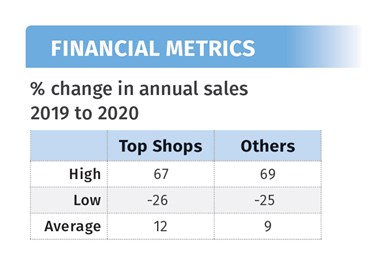

Because of the wrinkle of the global pandemic, or perhaps in spite of it, Plastics Technology’s annual Top Shops survey received its best-ever response as injection molders seemed anxious to take a deep dive into operations that stayed open as essential businesses, while other segments of the broader economy faltered.

“The biggest challenge was the unknown,” explains Mark Murphy, president of molder and moldmaker PRD Inc. in Springville, Ind.—one of PT’s 23 newest Top Shops. “We had gone for so many years with growing sales and a growing economy. We knew this could probably be the event that brought it all to a halt.”

“The biggest challenges were maintaining operations, assuring customers that we were taking steps to sustain their order flow, and keeping our coworkers safe,” says Craig Porter, president and owner of another Top Shop, PlastiCert in Lewiston, Minn. “As a small manufacturer, keeping track of COVID legislation, mandates and programs around finances for the company and our employees was a full-time job for people that typically already wear multiple hats.”

Those challenges, just like the virus, didn’t stop at the border. Aida Cecilia Mercado Salazar of Mexican Top Shop molder and moldmaker IEMSA in San Luis Potosi, said her company had to adapt to and embrace how the pandemic changed day-to-day life and work. “The first big challenge was to get used to the new normal,” Salazar says, citing the two most recognizable aspects of the pandemic: masks and uncertainty. “In the beginning, we were scared because we didn’t know how safe we actually were.” Ultimately, IEMSA, like so many of the molders we surveyed, never halted operations and came through the crisis even stronger. “We became a closer team, and because of that trust it was easier to overcome the challenges in the way.”

Now in its fifth year, this benchmarking survey of injection molders queries participants on demographic data, performance indicators, and business and process strategies. A selection of those performance metrics are then scored, with the highest scoring companies named Top Shops for 2021 based on their 2020 operations. The Top Shops display some stark contrasts with all other entrants, but in many ways they are quite similar.

Does Size Matter?

In terms of physical space, individual employees and machine fleet, the two groups in this year’s benchmarking survey were virtually indistinguishable. The average floor space of a Top Shops entrant was 88,184 ft2, with the rest averaging 79,614 ft2. Total employees at Top Shops averaged 95 vs. 98 at other entrants, with workers directly involved in plant-floor operations coming in at 73 for Top Shops and 78 at all others.

In fact, average plant-floor employee age, plastics/manufacturing experience, turnover rate and hourly wages were nearly identical for all survey participants—41/40 yrs; 17/16 yrs; 17/16% ; and $17/$16—for Top Shops/Others in all those categories, respectively.

On the equipment side, the average fleet size for Top Shops and the other respondents registered at 21 and 20 injection molding machines, respectively. So, we are looking at basically the same amount of workers utilizing the same amount of machines in the same amount of space for the two groups, but there are also some key differences.

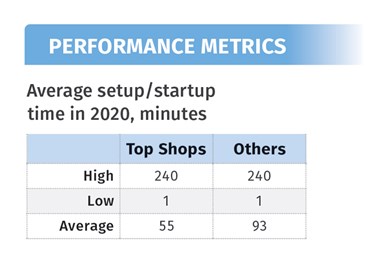

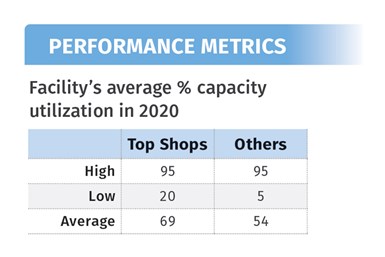

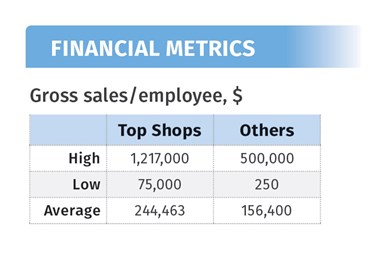

Examining other key metrics more closely, we see that Top Shops had more active molds (398 vs. 219) that molded more total parts (73 million vs. 32 million) for more active customers (102 vs. 56). Ultimately, it is that ability to wring maximum production from every person, every square foot, every tool and every machine that is part of what characterizes a Top Shop.

