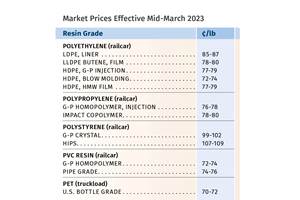

Prices of Volume Resins to End First Quarter Largely Flat-to-Down; PS & PVC Move Up

Decline in raw materials, slowed demand, record-high inventories and lower-priced imports in some cases impacted most resins.

Prices of nearly all volume resins appear to be trending flat-to-down as we head toward the start of second quarter. Even the exceptions in the group—PVC and PS, which moved up, were not in concert. The former moved up a bit after remaining flat for months and success of a new increase was highly unlikely, while PS was perhaps the true ‘maverick’ with increases this month and more to come in April, due to a cost push from its key feedstocks. Purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of the Plastics Exchange in Chicago offered this look at how things appear to be shaping up:

● PE: Prices settled flat in February, as suppliers were unable to push through their 3¢/lb increase. There was another 3¢/lb increase for March, but the February increase was not formally addressed, according to Mike Burns, RTi’s v.p. of PE markets.

All industry sources had doubts about any change in March contracts. Said the Plastic Exchange’s Greenberg, “There is another attempt to implement a price increase in March, which now seems to average around 3¢/lb, but realistically can it stick?” RTi’s Burns expected a strong push from suppliers to push the March increase through, noting that higher oil prices could also work to support higher PE price increase attempts. China tariffs may also impact demand and exports if further delayed or an outcome is decided. Added PCW’s Barry, “Exports are going down and supplier inventories are growing…I think March will be quite the same..we do not see the market dynamics that would support an increase.”

Burns noted that spot prices failed to increase in February despite strong efforts from suppliers. Some off-grade LLDPE resins were offered below December prices—as low as 42¢/lb. Barry noted that spot prices had weakened, moving lower on average by 2¢/lb going into March, and about 10¢/lb lower than prime contact prices. Greenberg reported: “Spot PE prices fell heavily over the past six months, while contracts simply have not. There continue to be large discounts provided for fresh spot railcars, and we believe the gaping gap will eventually need to shrink.” He noted that a quick correction was not clearly imminent as spot prices had failed to rally. He also noted that processors were seen to often opt for their minimal contract commitments blended with spot purchases.

For the next couple of months, Burns ventured that oil price surges could prove to be the only price driver to prevent even higher PE inventory levels. In general, he projected that barring any production disruptions, record inventories should prevent any price increases over the next 90 days.

Commenting on exports, Burns noted that traders are looking for signals from southeast Asia regarding demand after the Chinese new year holiday. Trader activity was average, but not robust—exports were down 5% from the record December exports that accounted for 37% of domestic PE production.

● PP: Prices dropped 1.5¢/lb in step with propylene monomer, which all industry sources conceded was too low. Spot monomer dropped to 32¢/lb at the same time and Scott Newell, RTi’s v.p. of PP markets, said he would not be surprised to see spot propylene drop to the low 20s. This has been a buyer’s market and the story is not over he noted, saying that it was difficult to tell when PP prices would bottom out at that point. “Inventories for both PGP and PP were at multi-year highs (a four-month-straight buildup), and demand has not come back to the levels that had been expected.”

Newell ventured that monomer and PP prices this month would drop within the 4-6¢/lb range and that depending on how much they dropped, further decline was possible for April. “We are seeing supplier margin erosion taking place with discounts being offered to move volume.” PCW’s Barry thought that amount to be a bit overly bearish, instead venturing that PP prices would drop by 2-3¢/lb.

Newell expected that PP imports, which had been at record highs in fourth quarter, have slowed during the first quarter. Newell added that PP import data lag, considering that even December numbers are not yet available. He noted that PP exports were up, primarily to Latin America but only at about 15 million/lb. He added that if suppliers look at other regions to move material, they will need to lower prices.

Going into March, The Plastics Exchange’s Greenberg reported seeing a normal flow of offgrade resin along with occasional well-priced prime railcars. But, he characterized spot PP demand as soft as processors anticipated another decrease this month. “Still, polypropylene prices have come off dramatically the past several months, and processors are enjoying the savings, but with market sentiment still negative, we have yet to see a major restocking effort.” PCW’s Barry reported that there had been ample PP prime in the secondary markets with discounts on the order of 2-4¢/lb.

● PS: Prices are heading up by 2-4¢/lb this month, after dropping a total of 9¢/lb by end of January. Both PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, ventured that a 2¢/lb increase was more realistic, and both believed that an uptick in prices would emerge for April.

Said Chesshier, “From a feedstock perspective—up a total of 1.5¢/lb through early March, the proposed lower-end of the price hike supports suppliers increase.” She noted that while ethylene contract prices dropped a bit, the reverse was true for benzene, styrene monomer and butadiene. Chesshier ventured further increases likely for April, primarily driven by increasing feedstock costs but also supported by the traditionally strong season for PS, which starts in April. Barry projected flat to slightly higher prices. Supply/demand has been largely balanced, with production rates in the 70s percentile, though higher output was likely if demand increases. There’s been a good flow of very attractively priced PS resin imports and a strong flow of styrene monomer exports, they said.

