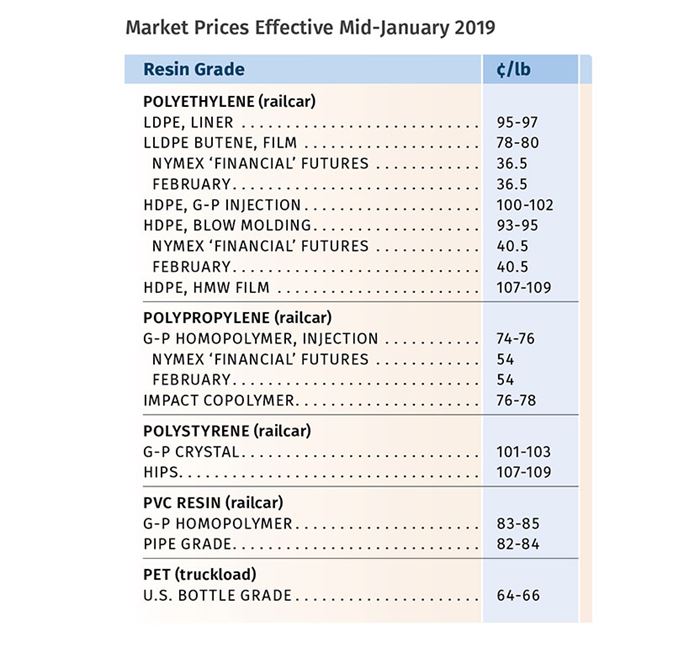

Prices Flat or Lower for Commodity Resins

Low feedstock prices, higher supplier inventories, and slowed demand are key drivers.

Prices of PE, PP, PS and PET dropped in December—with PP and PS in starring roles--and were expected to be flat generally through January and into this month. Driving the trend were continued lower feedstock prices globally, starting with crude oil, and globally higher supplier inventories, with lackluster seasonal demand.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of The Plastics Exchange in Chicago.

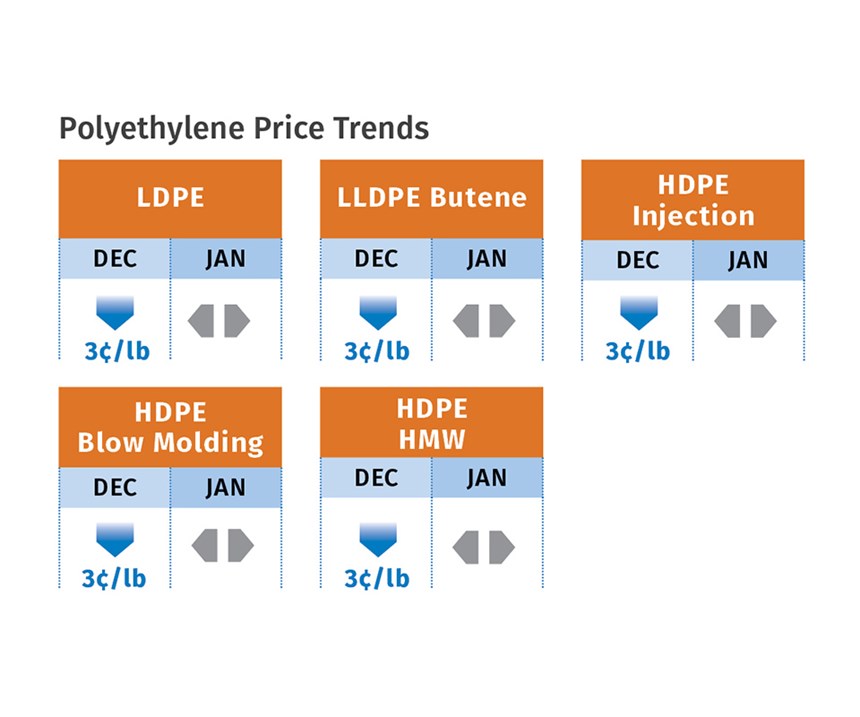

POLYETHYLENE PRICES DROP

Polyethylene prices dropped 3¢/lb in December, following a similar slump in November. Marching into 2019, PE suppliers issued increases of 3-6¢/lb for Jan. 1 and additional increases of 3-4¢ for this month, depending on the supplier.

