High-Tech Blow Molding At Agri-Industrial Plastics

This family-owned custom molder stands out in its use of advanced computer and automation tools to claim a niche in large, complex, and multi-layer parts.

What enables a relatively small, family-owned custom molder to dominate industry heavy- weights like Kautex Textron, ABC Group Fuel Systems (now YAPP USA Automotive Systems), and Walbro in the specialty niche of nonautomotive barrier fuel tanks? A look at the history of Agri-Industrial Plastics Co. (AIP) in Fairfield, Iowa, suggests three key ingredients of success:

- Fearlessness in taking on challenging new technologies;

- a deliberate approach to evaluating technical alternatives;

- and a readiness to invest—and keep on investing—in state-of- the-art technologies to optimize quality and productivity.

To these three, Mick Stielow, AIP’s director of sales and marketing, would add a fourth essential element: “What makes us competitive? It’s our people, from the design and engineering staff to our machine setup and processing technicians, and their legacy of understanding all about blow molding. A significant number of our employees have 25 to 30 years’ experience.”

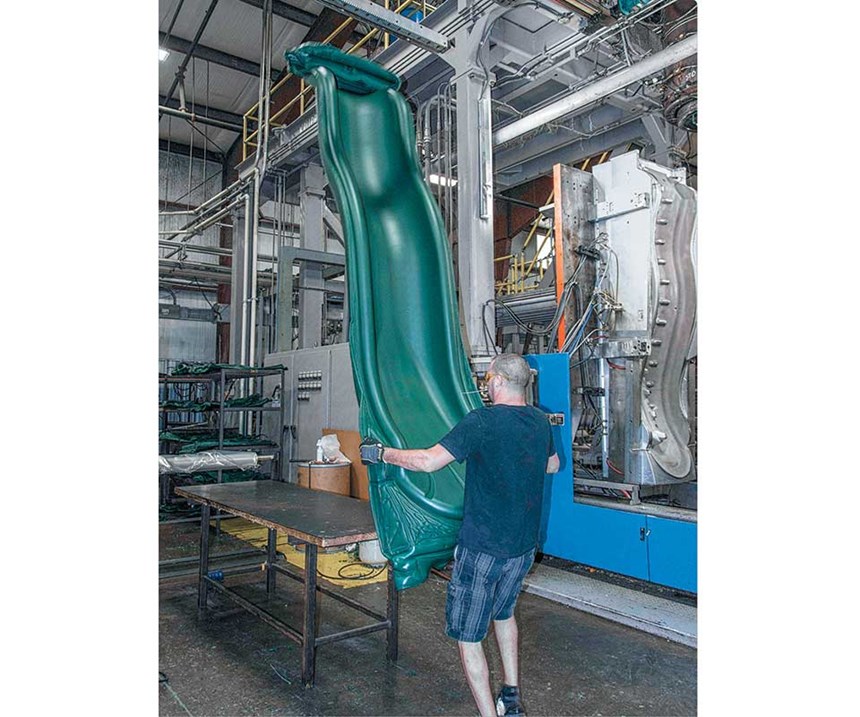

Adds Geoffrey Ward, director of engineering, “We have setup technicians that I would put up against any in the industry. Our guys like to prove that they’re the ones who can make a difficult part work. The automotive guys can’t believe the tanks we’re doing. Some of the crazy shapes we’ve validated appear to violate every rule of blow molding.

“We’ve developed a reputation for taking on difficult projects that other custom molders have not been able to support—larger parts with complex shapes and parting lines.” AIP’s machines can make parts weighing over 80 lb and measuring up 44 in. wide x 120 in. long. “And our design knowledge is a big edge because blow molding is still unfamiliar to many industrial designers out there.”

TAKING A LEAP INTO COEXTRUSION

AIP operates out of a 340,000-ft2 plant, expanded in 2015 by 105,000-ft2. The firm has 195 employees, making it one of the biggest employers in a community of 9500. The plant houses 20 accumulator-head blow molders from 5 to 100 lb shot capacity, two of them in the 70-100 lb range. But about half of the company’s revenue—in the $40-50 million ballpark—is generated by six continuous-coextrusion machines for multi-layer fuel tanks. A seventh coex machine is on order and due to arrive this summer.

