Suppliers Look for a Bottom in Resin Prices

Prices for first quarter could be flat for most commodity resins, with slight movement possible in the case of PET.

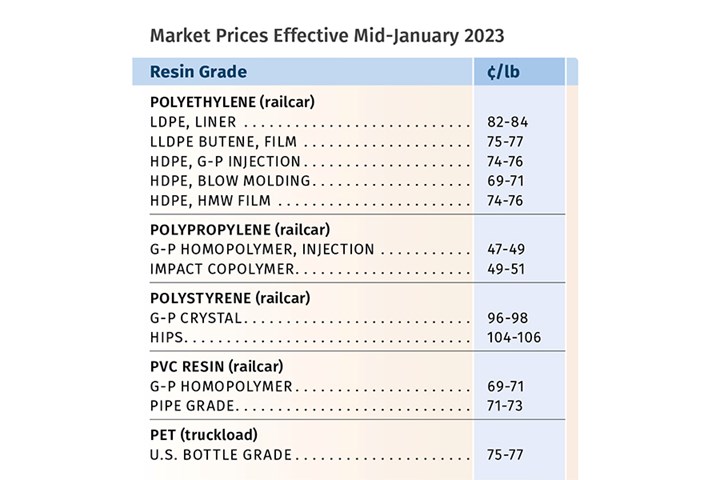

After at least five months of declining prices, a reset on all five major commodity resins is generally expected for this first quarter, with tabs likely to be flat to slightly higher, except perhaps for PET. Suppliers have cut production rates quite drastically; but despite these efforts, inventory buildup continued as demand remained largely dismal, while at the same time, major new capacity was being brought on stream in PE and PP. Resin suppliers reportedly offered significant discounts in new contract negotiations and on spot-market offers in the fourth quarter and were aiming to halt the slide. Price hikes emerged for PE, PP and PVC and were expected for PS. Weather-related production outages, as always, were a potential threat.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

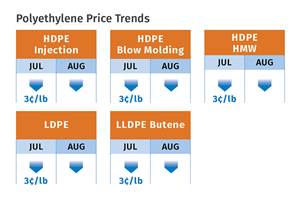

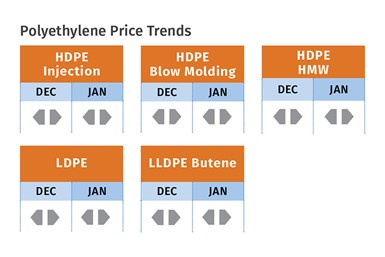

PE Prices Flat — or Higher?

Polyethylene contract prices in December rolled over once again, with most suppliers scrapping their announced fourth-quarter price increase but issuing a new round of price hikes of 5¢ to 8¢/lb for Jan. 1. Barring a major production disruption, prices in January and this month were projected to be flat, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Greenberg.

Barry noted that in contract negotiations for this year, PE suppliers offered price concessions due to the slowed market demand. “If some of the increase goes through, either in January or February, it would be a reflection of how much suppliers gave away in contract negotiations and their efforts to recoup some of that.” He noted however, that Shell, Nova, and Bayport Polymers will be positioning themselves to market their new resin capacities in the first and second quarters.

RTi’s Chesshier noted that this month could see suppliers aiming to push through at least part of an increase if exports show a strong rebound after the Chinese New Year. But going into 2023, she pointed to significant inventory buildup across the supply chain, with some processors claiming their inventories were the highest ever in their companies’ history and some were running fewer production lines. As a result, spot-market activity slowed, according to both Barry and Greenberg who reported, “Spot offerings were light, atypical for this time of year, especially as producers still face high storage costs and the upcoming inventory tax deadline at the end of the year, but the reduced production seems to be taking its toll on availability.”

These sources noted that PE suppliers had dropped operating rates to the low-to-mid 80s percent. Yet major new capacity is underway. Shell’s new Monaca, Pa., plant is expected to ship prime samples to customers in early 2023, while Nova’s new PE unit in Ontario is expected to start up in late first quarter or early second quarter. Also expected to start up sometime this quarter is Baystar’s third HDPE line in Pasadena, Texas.

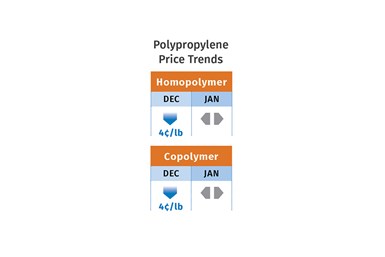

PP Price Bottoms Out

Polypropylene prices in December dropped 4¢/lb: 1¢/lb in step with propylene monomer and 3¢/lb in margin giveback. But two suppliers, Braskem and LyondellBasell, issued hikes of 3¢/lb for Jan. 1, though no real change in prices was expected in January and February by PCW’s Barry, Spartan Polymers’ Newell or The Plastic Exchange’s Greenberg.

