By far the lowest-cost global producer, the North American polyethylene resin industry has been booming for the last few years, with a new supply of commodity grades brought on stream and more to come—often through partnerships that complement or enhance each other’s technologies. At the same time, specialty, higher-performance grades have been developed to meet major market trends, which include sustainability, consumer convenience, and evolving E-commerce packaging needs.

Key sources from three leading PE suppliers weighed in on these trends and discussed the half-dozen or so growth applications and the new materials developed within the last three-five years to meet their needs. These sources included are Olivier Lorge, global PE market development manager at ExxonMobil Chemical; Chris Foy, leader of PE R&D, and Alan Schrob, market group leader, of Nova Chemicals; and Louis Orozco Aragon, technical service & technology manager at Braskem.

Sustainability loomed large in these discussions and covered topics such as ocean plastics, reuse and recycling, lightweight solutions like single-piece closures, and shifting to all-PE structures for high-tech packaging.

In a recent announcement of the winners of its 63rd Annual Flexible Packaging Achievement Awards Competition, the Flexible Packaging Association (FPA) noted that sustainability continues to be a focus. Speaking on behalf of the judges, Robert Kimmel, associate professor and director at Clemson University’s Center for Flexible Packaging, noted, “We saw several examples of bio-based and compostable materials. But what we thought was most significant is several excellent examples of conversion of multilayer films, which have previously been diverse materials, into materials that will be recyclable in existing recycle streams, particularly the polyethylene stream. We feel this is very important for the future of the industry.”

Says Nova’s Schrob, “As an industry we have a responsibility to educate consumers on the value of plastics in their lives, and to be a part of the solution, from reducing unnecessary packaging and food waste to ensuring everyone treats end-of-life plastic products as the valuable carbon resource they are and has the opportunity to recycle them, which will ultimately stop them from ending up as trash in our natural environment.” All these company sources concede that supply-chain collaboration is essential to both innovation and sustainability solutions.

Noting that many applications must be re-engineered to make them friendlier to the recycling ecosystem and to keep plastics and the goods they protect entirely out of the waste stream, Nova’s Foy and Schrob offer these examples:

• Reducing food waste through improved plastic packaging: Improving moisture and oxygen barrier performance, and package integrity (toughness and seal) in PE-based flexible film structures helps extend shelf life—and thus reduces food waste.

• Expanding the uses of post-consumer recycled (PCR) content: Across the industry there is much R&D on technology for creating “clean” recycled PE streams and finding ways to incorporate them into finished products with performance comparable to virgin resin.

• Moving from multi-material to mono-material, recyclable flexible films: In many food-packaging applications, including stand-up pouches and flow wrappers, films are commonly made using mixed materials in the structure. Numerous brand owners are working with suppliers and converters to redesign those structures to eliminate foil, nylon or other materials in order to meet both consumer demand for sustainability and the aggressive recyclability timelines that the plastics industry has set through the American Chemistry Council. Where multilayer blown and cast films, along with lamination, have been the dominant production technologies for many applications, oriented PE in films like machine-direction or biaxially oriented PE are being explored now to deliver stiffer and tougher all-PE films.

• Rigid to flexible conversion: Replacing traditional packaging materials with flexible plastics packaging can reduce packaging volume by 75-97%. While there is a growing anti-plastics movement centered on reduction and elimination of some single-use plastics, studies show that not only does plastic generally have a lower total lifecycle carbon impact, it also is more cost-effective. Industry sources advocate changing the economics for end-of-life plastics and building out waste-collection and recycling infrastructure in the world’s rapidly developing regions, most notably in Southeast Asia, to stop the flow of plastics and other materials into waterways and oceans.

• Conversion of two-piece (PP + PE liner) to one-piece (all-PE) closures: The movement from two-piece to one-piece closures in carbonated soft-drink and hot-fill applications has begun in earnest in North America, as the mono-material composition makes closures easier to recycle. That means just one part must provide all the required properties, and the interaction between the closure design, the resin and the way it’s molded are all critical to producing closures that will perform consistently.

• Material substitution in industrial storage containers: Polyethylene drums, IBCs (intermediate bulk containers) and storage tanks offer significant benefits over metal in many applications: they’re non-corrosive, lighter, more affordable, non-reactive to acids and chemicals, and less susceptible to temperature extremes. These blow molded or rotomolded industrial containers are also sustainable and less energy intensive to produce, and they can be endlessly reused or recycled.

Consumer convenience is also a key driver that is evident in on-the-go foods, pre-portioning, reclosable packaging, and the retail shift to e-commerce. Nova’s Foy and Schrob note that the trend is toward more on-the-go fresh and healthy foods. While optimization of packaging for this segment is in the early stages, they expect to see brand owners looking for more cost-effective single-serve packaging based on flexible plastics, while delivering recyclability and adequate protection of food.

