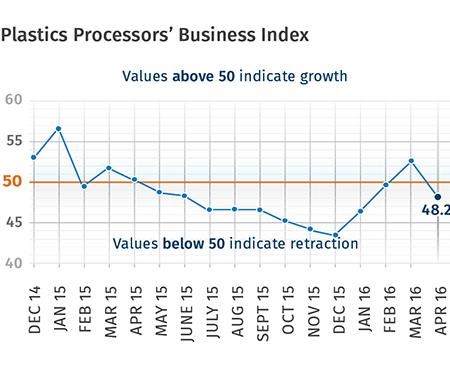

April’s Index: 48.2

Larger plants doing much better. Capital spending plans jump.

With a reading of 48.2, Gardner’s Plastics Processors’ Business Index contracted in April after expanding in March. (A reading below 50 indicates contraction, above 50 means expansion.) The good news, however, is that over the last three months the index has been substantially higher than it was in the second half of 2015.

New orders contracted marginally in April. So far this year, the new orders index has either grown or been just under 50. Production contracted at a faster rate than in January after two months of growth. While the backlog index contracted for the 15th month in a row, the index has been at virtually the same level for three months. Employment increased for the third time in four months, growing at its fastest rate since March 2015. The export index dropped significantly, contracting at its fastest rate this year. Supplier deliveries lengthened for the third month in a row.

Material prices increased for the first time since December and the index jumped to its highest level since November 2014. Prices received continued to decrease. But the rate of decrease has decelerated slowly since June 2015. Future business expectations fell, but remained above the level of the second half of 2015.

Processors with more than 250 employees grew for the third month in a row, although the rate of growth has slowed each month. Plants with more than 100-249 employees expanded for the second month in a row. Facilities with 50-99 employees expanded at a strong rate for the fifth month in a row. Companies with 20-49 employees contracted significantly, after expanding in the previous two months. The index for processors with 1-19 employees continued to contract as it has since February 2015.

The only region to grow in April was the Northeast. It has expanded for three straight months and grew at its fastest rate in the history of the survey in April. The North Central-East, North Central-West, West, and South Central contracted at a similar rate. The Southeast contracted for the first time since December.

Future capital-spending plans jumped above $1 million per plant for the first time since November 2014. Planned investments were above average for the second time in the last four months. Compared with a year ago, capital-spending plans were 80% higher. This was the second time in three months that spending plans increased compared with a year ago. The trend seems to indicate that capital-equipment spending among processors is entering its next “up” cycle.

ABOUT THE AUTHOR

Steven Kline Jr. is part of the fourth-generation ownership team of Cincinnati-based Gardner Business Media, which is the publisher of Plastics Technology. He is currently the company’s director of market intelligence. Contact: (513) 527-8800 email:skline2@gardnerweb.com blog: gardnerweb.com/economics/blog

Related Content

-

How to Select the Right Tool Steel for Mold Cavities

With cavity steel or alloy selection there are many variables that can dictate the best option.

-

Improve The Cooling Performance Of Your Molds

Need to figure out your mold-cooling energy requirements for the various polymers you run? What about sizing cooling circuits so they provide adequate cooling capacity? Learn the tricks of the trade here.

-

How to Reduce Sinks in Injection Molding

Modifications to the common core pin can be a simple solution, but don’t expect all resins to behave the same. Gas assist is also worth a try.

.png;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)