Barry noted that similarly to the PE contract price negotiations, PP suppliers also offered further reductions, and will try to stabilize prices going forward. He also said that many buyers are saying they want their contracts to be based solely on monomer price. Newell put it this way: “ I think we we’ll go back to the ‘old days’ of PP prices moving penny for penny with the monomer price,” noting that this hasn’t taken place for the last six to seven years, when supplier “margin increases” were explicitly factored into PP prices.

These sources also think that the monomer price today is quite low and unlikely to go lower. While they noted that a couple of production units were down and there were some weather-related outages, which led to spot prices spiking a bit, monomer demand is very low, as is the case with PP polymer. Said Newell, “It’s hard to project how first quarter will shape up. This is a depressed market with no guidance right now.” Plant utilization rates were in the high 60s to low 70s going into 2023, while significant new capacity is being brought on stream by Heartland Polymers and ExxonMobil.

By December’s end, The Plastic Exchange’s Greenberg reported that PP spot prices had come down a long way, and that some buyers were starting to rebuild their inventories at those levels, yet overall demand was lethargic. “Producers have already seen their wide margins erode due to oversupply and have taken aggressive action to rebalance the situation by reducing production, which is starting to have an impact.” He ventured it would not be entirely surprising to to see a price increase supported within first quarter.

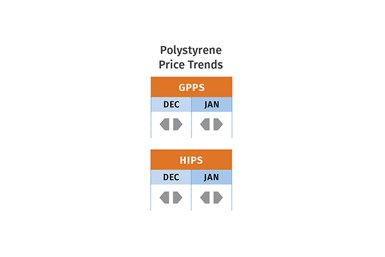

PS Prices Down

Polystyrene prices were flat to slightly up by 1¢ to 2¢/lb in November, following an upward blip in benzene tabs, and then were flat to about 4¢/lb lower in December, depending on the supplier, according to both PCW’s Barry and RTi’s Chesshier. Barry reported that the implied styrene monomer costs based on a 30% ethylene/70% benzene spot formula were up by about 2¢/lb over the first two weeks of December, but attributed that to that temporary rebound in the benzene market. He noted that spot PS prices remained largely unchanged, with ample resin availability, while some PS imports were lower by about 10¢/lb.

Chesshier ventured that PS prices would be flat-to-down in January-February, barring a major weather event that would send benzene prices spiking. In contrast, Barry ventured that due to benzene price volatility, it would not be surprising to see PS suppliers come out with an increase in the range of 2¢ to 3¢/lb. “Benzene volatility would be an issue during first quarter because some refineries are not producing benzene because of economics, which means buyers will need to go to imports and there is the uncertainty of the direction of crude oil prices.” Both sources noted that PS plant operating rates had dropped to the mid-50s, and despite that there was inventory buildup. This was attributed to poor demand and a continued surge in lower-priced PS resin imports.

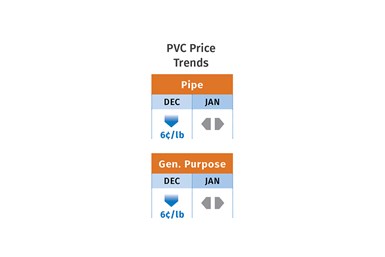

PVC Prices Bottomed Out?

PVC prices in November and December dropped by another 6¢/lb each month, bringing the total decline in prices in the fourth quarter to 17¢/lb. Meanwhile, suppliers were aiming to stem the slide by issuing price hikes of 6¢/lb for Jan. 1, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd. She reported, “The question then became how these increases will fare in the face of previous prognostications that PVC prices will drop by 3¢ in January, 3¢ in February and 2¢ in March.

RTi’s Kallman ventured that prices would be flat in January and, generally flat to slightly higher in the first quarter. “We expect some rebound in demand, mostly due to restocking, and there are some indications that exports will also rebound,” he says, noting that suppliers’ announced price hikes are partly to stop the price erosion and to get ahead of any potential freeze event toward year’s end in the Gulf Coast. With demand quite low, domestic production rates in the fourth quarter were the lowest in over a year.

PET Prices Down

PET prices dropped 2¢/lb in November and were poised to fall another 2.5¢/lb in December, based on feedstock costs, according to RTi’s Kallman. He

characterized the market as amply supplied, with slowed demand, and lower-cost imports were helping to bring domestic spot PET prices down by year’s end. He ventured PET prices in the first quarter would be flat-to-down slightly, depending on crude oil prices.

Related Content

Prices of the Five Commodity Resins Largely Flat

While price initiatives for PE and PVC were underway, resin prices had rollover potential for first two months of 2024, perhaps with the exception of PET.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreVolume Resin Prices Move in Different Directions

PE, PP, PVC, and ABS prices slump, while PS, PET, PC, and nylons 6 and 66 prices rise.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read More