Study Urges Companies To Disclose Data On Plastic

Companies could become more sustainable by improving the way they measure, manage and report the amount of plastic they use in their business operations and supply chains.

A new report, Valuing plastic; the business case for measuring, managing and disclosing plastic use in the consumer good industry, reportedly represents the first-ever assessment of the environmental costs of plastic in business. It calculates the amount to plastic used by stock exchange listed companies in sixteen consumer good sectors and assesses levels of corporate disclosure on plastic. It aim is to help companies understand the risks and opportunities of plastic and build a business case for improving its management.

Prepared by natural capital analyst Trucost, it was commissioned by the Plastic Disclosure Project (PDP) and the United Nation’s Environmental Program (UNEP). Trucost calculates the total natural capital cost of plastic in the consumer good industry to be more than $75 billion/yr. The cost comes from a range of environmental impacts including the harm done by plastic litter to wildlife in the ocean and the loss of valuable resources when plastics waste is sent to the landfill rather than being recycled.

The consumer goods sectors assessed are: athletic goods, automobiles, clothing and accessories, consumer electronics, durable household goods, food, footwear, furniture, medical and pharmaceutical products, non-durable household goods, personal products, retail, restaurants and bars, tobacco, toys and soft drinks.

When I attended the Plasticity Forum 2014 last month, Trucost CEO Richard Mattison gave this overview:

• The analysis identifies a range of risks and opportunities facing companies that are intensive users of plastic, as well as investors.

• The toy, athletic goods and durable household goods sectors use the most plastic in products per $1 million revenue.

• The retail, restaurant and tobacco sectors use the most plastic per $1 million revenue in their supply chains.

• Food companies are by far the largest contributor to the total natural capital cost of plastic used in the consumer goods industry—over $75 bn/yr, responsible for 23% of the total.

• The toy sector has by far the highest natural capital intensity, at 3.0% of revenue.

• Companies in the food, soft drinks and non-durable household goods sectors have the largest natural capital costs in absolute terms.

• Companies in the toy, athletic goods and footwear sectors have the highest natural capital intensity.

• Over 30% of the natural capital costs come from greenhouse gas emissions released upstream in the supply chain.

• The impacts of plastic vary around the world, based on background conditions and management practices.

• Levels of disclosure on plastic are poor. Only around half of the 100 companies assessed reported at least one item of quantitative data on plastic.

• Currently, there is no correlation between a sector’s disclosure rate and its plastic intensity or absolute natural capital cost due to plastic.

Mattison explained that in order to provide a sense of scale, the report sets out to quantify the physical impacts of plastic use translated into monetary terms. This metric can be seen as the current value-at-risk to a company, should these external impacts be realized internally through mechanisms like strengthened regulation, loss of market share, or increased price of raw materials and energy. This metric can also be used to understand the magnitude of the tangible benefits to stakeholders, including shareholders, of using plastic in an environmentally sustainable way.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

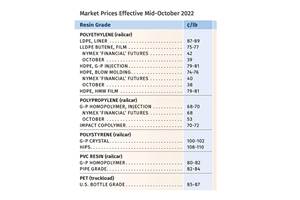

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

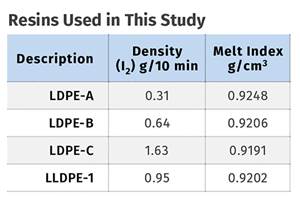

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

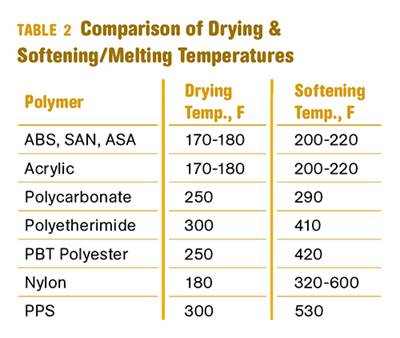

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More

.png;maxWidth=300;quality=90)