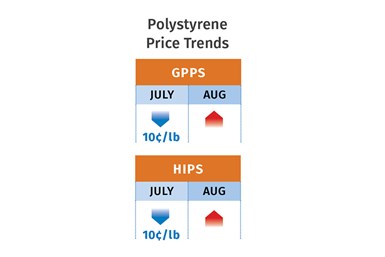

Prices Up for All Five Commodity Resins

There’s hope for flat or lower prices for each of these resins in the fourth quarter.

(Photo: Nova Chemicals)

Feedstock and/or resin supply constraints due largely to unplanned production disruptions added to the general resin tightness, particularly for PP and PE. Along with spiking feedstock costs, this tightness was a key factor contributing to the implementation of price increases for all five commodity resins. Yet, there appears to be potential for flat or even lower prices for each of these resins in the fourth quarter.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of The Plastics Exchange. Challenges noted by these sources include industrywide workforce shortages, which they blame for significant production backlogs, particularly in polyolefins.

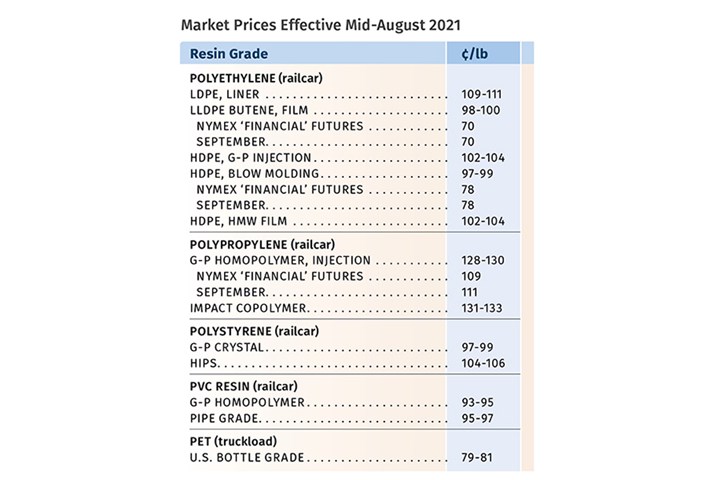

Polyethylene Prices May Have Peaked

Polyethylene prices moved up another 5¢/lb in July, bringing the total increase this year to 41-43¢/lb. Meanwhile, suppliers announced a 5¢/lb price hike for August, according to Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry, and The Plastic Exchange’s Greenberg. The latter included this in his report prior to the late implementation of the July increase: “Polyethylene contracts have relentlessly increased in 11 of the past 13 months, except Oct. and Nov., and have risen some 60¢/lb along the way on the back of limited supply availability, strong buyer demand, and premium spot prices helping pave the way.”

PCW’s Barry characterized the late-announced August hike as a “place holder,” noting that implementation of the July increase was not confirmed until early August, and suppliers were determined to push through another 5¢/lb increase, as they typically do during the hurricane season. Both Barry and Burns ventured that PE prices would stay firm through September, with some potential for higher market tabs in the fourth quarter. Burns noted probable factors that would contribute to lower prices, including limited exports, steady-to-lower demand, high production rates, and the beginning of aggressive 2022 contract negotiations.

All three sources concede that demand was still outpacing supply at the start of last month. While suppliers have been building up their inventories, unplanned production issues have kept things snug. In general, contract customers were able to get what they had ordered but not more. Tightness continued to be led by injection and blow molding HDPE grades.

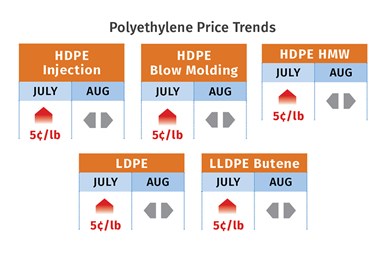

Polypropylene Prices Still Rising—for Now

Polypropylene prices in July increased by 2¢/lb in step with the propylene monomer contract price. Additional unplanned monomer production disruptions that resulted in feedstock tightness were expected to produce another monomer increase for August, on the order of at least 5¢/lb. Moreover, some PP suppliers came out with a non-monomer hike of 5¢/lb in addition to the monomer settlement, but missing was Braskem, which could torpedo this attempt, according Scott Newell, RTi’s v.p. of PP markets. PCW’s Barry and The Plastic Exchange’s Greenberg agreed with that assessment.