For example, squeeze pouches require a fitment and closure for dispensing, so R&D is being focused on ensuring that the entirety of these new packages are recyclable while providing seal integrity, shelf-life and other required performance attributes.

Another aspect of consumer convenience, when it comes to Baby Boomers and the older Silent Generation is easy product identification through colors, graphics or larger print; and ease of use, such as easy-open and recloseable packaging, and spill-preventing design.

E-commerce has been driven partly by convenience. Packaging for any product that may be sold online is being rethought through the lens of the e-commerce supply chain, say Nova’s Foy and Schrob. And, as Amazon, Walmart, and other big e-tailers also pursue sustainability targets—Amazon’s “frustration-free packaging” is a significant example—they’re looking for ways to eliminate secondary cardboard boxes and ship products only in their own container—yet another reason to develop tougher packages that arrive to the consumer’s door intact. Says Nova’s Schrob, “We see the e-commerce trend moving toward elimination of secondary packaging.”

Meanwhile, online food purchases have different requirements than other e-commerce purchases. Today the largest segments of online food purchases are click-and-collect, which has a similar supply chain to traditional in-store grocery shopping; and meal kits, which face a unique set of challenges. Food must stay fresh through temperature control; primary and secondary packaging must protect the food from physical damage; and the primary packaging must have integrity to prevent leakage. Meanwhile, consumers are also demanding a reduction in meal-kit packaging. Those are big challenges, and they require rethinking of packaging concepts. For example, we may see returnable meal-kit shipping containers that take shape as flexible, PE-based corrugated boxes, or flexible cans made with PE. Whatever the concepts will look like, they obviously will require polyethylenes that are stronger and tougher than ever before.

WHERE’S THE R&D ACTION?

Most of the current R&D underway appears to involve PEs produced with metallocene or other single-site catalysts. ExxonMobil’s Lorge identified two types of current R&D activity globally. At its Baytown, Texas, site, the focus is on catalyst and process research—namely, novel catalysts that can produce new polymers that provide exceptional performance and processability.

The company’s Exceed, Enable, and new Exceed XP families of metallocene hexene LLDPE film resins are part of this R&D thrust, as are new additions to ExxonMobil’s portfolio of Vistamaxx propylene-ethylene specialty elastomers, first launched in 2003 for use in broad applications from very soft fabric and films to very hard TPOs. At its Belgium and China facilities, the emphasis is on application development. Says Lorge, “We are working with our customers on development of innovative solutions, laminate films, and all-PE packaging for products ranging from food to liquid household cleaners, using our Exceed XP.”

Noting that sustainability has been one of Braskem’s pillars, especially in R&D, Aragon says, “We believe society itself has become more critical regarding how sustainable the products they buy are. This factor, combined with shifts in how and where we buy, such as e-commerce, has made us rethink previous applications that now have a bigger impact in the new market. As examples, Aragon cites two families within Braskem’s LLDPE film-resin portfolio: Flexus and Proxess, both metallocene-catalyzed hexene types. According to Aragon, Flexus provides better properties in the film but sometimes is difficult to process in older machines. Proxess is much easier to process in old machines, particularly for LDPE substitution. “It’s all in molecular-weight and comonomer distribution differences. All these products allow weight reductions vs. current packaging as well as enhancements in the products’ presentations.”

Nova’s Fay and Schrob see growing demand for higher-value PE made from metallocene or other single-site catalysts due to the performance requirements for today’s packaging applications. They say this is why we are seeing expansions in octene PE capacity, including Nova’s second Advanced Sclairtech plant. According to Foy, Nova’s bimodal technology allows for flexibility in PE structure design and tailoring of end-use performance, leading to highly differentiated resins for things like improving seals or barrier in demanding film applications; producing closures that satisfy the physical demands of the application while not imparting any taste or odor that could negatively impact consumer experience; and best-in-class, high-performance resins for the rotomolding.

Says Schrob, “With all of the new PE products and end-use applications we see in development, having multiple design parameters for PE is key. Multi-modal products, in combination with higher-alpha-olefins and, potentially, additive optimization, are key to how we design resins today and will be even more important in the future.“

FOOD-PACKAGING DRIVERS

Food packaging reigns as one of the hottest areas of application development, with all-PE structures for stand-up pouches and flexible freezer films in the lead.

All sources see flexible stand-up pouches as a big deal because of the conversion from aluminum cans and glass jars. The pouches results in 70% lower emissions than aluminum, take up much less space, and are very damage resistant and safer to transport. The new PE pouches also boast convenience, good shelf appeal and excellent printability. .

The first-ever all-PE stand-up pouch reportedly was commercialized in 2016 by film processor Accredo Packaging of Sugar Land, Tex., in collaboration with Dow Chemical, making pouches for dishwasher pods from brand owner Seventh Generation.

