How COVID-19 Did (and Didn’t) Change Automation in Plastics

The global pandemic invigorated longstanding trends and new market forces to push broad-based adoption of automation and robotics from the incremental to the inexorable.

Share

Plastics processors already short staffed due to a yawning skills gap faced sudden, desperate demand for products needed to respond to the coronavirus outbreak. Initial stop-gap emergency manufacturing of things like personal protective equipment (PPE) quickly converted to full-on reshoring, as the public, brand owners and OEMs considered anew the wisdom of outsourcing whole swaths of critical goods in the face of pandemic-fueled supply disruptions.

In addition to acknowledging the importance of domestic production of critical items, the renewed reshoring push was also fed by the unplanned supply-chain disruptions at the start of 2020. At that time, before the novel coronavirus reached U.S. shores, companies got a preview of the delivery headaches to come when many Asian suppliers shuttered as the virus rampaged locally.

You have customers for whom the pandemic made them step back and realize, ‘You know what? I better do something, because I cannot find people, or I need to improve my costs, or I want to improve my output.’”

Drop into this maelstrom of competing currents the North American injection molder. You’ve been pressed into emergency production. Even before the pandemic, you struggled to find staff; and now, health requirements force you to socially distance the people you do have. In some parts of your plant, this may be doable; but in especially “human-heavy” areas of your shop like secondary operations, it’s much trickier. As you juggle Zoom calls with customers and suppliers, while keeping tabs on which workers might need to be quarantined for coronavirus exposure, you’re told that if you can pull off these new jobs, and price competitively while doing so, there’s an interest in permanently awarding this work in a bid to reshore some production. So what’s your move? For many, it was to add more robots and automation.

“You have customers for whom the pandemic made them step back and realize, ‘You know what? I better do something, because I cannot find people, or I need to improve my costs, or I want to improve my output,’” says Raul Scheller, managing director of robotics and automation supplier Sepro North America. “Automation has been accelerated because of the pandemic. If you never considered it before, now with that acceleration, it goes from, ‘Maybe I should consider it’ to ‘Now I have to do it.’”

That imperative to act pushed many automation companies, Wittmann Battenfeld among them, to record sales in 2020 as their customers reconsidered robotics.

Facing difficulty finding skilled labor and having to operate during COVID-19 with a reduced number of workers,Trademark Plastics increased its use of robotics and automation, turning to Wittmann Battenfeld in 2020.

“A lot of the companies that really didn’t want to invest big chunks of money into automation definitely started investing in 2020,” states Jason Long, national sales manager for robots at Wittmann Battenfeld. “I think that’s the biggest trend I’ve seen—just how fast it sped up as people transitioned into more automation.”

Acceleration was a theme echoed by many automation suppliers contacted by Plastics Technology. Take an emerging trend, introduce the myriad pressures of the pandemic, and watch it take off. “We already saw a little evidence of people not being able to find help and increasing automation, so I think it was just amplified with the pandemic,” explains Dino Caparco, engineering manager for Yushin America. “Some customers who were doing manual operations suddenly saw their demand increase exponentially, and they realized that, ‘Wait a minute—we’re not going to be able to get enough people to do these operations manually, so we’re going to have to automate.’”

The same calculations are still being made across the industry. “People are realizing from a resource standpoint that automation is necessary,” says Jim Healy, vp sales and marketing for Sepro. “What the pandemic did was just reinforce that and accelerate that goal of automation.”

The acceleration was not a gradual depression of the gas pedal, either. “It was certainly not ‘This is something; let’s look at this,’ or ‘I need this in six months,’” Healy says. “It was, ‘I’m-doing-this, I-need-it-tomorrow!’ That’s what we had to try to address.”

In the past, when price might have dictated the choice of automation supplier, in 2020 under the pressure of COVID-19, delivery time was the ultimate deciding factor. “We have to be sure we have the inventory because so many of these customers are calling us. It’s shifted from price purchases to lead-time purchases,” says Carparco at Yushin. “We’re seeing customers say, ‘Hey, I need this in X amount of time,’ and that’s solely what they’re making their purchasing decision on.”

Robotics’ Record Results

Sepro’s and Yushin’s experience of I-need-it-yesterday levels of demand was felt across the industry, with the coronavirus to thank or blame. As the Robotic Industries Association (RIA) described the situation in its summary of 2020 statistics, “Despite the pandemic, or possibly because of it, robot orders in North America were up by 3.5%.” Rising in an economy where most sectors contracted, automation in North America grew in ways it never had. For the first time on record, sales to non-automotive companies overtook automotive-related deliveries. Year-over-year orders in life sciences increased by 69%, food and consumer goods grew by 56%, and plastics and rubber saw a 51% increase. Automotive orders, in contrast, increased merely 39% in 2020.