The company was started in 1978 with one used machine and four employees. The founder, Richard “Dick” Smith, had been in blow molding since the 1960s. He’s company chairman today, and still actively involved. His daughter, Lori Schaefer-Weaton, took over the reins as president in 2015. She had worked part-time in the plant during her high-school years, went on to earn a finance degree, and worked in the Chicago area before returning to Fairfield in 2004 to learn the ropes in the family business.

AIP’s evolution to become the leading producer of nonautomotive fuel tanks started in 2004, when the U.S. EPA first issued fuel-vapor emission standards affecting the power-sports industry. At the time, AIP made monolayer HDPE tanks. “We asked ourselves how we were going to meet the new requirements. We talked with our customers about their plans to meet the evolving standards. Either we would stay in fuel tanks and figure out a solution, or get out,” recalls Ward.

AIP tried using a laminar blend of HDPE with DuPont Performance Materials Selar PA amorphous nylon additive but wasn’t satisfied with the results. AIP also considered fluorination and sulfonation before settling on coextrusion as the most promising solution. It was an expensive way to go. Each coex machine costs $3-5 million. “A publicly traded company couldn’t have made the business case for such an investment,” says Ward. “We ordered the first coex machine in 2004. The lead time was long—it arrived in 2006 and went into production in 2007. So it was three years before that machine made a dime.”

“We were the first custom molder to order a coex machine for nonautomotive fuel-tank production,” says Ward. “We never envisioned what it would become today.”

Fuel tanks became half of AIP’s business and will grow to 55-60% this year. Ward estimates that 80% of the tanks it molds are multi- layer and 20% are monolayer diesel-fuel tanks, which require no barrier. AIP also molds a couple of monolayer HDPE tanks that are sent to an outside vendor for fluorination treatment. Ward thinks fluorination could have a limited future as a barrier solution in fuel tanks. He explains, “California is talking about making big changes in regulations—tightening requirements for certification, which will require greater consistency of barrier performance. Our data show fluorination is much less consistent than a coextruded barrier. California’s changes— including possible lower emission limits later on—could squeeze out fluorination.”

AIP’s two biggest markets for tanks and other blow molded products are outdoor power equipment (~40%) and power sports (~30%). The latter includes ATVs, UTVs, snow-mobiles, golf carts, and marine applications. The remaining 30% or so is made up of other sporting goods, heavy trucks, agricultural and construction equipment, traffic safety, defense, furniture, medical, and industrial.

HDPE accounts for 90% of AIP’s material consumption, though it also molds a few parts in PP, ABS, PC, nylon, and Eastman Chemical Co.'s Tritan copolyester. The firm does “quite a bit” of insert molding, Ward notes, including metal fasteners and injection molded components such as fuel-tank fill necks, vent barbs, and mounting tabs. “A few OEMs were initially skeptical about whether overmolding inserts would work with multi-layer blow molding, but we proved this out from the very beginning.” In some cases, plastic components are hot-plate welded onto the tanks instead of overmolded.

Stielow says AIP has fewer than half a dozen direct competitors in coex fuel tanks, plus a handful of firms using fluorination or barrier additives such as nanoclays. “We’re unique in offering both multi-layer coextrusion and monolayer non-tank production capacity,” says Stielow. “That works for us because our OEM fuel-tank customers also need monolayer coolant tanks, air ducts, ORV doors, tailgates, etc.”

COMPETING WITH TECHNOLOGY

“Fuel tanks are a big growth niche for us, due to our blow molding expertise and because owenrship has been willing to invest,” says Stielow. And invest they did. All six of AIP’s coex machines, and the one on order, are supplied by Kautex Machines, Inc., North Branch, N.J. “These are state-of-the- art machines,” Stielow notes. “There are lower-cost multi-layer machines available, but none of them come close to matching Kautex machines for process control, consistency, and reliability.”