Lorge says ExxonMobil researchers are working on replacing oriented nylon 6 and PET. “One Latin American customer successfully replaced a nylon 6 layer—which afforded toughness and flexibility to the flexible food pouch—with an Exceed XP resin and a very thin EVOH layer, making the product easy to recycle.

Lorge also gives an example of flexible freezer film--an all-PE, three-layer structure made of Enable metallocene hexene copolymer and HDPE, with Exceed XP in the sealant layer, for a brand owner of frozen chicken. ExxonMobil also recently launched new Exceed XP 8784 for high-performance coextruded films for laminated sacks, freezer films, barrier packaging and sachets. It boasts improved processability combined with extreme film toughness and sealing properties.

Fay and Schrob from Nova note that the company offers numerous resins suitable for frozen goods, including one that’s used in a new recyclable moisture-barrier film.

Nova’s Surpass HPs667-AB is a bimodal HDPE said to provide excellent oxygen barrier and stiffness in extrusion laminations and/or cast film. (This resin’s blown-film equivalent is HPs167-AB.) The material can help in replacement of multi-material films, adds stiffness to aid in rigid-to-flexible conversions, and can be used in injection molding applications where high barrier is required. The material was used in a novel milk jug by Tetra Pak in 2016, said to be the world’s first aseptic carton bottle for ambient white milk. .

Surpass VPsK914, a new octene LLDPE sealant resin, is said to allow for faster foolproof sealing in most demanding food and food e-commerce applications. It reportedly produces a strong film without adding plastomers and cost to the film formulation. It reportedly offers triple the toughness of a typical PE/plastomer sealant blend, suiting it to products such as granola and bone-in chicken.

Braskem’s latest addition to its Proxess metallocene LLDPE family, touted for excellent processability, processing flexibility (usable with any screw configuration), and blending with other resins, is Proxess1509XP, a 0.9 MI grade with stable COF (coefficient of friction) due to a special additive package tailored specifically for lamination. It reportedly can replace LDPE or other metallocene LLDPEs, including octene types, due to its superior processability. It complements Proxess 180653, 0.6 MI grade, and Proxess 1809 0.9 MI grades, for coextrusion of general-use films, high-performance films, and technical films for automatic packaging and lamination.

HEAVY-DUTY SACKS

As just one example of progress in this field, there’s been a major improvement in sacks for 25 kg/55.2 lb of plastic resins, which today are 105-microns thick—downgauged more than 50% since 1998. Lorge says these are three-layer film constructions with Exceed XP in the skin and a blend of Exceed XP and HDPE in the core, which provides very good sealing and excellent stiffness. Such structures are also replacing PP raffia bags in Asia for rice and fertilizers (50 kg/110.3 lb).

Nova’s Surpass VPsK914 ultra-durable, abuse-resistant sealant resin also plays a big role in heavy-duty bags for sharp and heavy contents. Its high melt strength enables up to 20% increase in line speeds vs. a typical octene LLDPE, Nova claims.

Surpass SPsK919 is described as a stiffer, tougher and clearer multi-modal octene LLDPE, optimized for heavy-duty bags and e-commerce packaging.

PALLET STRETCH FILM & HOODS

Power pre-stretch (PPS) cast-film technology pioneered by ExxonMobil for securing loads/pallets of various goods in transportation is growing fast in the U.S. and Europe, says Lorge. “We have been working with cast stretch-film producers and machine manufacturers to improve these film structures. The Vistamaxx 6000 family of metallocene-catalyzed specialty olefinic TPEs specifically targeted for PPS films is combined with Exceed 3812 metallocene LLDPE to provide the extra strength and elongation needed.”

Nova’s Schrob notes that traditional basic stretch film is a very large and mature market for which Nova offers several products—both blown and cast resins. New Novapol PF-Y-818 is a butene LLDPE said to be tougher and clearer than traditional butene LLDPE, and it can process up to 20% faster on many blown film lines. Applications include stretch film, retail bags, trash bags and industrial liners.

Braskem offers puncture- and impact-resistant Flexus metallocene LLDPE resins and has a partnership with Austria’s SML Maschinengesellschaft mbH to develop new solutions for the stretch segment. At the K 2016 show in Germany, the two firms featured a 13-layer, 12-micron stretch film with outstanding properties. Two Flexus resins for stretch films are 3600, a 4.5 MI grade, and 7200 XP with 3.5 MI. Flexus Cling, a 4.3 MI grade, is designed for the cling layer.

The alternative pallet stretch-hood blown film technology is fast growing for both palletized goods and appliances, according to Lorge. Typically three-layer film structures, where both Exceed XP and Vistamaxx resins play a part, they offer better protection against rain and other contaminants and boast toughness, high tear resistance and excellent puncture resistance, as well as high snapback and elastic recovery—and they cost less than paperboard.

