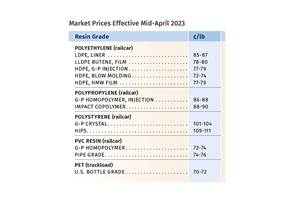

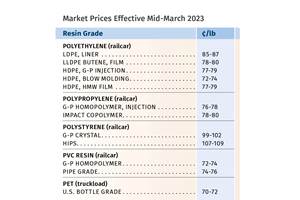

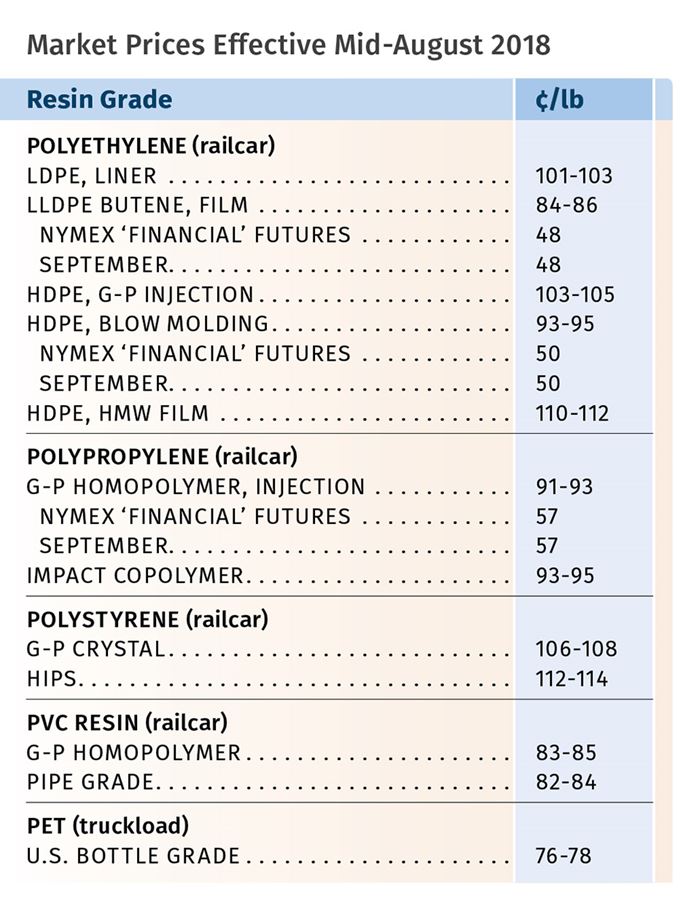

Prices Flat for PE, PVC; Down for PS; Up for PP, PET

Contrary feedstock and demand trends lead to divergent pricing behavior.

A combination of lower feedstock prices, in some cases softer domestic and global demand, and generally improved supply/demand balance have been key drivers in keeping prices steady for PE and PVC and reducing PS prices. Pressure from feedstock prices and resin supply tightness were expected to drive prices of PP and PET upward.

These were the views last month of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

PE PRICES FLAT

Polyethylene prices appeared to have remained steady in July, though suppliers were still trying to implement a delayed 3¢/lb hike. Mike Burns, RTi’s v.p. of PE markets, noted that this intent persisted despite contrary market drivers such as lower global PE prices, high domestic inventories, soft global demand, and steady or lower oil prices.

Burns ventured that lower export prices and soft global demand would delay if not negate further price increases in August and September. As for fourth-quarter pricing, he advised keeping an eye on oil price trends: “Lower oil prices and soft global demand may end the past year’s continued price increases. Weather will be the last driver heading into this quarter.” Meanwhile, spot ethylene monomer prices slipped back below 15¢/lb—below the 2017 low.

PCW reported PE spot prices as flat to lower, noting that availability continued to improve for most grades, except for HDPE blow molding and HMWPE film resins, which were balanced to tight. Greenberg reported very active spot PE trading with steady prices and noted, “Producers have sometimes been vocal in their attempt to finally implement their old 3¢/lb increase, but their plentiful downgraded prime offers suggest otherwise. There is good overall PE availability, and the new capacity has generally exceeded demand.”

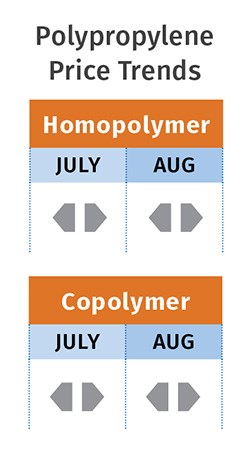

PP PRICES FLAT TO HIGHER

Polypropylene prices in July held even from June, in step with monomer contracts. Prices in August were likely to be flat to higher, depending on the monomer contract price, according to Scott Newell, RTi’s vp of PP markets. PCW reported spot propylene monomer prices were moving up, as was the case with PP spot prices, driven by both the rising monomer tabs and overall tight supply.