● PVC: Prices appeared to have moved up 1-2¢/lb in February, after rolling over for the third month in a row, and prices for this month were likely to be flat despite suppliers’ aim to implement the remainder of their 4¢/lb price hike, according to both PCW’s senior editor Donna Todd and Mark Kallman, RTi’s v.p. of PVC and engineering resin markets. As for April, Kallman ventured that prices would be flat-to-up by another 1-2¢/lb, if demand improves as we get into the construction season.

Todd reported by March 1, that suppliers were considering announcing a 2-3¢/lb increase, effective April 1, though such moves were unconfirmed. Both industry sources noted that there was not much support for an increase, with a downward trajectory for PVC driven by lower ethylene and chlorine prices, lower export prices, sluggish global demand and bad weather that impeded demand.

● PET: Prices for domestic bottle-grade PET as well as imported material ended February at 62-64¢/lb on a delivered rail Midwest basis, and had remained steady from the start of that month, according to PCW senior editor Xavier Cronin. In the first week of March, Cronin reported that California’s Long Beach and Los Angeles ports were oversupplied with imported PET, while demand was “still way below normal,” according to a PET resin distributor. “The U.S. remains an attractive destination for PET produced around the world because domestic PET prices are higher than in most other regions, with good payment terms in most cases,” said Cronin.

Cronin ventured that PET prices this month would trend lower by at least 2-3¢/lb due to the sluggish demand factor and surging import supply. This took place as PET feedstock costs —namely PTA and MEG—climbed higher in February over January in global markets driven by higher hydrocarbon prices. As for April, PET prices could dip to under 60¢/lb, if imports continue to be robust and demand from thermoforming does not pick up by mid-March, ventured Cronin.

● ABS: Prices dropped in late fourth quarter and into January on the order of 4-6¢/lb, following significant decline in key feedstock costs. While prices in February and March appeared to be flat, April prices were expected to be flat-to-up, according to RTi’s Kallman. Any April increases would be driven by higher costs of feedstocks: benzene, acrylonitrile and butadiene.

While the market is characterized as balanced, demand for ABS doesn’t typically pick up until the second half of the year. Moreover, there are plenty of low-cost imports still available which serve to keep prices down, said Kallman.

● PC: Prices were trending down in late fourth quarter and the beginning of the year, with suppliers giving concessions of 8-10¢/lb as new contracts were negotiated, according to RTi’s Kallman. This shaved off quite a bit from the prices increases of up to 14¢/lb implemented in first quarter 2018.

February and March prices appeared to have rolled over, and Kallman ventured continued flat pricing for April. “Raw materials cost pressure has been incremental, the market is very well supplied, and there is plenty of opportunity for low-cost imports.The market has gone from well-balanced to oversupplied due to an influx of lower-priced Asian imports and ample domestic availability,” he said.

● NYLON 6, NYLON 66: Nylon 6 prices were flat-to-slightly down in January as suppliers did provide some small price concessions, though not across the board, according to RTi’s Chesshier. Prices rolled over in February and this month as there was no upward pricing pressure. However, if benzene and caprolactum contract prices were to move up, coupled with higher nylon 6 prices in Europe, April nylon 6 prices could move up, she noted. “Seasonal demand—ranging from textiles to automotive—has been delayed this year, but is likely to pick up through second quarter,” said Chesshier.

Nylon 66 prices have trended largely flat through first quarter, following the 2018 increases of 25-40¢/lb, that was driven by globally tight supply of nylon 66 intermediaries. RTi’s Kallman noted that a force majeure by Ascend Performance was to officially end this month. A couple of planned turnarounds in intermediaries this month along with slowdowns in automotive in Asia and Europe, were expected to contribute to a continued tightness through mid-year. He ventured that nylon 66 prices would most likely remain flat in April as suppliers have seen increased margins on the order of about 10¢/lb through some lower feedstock costs in first quarter.

Related Content

Prices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreBaxter to Scale Up PVC Intravenous Bag Recycling Program

Successful pilot program with Northwestern Medicine will expand to additional units and health systems.

Read MoreVCM in the News Again, Not in a Good Way

Those three letters, V-C-M, stood out from the headlines of the toxic train wreck in Ohio this past week — bringing up echoes of a time that few may remember today, when the vinyl industry was in an uproar over reports of VCM hazards in the workplace and possibly in PVC food packaging.

Read MoreRead Next

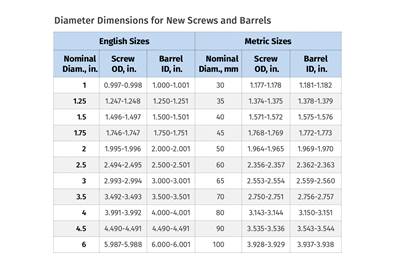

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More