Both Mike Burns, RTi’s v.p. of PE markets, and PCW senior editor David Barry maintained that there were no market drivers supporting any price increase. On the contrary, they cited global trends to lower feedstock prices, led by falling oil prices, and healthy PE inventories. Burns noted that domestic inventories continue to exceed strong U.S. demand. Also, while exports were very robust at the end of 2018, a slowdown was expected from Asia due to slowing economies there and Chinese New Year, so that market conditions were likely to be uncertain until late February.

Barring either a major disruption in production or oil prices spiking, RTi’s Burns foresees relative stability for PE prices through the first quarter, at least, if not for most of the year. PCW’s Barry noted that only a big uptick in oil pricing would support an increase. He ventured domestic demand would be strong in January, partly due to some restocking and suppliers’ push for increases. He saw the downward pressure on PE as having played out and predicted flat to possibly upward pricing trend in this first quarter. Both sources noted that 2018 ended with domestic PE supplies rising by over a 1 billion lb following major new capacity brought on stream.

Commenting on the culmination of 2018 PE pricing trends and the spot market, The Plastics Exchange’s Greenberg said, “In general, the need to export the vast majority of the new polyethylene production in the face of Chinese tariffs and falling oil prices required sharp discounts; and consequently, we saw the Houston/export discount vs. higher domestic prices grow to perhaps unprecedented levels.”