Machines, Molds, Materials & More

Looking more deeply into the numbers, while the Top Shops and the other respondents were very close in average fleet size, the presses on Top Shops’ floors had considerably less miles on them, boasting an average age of nine years compared with 14. The Top Shops ran horizontal machines exclusively, while 9% of the other facilities also had vertical presses in their plants. Top Shops operated slightly fewer hydraulic machines (62% vs. 71%) than other survey entrants; and far more all-electric presses (65% vs. 50%) and hybrid (50% vs. 26%) machines.

As for their fleets’ clamp-force ranges, Top Shops and other entrants tracked closely in the 0-100, 101-500, and 501-1000-ton ranges, but only 9% of Top Shops utilized machines over 1000 tons, vs. 15% of other entrants. Top Shops also offered more specialty injection molding technologies, outstripping other entrants in providing two-shot, gas/water-assist, in-mold label and insert molding.

A nearly identical number of all survey participants said their facilities featured an in-house tool room (78% of Top Shops and 77% of all others), with both groups utilizing them in equal measure for mold building (rather than just repairs)—44% of Top Shops and 41% of other entrants. While 36% of Top Shops’ molds featured hot runners, only 22% of tools at the other facilities applied this technology. Only 9% of the Top Shops’ tools and 8% of the other entrants’ molds had more than 16 cavities.

Materials run by our survey entrants largely tracked along similar lines, with other shops running slightly more polyolefins than Top Shops (63% to 52%), while Top Shops processed more engineering resins (87% to 76%). Only in LSR and bioplastics was the gap noticeably wide, with 9% of Top Shops running LSR and 17% bioplastics, compared with 2% and 7%, respectively, for other plants.

Where the gap between the groups widens further is the volume of resins processed, with Top Shops nearly doubling the other entrants’ poundage, running an average of 22.3 million lb of material in 2020 vs. 12.5 million lb average for the others. In addition to more material, our honorees processed more kinds of resins. Top Shops ran an average of 43 different material categories, compared to 18 for the remaining survey participants.

Molder or Contract Manufacturer?

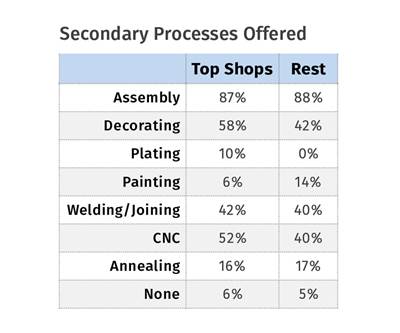

While this is technically a survey of injection molders, in reality, nearly all of its participants are more accurately described as contract manufacturers. A purchase order for molding a single component dropped from the cavity with nothing else done to it—inspection, decoration, assembly, packaging—is most definitely not the business model for today’s molders. Fully 78% of Top Shops and 81% of other shops provide assembly for customers, with 70% of Top Shops and 60% of the remaining survey respondents offering customers collaborative design services. Where Top Shops go even further is in shipping/packaging/labeling, with 87% of our honorees providing those services, compared with 66% of others.

Markets served for both groups largely mirror each other, except for two sectors: medical/healthcare and building/construction. While 74% of the other respondents serve the building/construction market, only 35% of Top Shops generate business from it. And 74% of Top Shops have medical customers, vs. 54% of other survey respondents.

Skills Gap Spares None

Fully 83% of Top Shops and 80% of other shops experienced a skills gap in 2020, with all participants looking to address the issue, just in different ways. On the people side, Top Shops outstripped other respondents in flexible schedules, mentor programs, and outreach at local schools by 18, eight and 26 percentage points, respectively. As for partnering with area schools for open houses or staff recruitment, 64% of Top Shops took that step, while only 28% of the other respondents did so.

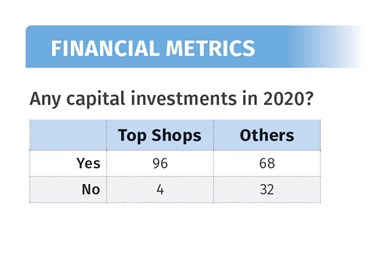

On the non-people or robotic side, 52% of Top Shops increased automation in 2020, compared with 35% of the rest of the shops surveyed. Those investments add to an already sizable fleet of robots for top shops, fully 96% of whom said their facilities used automation, compared with 68% of others.

PlastiCert’s Porter says his company’s location in a small, rural farming community in Minnesota situated between two large cities equates to a shallow talent pool. Its answer to that geographic challenge: “First and foremost, we have created a desirable and accommodating workplace environment, resulting in turnover being practically negligible,” Porter says. The company has also sought to raise its visibility in the community and to partner with a nearby state university for a stream of interns.

