Automotive Outlook: Steady Improvement in 2013

Wood on Plastics

One of the true bright spots in the economy over the past 24 months has been the automotive industry. Our forecast for 2013 calls for another solid increase of 6% to 8%.

As we close out 2012 and look forward to 2013, the prevailing trend in the U.S. economy is pretty much the same as it has been for the past two years. We remain mired in a slow-growth recovery in which real GDP is expanding at a subpar pace of about 2% per year and the labor market is creating about 150,000 jobs per month. This is the macroeconomic equivalent of treading water.

But one of the true bright spots in the economy over the past 24 months has been the automotive industry. In 2011, the number of motor vehicles assembled in the U.S. expanded by 12% over the previous year, and in 2012 that rate of growth has accelerated to over 20%. Our forecast for 2013 calls for another solid increase of 6% to 8%, which will bring the industry back very close to pre-recession numbers of vehicles assembled.

For plastics processors and other suppliers to the auto industry, a trend even more important than rising market demand for new autos is that of rising profitability for automakers. As the chart above illustrates, profits in the auto sector have been hard to come by in recent years. But this situation may have turned around in 2012. After all of the trials and tribulations of bankruptcy and government bailout, it now appears that the U.S. auto industry is once again making both cars and money. This should allow auto makers to pay their suppliers and continue to invest in products and ideas that will enhance their productivity and competitiveness.

Our forecast for 2013 is based on the continuation of several beneficial trends that have emerged recently. The most important is that overall GDP growth in the U.S. is expected to ramp up to 2.5-3% in 2013. This increase will be attributable in large part to increased activity in residential construction. This sector was badly damaged when the housing bubble burst in 2008, and it has languished at very low levels for most of the past five years. But recent improvements in housing starts and home prices indicate that a sustainable upward trend is gaining momentum.

These escalations in home prices and construction activity are important to the auto industry for several reasons. First, rising home prices make consumers more comfortable about purchasing big-ticket items. The second reason is that rising home prices will allow banks to lend money more easily. As home prices rise, more people will be able to use their homes as collateral for loans. So when it is a good time to buy a new house, it is also a good time to buy just about anything else.

The expected increase in construction activity will result in a lot of new jobs being created, and a strengthening labor market is always good for the new car business. It will also spur demand for vehicles such as pickup trucks and delivery vans because these are the preferred vehicles for construction workers.

There are also several positive trends not directly related to construction activity that will persist through the coming year. The average age of cars in America is over 10 years. Many households have postponed purchasing a vehicle due to uncertain economic conditions, but these fears will ease as 2013 progresses. Another trend is the inexorable upward march of fuel prices. This will generate steady demand for smaller, more fuel-efficient vehicles.

WHAT THIS MEANS TO YOU

•Natural gas will continue to gain popularity as a fuel for motor vehicles. As a result, processors will find opportunities in both new auto parts and also the expansion of the infrastructure needed to deliver natural gas at a retail level.

•The price of steel and most other metals will continue to rise. This will push demand for car parts made of plastics because they are less expensive to make as well as lighter in weight.

•Cars that drive themselves will likely be a major product of the future. This will not happen in the next two years, but it will be a dominant feature in 10 years.

About the Author

Bill Wood, an economist specializing in he plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. Contact BillWood@PlasticsEconomics.com.

Related Content

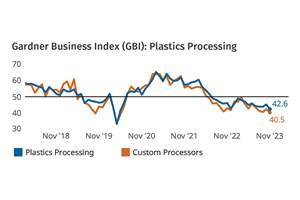

Plastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

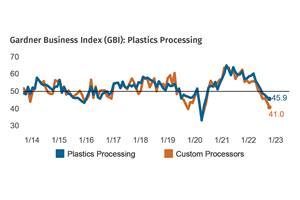

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

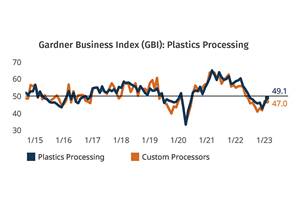

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

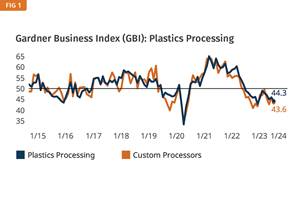

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More