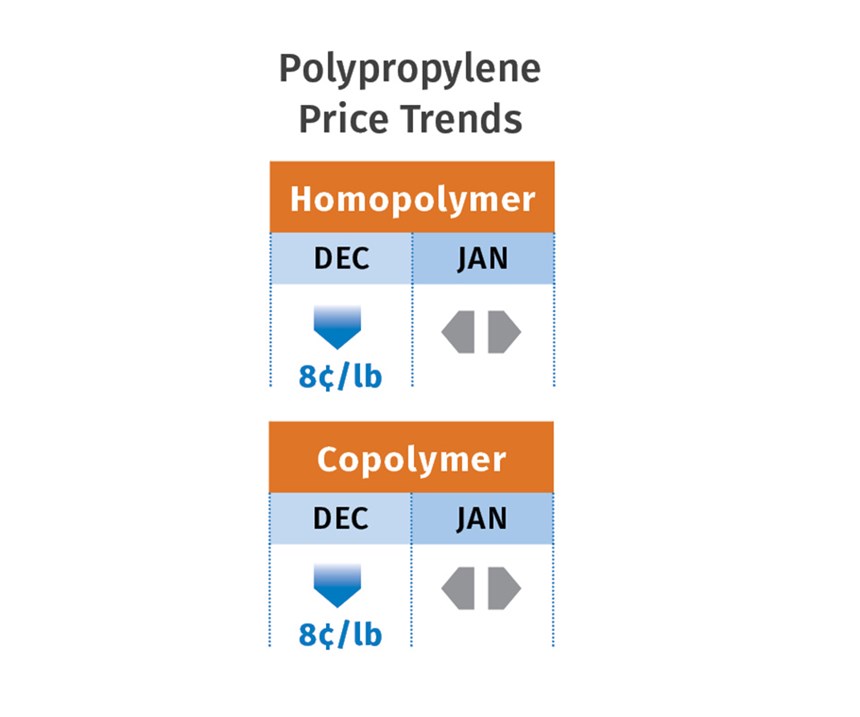

POLYPROPYLENE PRICES DROP FURTHER

Polypropylene prices dropped by another 8¢ in December, in step with propylene monomer contract prices, for a total decline of 18¢/lb in the last two months of 2018. There was no sign of the 3¢/lb profit-margin increase attempted by suppliers. Noted PCW’s Barry, “It’s hard to justify that kind of margin increase with monomer down to 42¢/lb and spot PP homopolymer at 54-57¢/lb.” Prices in the first month of the year were likely to be flat or down by another 1-2¢ if monomer prices slipped a bit further, according to Scott Newell, RTi’s v.p. of PP markets. Meanwhile, Greenberg reported that spot PP availability was sporadic, with spot prices dropping a lot less than contract prices. “Those with inventory on hand (resin sellers) have commanded and generally received most of the premiums they have sought.”

These industry sources generally saw stable prices, at least for January. Newell said that a lot will depend on PP demand and to what extent the monomer excess would be reduced with planned maintenance shutdowns in late first quarter. At the start of 2019, domestic monomer prices were the lowest in the world, while PP prices had dropped to about equivalent with European prices, yet about 10-15¢/lb higher than Chinese PP. Newell also noted that while PP imports were at record highs for fourth-quarter 2018, he expected imports to dwindle through the first quarter.

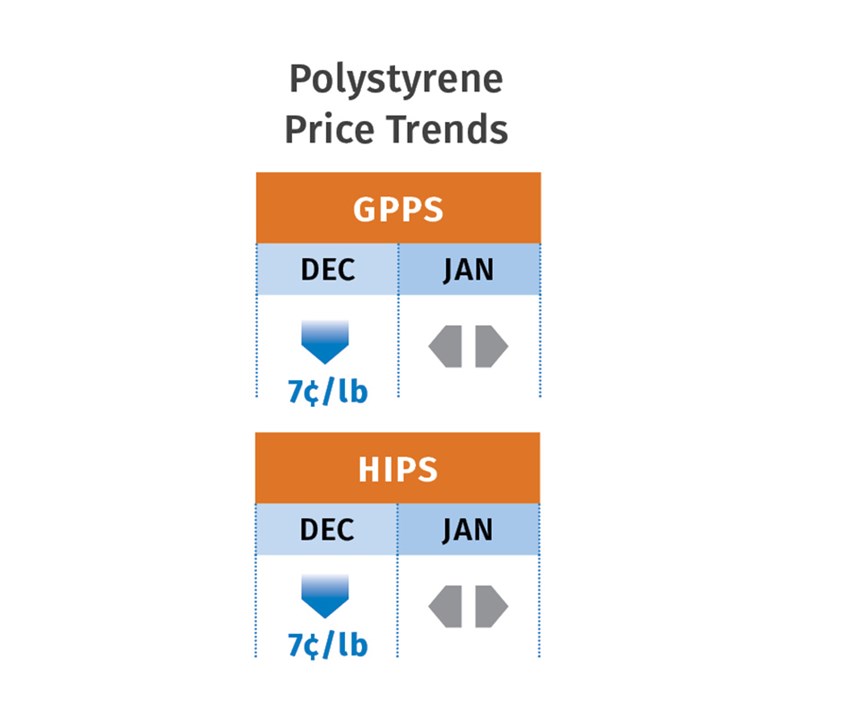

POLYSTYRENE PRICES DROP

Polystyrene prices dropped 7¢/lb in December, and additional price concessions on the order of 3-5¢/lb were expected by both Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, and PCW’s Barry. Falling benzene contract prices were the key driver, with January contracts settling 27¢ lower at $1.83/gal. Lower butadiene and styrene monomer prices, along with seasonally slowed demand, also contributed.

However, both these industry sources saw a somewhat different scenario shaping up as early as this month, based on a potential rebound of benzene prices that would depend on both oil prices and the fact that benzene is perceived as being about 50¢ underpriced, noted Barry. He added that in February of 2017 we saw a major increase in PS prices—up 8¢, driven by a sharp upswing in oil and benzene tabs. Chesshier ventured that PS prices this month would be flat to slightly higher. Barry reported at 2018’s end that spot prime GPPS was at 76-78¢/lb, 10¢ lower than in 2017, while spot prime HIPS was at 81-83 ¢/lb, down 12¢lb in that same time span.