Both PCW and Newell noted that the gap between wide-spec and prime market prices was wider than normal. Both saw price relief in August as unlikely. Newell said a key issue with propylene monomer is that there is no supply cushion to insulate against adverse events. In addition to unplanned outages, two factors are contributing to the tightness: the ethane advantage at refineries, which translates to lower yields of propylene, and the very high volume of monomer exports. “If anything will allow for a decrease in PP prices, it is demand destruction,” Newell remarked.

PCW reported that pricing of PP imports in July was attractive on paper, but buying interest was limited, possibly due to long lead times. Newell, however, predicted that lower-cost PP imports were very likely to increase in August and September: “It’s difficult at this juncture to project whether that’s what it will take to see price relief.” He characterized PP demand as “holding up well” but expected some demand destruction. Both Newell and Greenberg noted that suppliers have throttled back production to keep the supply and demand in balance. Both agreed it would make sense for processors to ensure they had adequate inventories as the Gulf hurricane season approached.

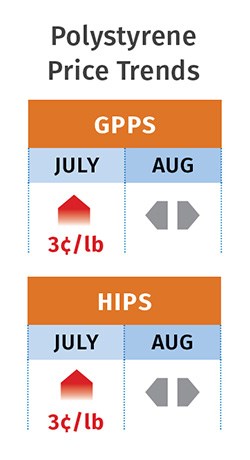

PS PRICES DOWN

Polystyrene prices dropped 3¢/lb in July and were likely to remain flat in August and possibly this month, according to Robin Chessier, RTi’s v.p. of PE, PS and nylon 6 markets. PCW reported PS spot prices as flat to lower amid indications of slower-than-expected downstream demand. Both PCW and Chessier characterized PS supply as balanced and styrene monomer availability as adequate. According to PCW, implied styrene production costs based on a 30/70 formula of spot ethylene and benzene were up 1¢/lb to 31.7¢.

Chessier noted that benzene prices did not react as expected when oil prices rose, hovering instead in the $2.85-2.95/gal. range. As a result, she said it was unusual that a PS price increase wasn’t announced for August. She thought that PS prices could remain flat through August and September, partly because this is the start of the seasonal slowdown in demand for the domestic PS market. Things could change if benzene prices go above $3/gal, or if the Trump administration opts not to remove the tariffs on chemicals and plastics.

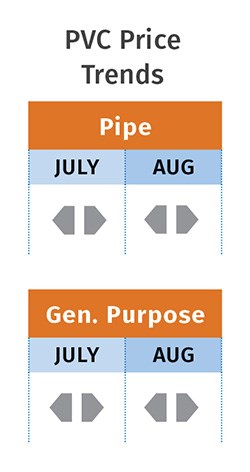

PVC PRICES FLAT

PVC prices in July held even and were likely to stay that way in both August and September, according to Mark Kallman, RTi’s v.p. of PVC and engineering resin markets. He noted that there was no pressure from feedstock prices.

PCW reported that while June ethylene contract prices rose by 1.5¢/lb, ExxonMobil’s new 3.3 billion lb/yr ethylene cracker had started up, making it the second olefins unit of that size to come on stream this year.

Both RTI’s Kallman and PCW report that PVC suppliers have been expanding production to take advantage of low ethylene costs. Kallman noted that domestic demand rose, reducing suppliers’ inventories and resulting in a well-balanced market. He cautioned that “tariff activity” brought a certain degree of uncertainty in terms of trade flow. PCW added, “More and more overseas markets are being closed to U.S. PVC due to anti-dumping duties or tariffs. Buyers abroad are eschewing U.S. resins out of fear that duties could be imposed after they have ordered the resins but before they arrive. In response, U.S. export prices have begun to fall.”

PET PRICES FLAT TO HIGHER

Prices for domestic bottle-grade PET in July were steady at 76-78¢/lb delivered Midwest, according to PCW. Supply was reportedly bolstered by restarted production at the former M&G Polymers PET plant in Apple Grove, W. Va. With capacity of nearly 805 million lb/yr, the plant was shut down last October, and along with a research facility in Ohio, was acquired by Taiwan’s Far Eastern Investment Holdings.

PET imports from Mexico were down in July due to production issues at plants there. Prices ranged from about 71¢/lb delivered duty-paid West Coast to 78¢/lb delivered to plants in the Northeast. PCW reported that market sources saw the possibility of domestic and import PET prices increasing 2-3¢/lb in August, driven by strong demand in the thermoforming sector.

PCW noted that prices this month could continue to rise if production disruptions in Mexico remain unresolved. Another factor is the PET imports from the five countries that were hit with anti-dumping duties in May, forcing buyers to seek alternative supplies.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)