In fact, most of AIP’s machines come from Kautex, except for a few older units that were bought used at the launch of the business in 1978.

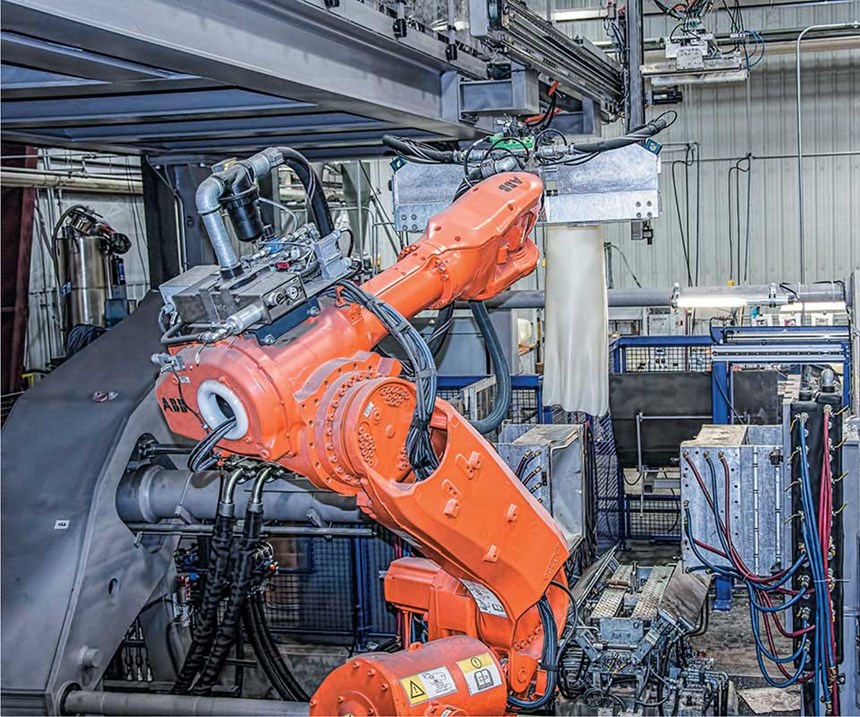

AIP makes considerable use of robotics, in applications both inside the molding machine—for parison transfer, insert loading, and demolding—and outside the machine in the finishing/assembly area for trimming and hot-plate welding. Several presses use simple linear robots to transfer parts out of the mold area, which can be high up and/or difficult to access on some machines. The multi-layer coex machines use six-axis articulated robots to grab the parison and transfer it from the extrusion die head to the mold clamp. It’s more efficient than a shuttling press, Ward explains.

Other six-axis robots are used for automated trimming, drilling, and welding. These units are mounted on a base with a part-fixturing platform, and can be moved to different machines with a forklift.

In addition, AIP installed early this year its first “collaborative” robot, a UR10 model from Universal Robots USA, Inc., Ann Arbor, Mich., designed to work safely alongside humans without needing to be caged in with guarding. “We use it for insert loading in high-volume applications,” Ward notes. One advantage of this type of robot (or “cobot”) is that it uses lead-through teach programming to make setup for new jobs faster and simpler.

“Like most new technologies, there is a learning curve to get everyone comfortable using and programming it,” Ward reports. “It works well in select applications. We’re still evaluating applying this option where it makes sense.”

Another new addition at AIP is an ERP system from IQMS, Paso Robles, Calif. AIP went live with the system in December 2016. “There are growing pains with any new ERP system,” admits Ward, “but the amount of data we can generate now is remarkable. We’re learning a different way to run the business.” A data-entry terminal is now located at every molding press. “It allows us to monitor what’s happening in real time— production efficiencies, cycle times, and scrap rates.”

AIP’s most adventurous exploration of new technology—since its initial decision to dive into multi-layer coextrusion—is its involvement with computer-aided blow molding simulation. Analogous to the flow-analysis software that has revolutionized injection molding, blow molding simulation is at an earlier point in development and little known to the vast majority of blow molders.