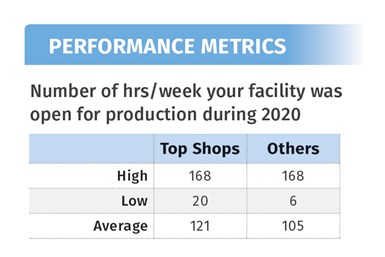

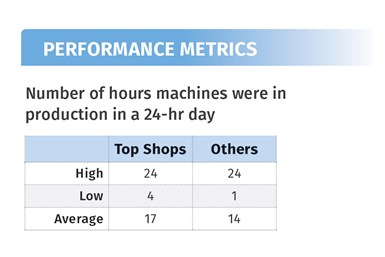

Jim Goerges, president of Precision Tool Technologies Inc. (PTT) in Brainerd, Minn., another Top Shops honoree, says that even before the pandemic, the company had a goal of unattended machining through all 168 hr in a work week, investing in lights-out capable machines over the years to get there. “Our investment in the right automated machining technologies put us in a strong position to navigate the issues related to increased social distancing during the pandemic,” Goerges says.

On the injection side, this firm deploys all-electric presses with integrated parts-handling robots and machine-monitoring systems that can run unattended. “We also mounted cameras strategically throughout our facility so remote operators can log in from their phones.”

PRD’s Murphy says his company has thrown people and automation at the skills gap, which is “by far the biggest challenge. We have implemented automation where possible, increased wages, and gone out of our way to ensure our employees know how much we appreciate them,” including discretionary bonuses. “Unfortunately, I don’t hear anyone with a good answer to the predicament we find ourselves in. Everyone talks about the end of extra unemployment benefits, and while they do not help the situation, I am not convinced this well be the solution.”

Meet, Communicate, Plan, Repeat

Meetings may be the bane of many in the business world, and certainly the running butt of a slew of jokes, but the communication, goal setting and goal measuring that well-designed and organized meetings facilitate are very much a part of Top Shops’ winning strategies.

Fully 70% of Top Shops perform regular, formal business reviews, compared with 54% of others, with 83% of Top Shops applying business-metric goal setting vs. 42% of others. And 87% of Top Shops have regular management meetings, compared with just 63% of others.

“We are very open and honest with our employees and communicate frequently on the state of our business and outlook,” Murphy says. “We have always had a great culture at PRD where everyone feels like family. For some it is just a job, but many feel ownership and accountability for our success. We try to provide clear production goals, learn from our mistakes and celebrate our successes.”

“We think our coworkers have a feel for how our operation is doing and strive to maintain a high level of engagement in operational efficiency and quality,” Porter says, noting that PlastiCert has a monthly “all coworker” meeting, which has become two meetings an hour apart as the business grows. In these meetings, leadership communicates revenue trends, areas of operational interest, new internal developments, and items of interest in the surrounding community. “We also pick a customer to tell workers more about how what we do for that customer contributes to its mission,” Porter says.

“We listen to each others’ ideas to make the best choices and become closer as a team,” IEMSA’s Salazar says. “We also allow doubts and mistakes to happen—we let the learning process be part of our daily life—always taking care of the situation and solving the issues.”

Related Content

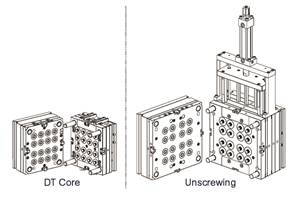

Best Methods of Molding Undercuts

Producing plastics parts with undercuts presents distinct challenges for molders.

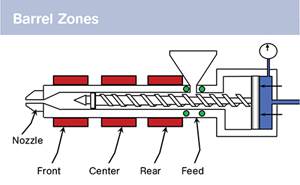

Read MoreHow to Set Barrel Zone Temps in Injection Molding

Start by picking a target melt temperature, and double-check data sheets for the resin supplier’s recommendations. Now for the rest...

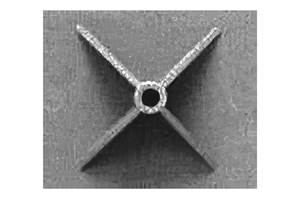

Read MoreHow to Reduce Sinks in Injection Molding

Modifications to the common core pin can be a simple solution, but don’t expect all resins to behave the same. Gas assist is also worth a try.

Read MoreRead Next

Gardner Business Media Announces Inaugural Top Shops Expo + Conference

The new industrial event from the publisher of Plastics Technology will feature data, sourcing and technology updates for manufacturing businesses, including injection molders.

Read MoreTop Shops 2020: Molding More from Less

Plastics Technology’s 2020 Top Shops benchmarking survey reveals that the most effective molders are, not surprisingly, the most efficient, accomplishing more than their peers from a smaller manufacturing footprint.

Read MoreExclusive Benchmarking Report: Top Shops Are More Than Just Molders

The 2019 Plastics Technology Top Shops Survey shows that for its highest-rated respondents, injection molding is just one element in a growing suite of services and capabilities offered to customers.

Read More

.png;maxWidth=300;quality=90)