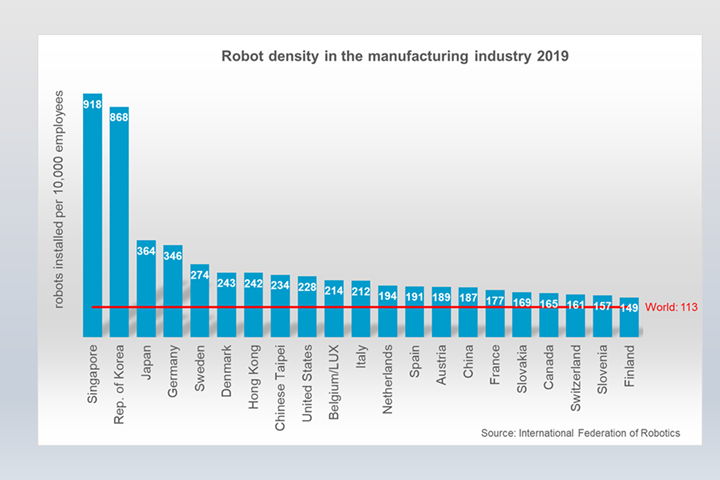

North America was not alone in gearing up automation. The average robot density in the manufacturing industry hit a new global record of 113 units per 10,000 employees, according to the International Federation of Robotics (IFR). By region, Western Europe (225 units) and the Nordic European countries (204 units) use the most automated production, followed by North America (153 units) and South East Asia (119 units). The U.S. ranks No. 9 globally amongst the most-automated countries, with Singapore, South Korea, Japan, Germany, and Sweden, making up the top five.

Robot density reached new highs in 2020 according to the International Federation of Robotics.

All the robot and automation suppliers Plastics Technology spoke with also acknowledged outsized demand in 2020. As of Dec. 1, Wittmann Battenfeld’s U.S. division had already broken its yearly record for robot sales, with a month to go in 2020. In the company’s newsletter, vp of Sales Sonny Morneault said the company could reach sales of 550 robots by the end of the year.

Sepro experienced the dramatic slowdown in March 2020 that was felt by the entire U.S. economy, as lockdown orders were instituted to “flatten the curve” of coronavirus infections. As lockdowns eased, however, demand grew rapidly. “I think there was a little bit of unease, restlessness in the market,” Healy says; “but certainly in the last six months of the year for us, business was steady and increasing, especially in the medical market. We saw a dramatic increase there.”

“2020 was one of our busiest years here at Yushin America,” Caparco says. “It was very dynamic over the past year. Initially, I don’t think we were really expecting our business to to just take off like it did. The pandemic really touched almost every facet of our business.”

Reshoring Revitalized

The first COVID-related supply-chain interruptions hit the U.S. well before the country recorded its first cases of the disease. As China locked down in January 2020, many OEMs scrambled to procure production, reverting to North American molders and processors. “Reshoring started purely out of necessity in some cases,” Yushin’s Caparco explains. “People were saying, ‘The borders are closed down so we can’t source things where we’ve sourced them from in the past.’ We started seeing a lot of companies figuring out how they can set themselves up to make these products again, whether it’s PPE or testing equipment, but I think there’s going to be a lot more of that in the future.”

To ensure the viability of that work going forward, Scheller says many of Sepro’s customers sought to bolster their efficiency and the case for keeping the molding stateside.

To meet pandemic-fueled demand, Cincinnati-based Performance Plastics added a softwall cleanroom cell with a Milacron Fanuc press and a Yushin 0B7 collaborative robot.

“With automation and robots, you can be very cost-effective within the U.S.,” Scheller adds. “It’s my belief that we will see more companies bringing their supply chains back to North America.” That return of production was especially evident in packaging and consumer products like cleaning supplies, according to Long at Wittmann Battenfeld. “A lot of that stuff wasn’t made in America,” he says, “so a lot of the companies that were making it overseas started reshoring that kind of products. The companies that were already making them here started looking at how do you not only meet demand, but stay competitive, to make sure that after this is all done they can continue to make it here.”

Focus on Flexible Automation

Given the fluidity of the market in 2020, and the ever-shifting nature of life as a custom molder, many of the companies that added robotics and automation sought to do so in the most adaptable way possible. One key to this was working with controls that were easily reprogrammed as jobs came and went.

“While our controls are very, very powerful,” Sepro’s Healy says, “they’re also easy to use. The typical operator can manage their way through, especially with support from us, if needed, via the phone or onsite.”

Wittmann Battenfeld has focused on its Wizard programming, including a video assistant featuring a checklist of questions to guide molders through programming. “Within 10 or 12 questions, it writes the program for you,” Long says. “It does all the logic instead of a user having to write line by line in code. We definitely see a big push in the industry, and through Wittmann, for more wizard-based programming.”

At Yushin, Caparco says interest in flexible systems that can take on different tasks for different product runs is high, as is simplified programming that makes quick switches feasible. “It’s very easy to utilize our robots for a complicated automation project,” Caparco says, “where you can change the program with one touch to do a simple pick-and-place application or something else. You don’t see the big, fixed automation systems to run one specific product any longer. You’re seeing automation systems that are able to adapt to other products with little or basic changeovers.”