SHRINK FILM

Used heavily for food packaging, including water and carbonated beverages, shrink wrap has come a long way, according to ExxonMobil’s Lorge. “For wrapping six 1.5L bottles, we went from 100-micron LDPE shrink films 20 years ago, to monolayer films in 2010 with Enable metallocene branched LLDPE, to today’s three-layer, 50-micron, all-PE solution with Exceed XP in the skin and Enable 4002 in the core. It also allows for nice printing capability.” ExxonMobil also is working with customers to replace thick, foggy films with clear, glossy films for better shelf appeal and printability.

Braskem’s new Proxess 2609, a 0.6 MI metallocene LLDPE, is designed for shrink film as well as ice bags, industrial sacks, and mortar packaging.

CAPS & CLOSURES

For this rigid packaging market, Fay and Schrob point to Nova’s development of HDPE grades that leverage the company’s Advanced Sclairtech single-site catalyst technology. Surpass CCs757 sHDPE resin was designed specifically for water closures, where line speed, organoleptics, consistency and physical performance are all essential. A single railcar of these resins can make up to 100 million closures, so the functionality of that resin is critical, as it translates into consistent performance of each closure throughout the supply chain to the consumer’s hands.

Surpass CCs154 sHDPE resin is designed for carbonated soft drinks. It leverages the same technology as CCs757 but is tailored for carbonation pressure and ESCR. Says Fay, “There are very few PE technologies that can create the kinds of resins that produce closures that meet these kinds of demands, and can replace PP—converting from two-piece to one-piece closures.”

Sclair 2807CC resin is designed for multiple applications, including non-carbonated beverages, personal-care and industrial closures, and is well suited for one-piece PE closures for standard-weight, hot-fill beverage applications. Its excellent balance of processability, stiffness, ESCR and organoleptic properties enable resin consolidation for closure manufacturers.

ROTATIONAL MOLDING

Nova has developed Surpass RMs245-U/UG sHDPE resin specifically for large tanks and custom rotomolded goods. This “all-around performer,” say Fay and Schrob, has an industry-leading combination of stiffness, toughness, and ESCR. It also has a best-in-class 1600-psi hydrostatic design basis (HDR) cell classification, which translates into improved sidewall stiffness in large storage tanks. Higher stiffness enables downgauging tank wall thickness by 10-20%, or making walls with the same thickness that have an additional safety margin. It also boasts outstanding melt flow and processing characteristics.

MORE GROWTH OPTIONS FOR PE

- PE Grades for Enhanced Recyclate. ExxonMobil has been using the phrase “Rethink Recycle” to promote its Vistamaxx performance polymers, which reportedly allow low-cost recycling for high-value applications. Use of Vistamaxx to compatibilize PE and PP recycle reduces the need for costly and time-consuming materials separation and allows for higher PCR content, while enhancing end-product performance.

Nova Chemicals has formulated new Novapol PF-0118-FI, a 1.0 MI, 0.919 g/cc butene copolymer LLDPE, to be more forgiving and robust under the rigors of recycling. Either it can be recycled more often, or it can be used to enhance a higher percentage of lower-quality PCR. Likely to be the first of a family of resins of this sort, it is targeted for blending, trash bags, liners, general packaging, heavy-duty bags, stretch wrap and garment film. Nova is working with customers to help brand owners convert their mixed-material, hard-to-recycle flexible applications to more environmentally friendly formulations. Work is underway on incorporation of PCR into packaging and goods currently made typically of 100% virgin material.

Braskem’s Wecycle recycling platform entails working with different technologies for all types of PE and PP. The technology used for LLDPE, LDPE and PP are undergoing lab trials; the technology for HDPE is in the validation stage with ongoing trials at customers and partners who are testing the recycled resin as the raw material in small-volume thermoformed packaging. The promising technology allowed for the creation of recycled HDPE with high quality and a high percentage of recyclate from household post-consumer thermoformed packaging. It boasts stress-cracking resistance, tensile strength similar to virgin resins, and 70% higher mechanical properties than the current recycled HDPEs.

- Agricultural Films. Mulch films and greenhouse film are growing fast in Asia and Australia and is another area where ExxonMobil’s Exceed XP is gaining market share. Says Lorge, “One of the latest applications is with an Australian mulch-film producer that has made a black, three-layer film made of Exceed XP in the skin and core that allowed downgauging by 20%.

Similarly, Exceed XP grades have been successfully used in greenhouse films, allowing farmers to keep the film longer in use due to its better mechanical properties and weatherability.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

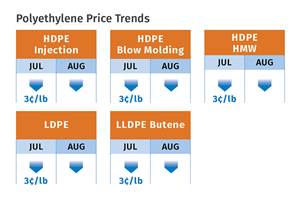

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More