT we need to compare apples to apples—the semi-crystalline forms of each polymer.

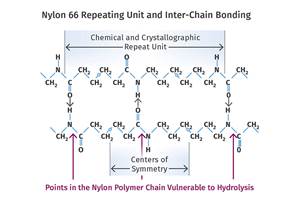

Read MoreWhat is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More