Remote Required

The pandemic not only accelerated the acquisition of robots and automation, it also led molders to view remote capabilities in a new light. “The technology behind being able to look at a robot program here without having to physically send someone out in the field is something we’ve seen a big spike in lately,” Long says. For Wittmann Battenfeld, that ability has been available for some time, but in the past there was often pushback from companies not interested in allowing a supplier to dial into a molder’s network and connect with a robot remotely. “That’s the big turn we saw in the first half of 2020,” Long says, “A company that used to not allow us—didn’t want to go that far in remotely setting up their equipment—dove into, ‘How do we get this done and how do we get it done more quickly?’”

Sepro’s redesigned Success line of robots met strong market demand in 2020.

At Sepro, this need manifested itself in utilization of its Live Support offerings, according to Healy. At Yushin, Caparco says more customers used its Yushin University program for remote training, as well as seeking out virtual support and installations. During the pandemic, Yushin also began a virtual runoff process for new equipment. In the past, if a customer was able to, they’d come in and see the new automation system running before it was delivered. That has switched to a virtual demonstration, which is for the better in many ways. “The customer can see the equipment running, and we can have that interaction,” Caparco says. “Even though it’s not face to face, at least we’re doing it digitally and it’s easier for the customers. That’s something that going to stick around; I think we’re going to see a lot more of that.”

Covid Fades, Skills Gap Remains

So what happens when the black swan event of the pandemic slowly fades as vaccines and herd immunity take hold—will the economy let up on the gas pedal that accelerated automation adoption over the last year? Demographic changes say increased automation adoption is here to stay. Nearly 25% of the manufacturing workforce is age 55 or older, according to a July 2019 Manufacturing Institute report.

This is part of an overall graying of the U.S., where by 2030, one in five Americans will be 65 years or older, and by 2035, retirement-age Americans will outnumber Americans under 18 for the first time. That shift is already happening in the manufacturing workforce, where the median age of a manufacturing worker rose from 40.5 in 2000 to 44.1 in 2018, compared with the total U.S. labor force, which had a median age of 39.3 in 2000 and 42.2 in 2018.

“There’s not a day that goes by when I haven’t called on a customer and very quickly out of their mouths is, ‘I can’t find people.’”

“Employers are likely to experience worker shortages, and may struggle to recruit entry-level employees and retain talented workers,” the Manufacturing Institute said in its 2019 report. “This, in turn, may lead to higher wages and salaries and accelerate the deployment of technology like robotics and artificial intelligence to boost worker productivity.”

That experience of worker shortages was echoed by plastics automation suppliers, who have helped processors try to meet the ongoing challenge. “Our industry already had a limited amount of workforce; it’s always been hard to find people,” says Wittmann Battenfeld’s Long. “So now you even see your “A” and “B” team processors—your good guys—stretched very thin, so they look for a lot more help.”

That help isn’t to replace or eliminate a human worker. “It’s not really trying to keep people out of work,” Long says, “it’s just that manufacturing is always short of people,” a situation made worse by COVID-19. “We see a lot of companies looking at how can we introduce robots and automation just to keep things going that don’t need a hands-on person to do them.” This has been manifest with systems for tasks like checking or labeling parts, according to Long.

“Are our customers trying to do more? Certainly,” Sepro’s Healy says. “Just having the capabilities to take as much of the operator’s time off of the press as possible, customers are trying to accomplish that.”

That effort is reinforced by what’s become a common conversation for Healy. “There’s not a day that goes by when I haven’t called on a customer and very quickly out of their mouths is, ‘I can’t find people.’ You hear it everywhere. It doesn’t matter what geographic portion of the country you’re in or what industry you’re in, it’s an ongoing issue—which just lends itself to automation.”

Related Content

-

Five Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

-

Automation in Thermoforming on the Rise

Equipment suppliers’ latest innovations exemplify this trend driven by factors such as labor shortages, higher-speed thermoformers and tighter quality control.

-

New Technology Enables ‘Smart Drying’ Based on Resin Moisture

The ‘DryerGenie’ marries drying technology and input moisture measurement with a goal to putting an end to drying based on time.

Related Content

Five Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

Read MoreAutomation in Thermoforming on the Rise

Equipment suppliers’ latest innovations exemplify this trend driven by factors such as labor shortages, higher-speed thermoformers and tighter quality control.

Read MoreNew Technology Enables ‘Smart Drying’ Based on Resin Moisture

The ‘DryerGenie’ marries drying technology and input moisture measurement with a goal to putting an end to drying based on time.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreRead Next

Plastics Processors Waking Up to the Digital World

The ongoing coronavirus pandemic could force plastics processors to revisit technologies previously overlooked, many of which will be on display at May’s NPE2021 show. In part one of a series on emerging trends and technologies to explore during the triennial event, we look at digital manufacturing.

Read MoreROBOTS TO ‘COBOTS’: Next-Gen Automation in Plastics Processing

So-called ‘collaborative robots’ are a new category of ‘human-friendly’ automation that can work safely side by side with people, unprotected by guarding.

Read MoreCan Robots Bridge the Skills Gap?

Robot sales break records as manufacturers’ struggles to hire skilled workers heighten—industry watchers see a direct correlation.

Read More