PVC PRICES FLAT

PVC prices rolled over in December as they had in November, despite suppliers attempts to push through a 2¢/lb increase, which both Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, and PCW senior editor Donna Todd said had little chance of implementation.

Both sources cited lower feedstock prices and seasonally low demand and expected these drivers to factor into continued flat pricing in January and potentially this month. Late-settling December ethylene contract prices were unchanged from November, and supplies appeared to be in good shape. Kallman foresaw fairly flat pricing for PVC in first quarter, barring any unplanned production outages or increases in oil prices and/or demand. He noted that after planned maintenance outages late last year, PVC suppliers were likely ramp up utilization rates to the mid-80s to rebuild some inventory. Todd reported that in the past, January PVC price hikes (and the pipe price increases that inevitably follow) have not had a good track record of success.

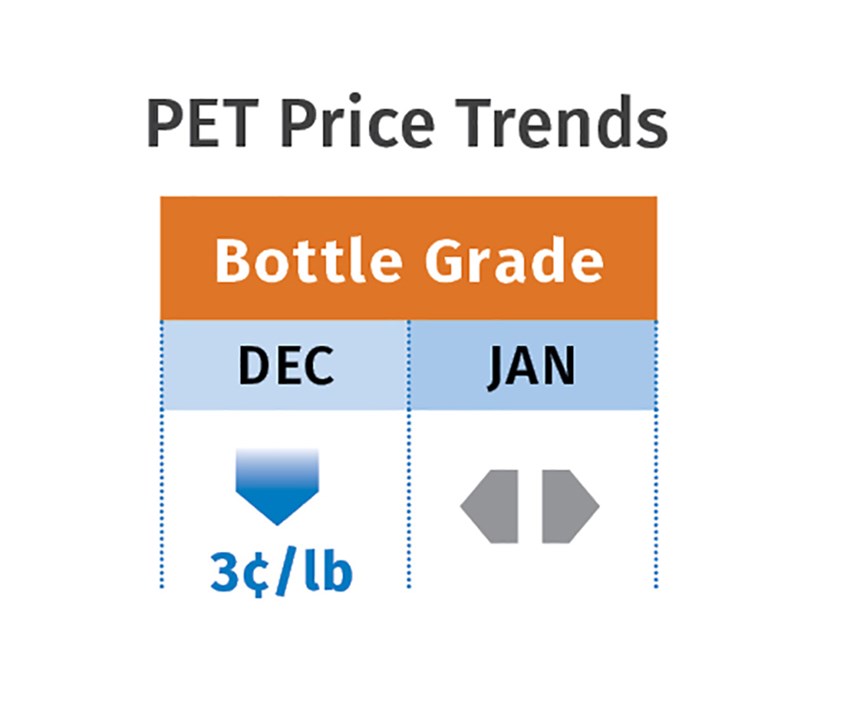

PET PRICES FLAT-TO-DOWN

Prices for domestic bottle-grade PET entering 2019 were in the mid-60¢/lb range—down from the wide spread of 68-75 ¢/lb in early December. Demand is down due to typical seasonal factors, while PET imports from more than 50 countries are once again available to domestic buyers, according to PCW senior editor Xavier Cronin.

One PET resin distributor expected a potential “bounce” in PET prices last month noting that some bloated supplier inventories were reduced in December for end-of-year book-squaring and other business reasons. Still, PCW’ senior editor Xavier Cronin ventured that January PET prices would remain flat or possibly fall a couple of cents. As for this month, he expected prices to meander around 65¢/lb, barring supply disruptions due to logistical issues like bad weather creating delivery problems for truckload and bulk-truck deliveries.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)