For the last three years, AIP has been a member of a consortium, the Special Interest Group in Blow Molding (SIGBLOW), formed by the National Research Council Canada (NRC), Ottawa, Ont. Members of SIGBLOW have access to proprietary blow molding simulation software, called BlowView, which is not available on the commercial market. There are currently 14 members of the consortium, which puts this small custom molder in company with the likes of Ford Motor Co., TI Automotive, Plastic Omnium, IAC Group North America, ABC Group-Saflex Polymers Ltd., Kautex North America, Graham Packaging Co., Amcor PET Packaging, and The Coca-Cola Company.

BlowView models the thickness of the parison during extrusion and the finished part after blowing. It takes into consideration parison sag and swell. “It gives us a warning—or confirms our intuition—that there is going to be a thin corner,” says Ward. “It helps quantify potential issues—we know it’s going to be thin, but how thin? Through repeated iterations, we can determine how thick we have to be over here in order to meet minimum thickness requirements over there.” “It really helps us communicate with designers,” adds Stielow. “It helps validate our recommendations when the customer resists making changes. We now can demonstrate how shifting a parting line or increasing a localized radius can improve overall wall-thickness distribution—and increase the usable liquid capacity of the tank.”

AIP is using simulation more and more, on about half of its new jobs, mainly the more complex parts. “We can see where the parison will touch the mold first,” says Ward. “That helps us troubleshoot needle location on very large parts, and optimize that location if we have flexibility.”

Ward notes that AIP engineers can enter parameters into the software and get good correlation with real-world results. “The ideal state would be where the software can tell us what machine parameters to use in production—that could save us a lot of time in setup.” How good are the software’s predictions? AIP measured the actual thickness at 22 locations on a particularly complex-shaped fuel tank that ranged in nominal thickness from 2 to 6 mm. Comparison of the predicted and actual thicknesses ranged from ±0.0 to ±0.6 mm. Sixteen of the 22 measurements were within ±0.2 mm, which was both the mean and median of the differences between predicted and actual thicknesses. “That’s close enough,” Ward allows. “We can get that much in shot-to-shot variations.”

The BlowView consortium is continuing to research and refine the software in several directions. One is shrink/warp prediction. “I’m very excited by this,” enthuses Ward. “Variable wall thickness is inevitable in blow molding, and with that comes warpage. We’ve seen parts that met all key dimensions but didn’t fit in the final assembly due to warpage. If you can predict even the right direction of warpage, that’s half the battle. It can save a lot in geometry and tooling revision costs.” The software has not been developed for cooling analysis yet, but Ward says some in the consortium would like to see R&D in that direction.

He adds, “We are also using simulation for troubleshooting on the shop floor. One of our very skilled but skeptical technicians initially resisted it, but now has asked for help from our design team to apply simulation to solve a processing challenge. That’s an encouraging sign. We’re still a long way from using simulation to its full potential. But the results we have achieved so far outweigh the costs.”

AIP has nine CAD seats for part and mold design, and one seat for BlowView simulation. In addition, it has a small 3D printer to enable customers to visualize particular features of large parts at the design or prototype stage. AIP’s quality lab has a laser scanner, which Ward says is a lot faster than a touch-probe CMM to get a full 3D profile of a molded part.

Related Content

A Cost Saving Modular Approach to Resin Drying Automation

Whether implementing a moisture-sensing closed-loop system for a single dryer, or automating an entire plant, technology is available to take the guesswork and worry out of resin drying. Using a modular approach allows processors to start simple and build more capabilities over time.

Read MoreSystem Offers 'Lights Out' Mold-Channel Cleaning & Diagnostics

New system automatically cleans mold-cooling lines—including conformal channels—removing rust and calcium, among other deposits, while simultaneously testing for leaks, measuring flow rate and applying rust inhibitor.

Read MoreFive Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

Read MoreDrones and Injection Molding Ready for Takeoff

Drones and unmanned aerial vehicles (UAV) are approaching an inflection point where their production volumes — and functionality — will increasingly point to injection molding.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More