Newell noted that while resin supply remained tight, solutions were underway. Suppliers were building up inventories, and imports that were held up by logistical issues were starting to flow. He did note that labor shortages at processors have resulted in some inventory backlog. Both he and Barry characterized demand as strong, but Newell said he was watching what may be the start of a slowdown in demand, just as supply is catching up. “If demand stays strong and monomer stays tight, there will be price volatility. But, going into fourth quarter, we could start seeing a major price correction.”

Barry noted that prices of homopolymer PP were 40-50¢/lb higher than propylene monomer costs, whereas in the past, a 16-18¢ differential typically had been profitable for producers. He reported that apart from tightness in random and impact PP copolymer availability, processors were getting their needed material, and spot prices had eased by a couple of cents. Greenberg put it this way: “A couple cents off PP is not much of a win, as prices remain in the realm of record levels that have been maintained since the immediate aftermath of the February storm. However, processors have seemingly grown accustomed to the strong price levels, which will likely endure for at least the near/mid-term as upstream inventories rebuild.”

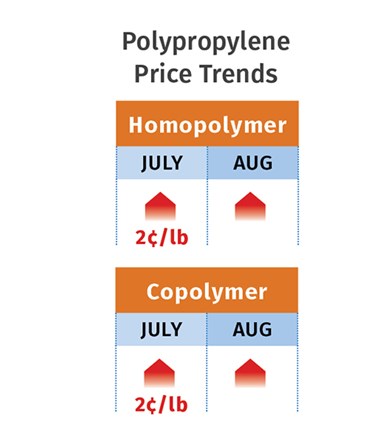

Polystyrene Prices Down, Then Up

Polystyrene prices dropped 10¢/lb in July, in step with a nearly $1/gal drop in benzene. However, spot benzene moved up by 46¢/lb and August contracts were expected to settle higher. Moreover, August ethylene contracts were expected to move up as much as 10¢/lb due to strong demand from PE, PET and PVC and unplanned cracker outages. As a result, PS suppliers issued hikes of 8¢/lb for GPPS and 9-13¢/lb for HIPS, due to higher butadiene costs, according to PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets.

Chesshier noted that PS suppliers were asking for about 2-3¢/lb more than the anticipated feedstock cost runup. Barry reported that, going into August, the implied styrene cost based on a 30/70 ratio of spot ethylene/benzene was up 4.3¢/lb over the previous four weeks. “Supply was snug due to unplanned production outages. North American industry operating rates have been approximately 70% this year,” he reported. Chesshier expected that PS prices this month would be flat to higher. But both sources foresaw a downtrend in the fourth quarter. Barry pointed to the forward curve, which is largely flat for benzene and downward for ethylene, and the potential for a drop in PS prices of 3-4¢/lb by year’s end.

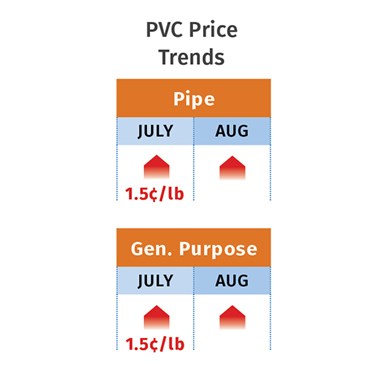

PVC Tabs Higher

PVC prices were flat in July, after rising 1.5¢/lb in June. However, some suppliers posted increases of 4¢/lb for August, while at least one split the hike between August and September. At least partial implementation was expected by Mark Kallman, RTi’s v.p. of PVC and engineering resins, and by PCW senior editor Donna Todd.

Said Todd, “Some resin buyers speculated that, despite July’s unprecedented runup in spot ethylene prices, PVC suppliers may well have had difficulty getting more than 2¢ out of the 4¢/lb in August. They thought that by splitting the price hike producers may now have a better chance of picking up the second 2¢ in September.” She noted that the late-settling July ethylene contract increase of 11¢/lb could add fuel to the pending 4¢/lb PVC price hike, and spot ethylene prices were 20¢/lb above June levels.

Kallman characterized the market as somewhat tight, due to production issues in July and some planned maintenance shutdowns in August, while demand continued very strong.

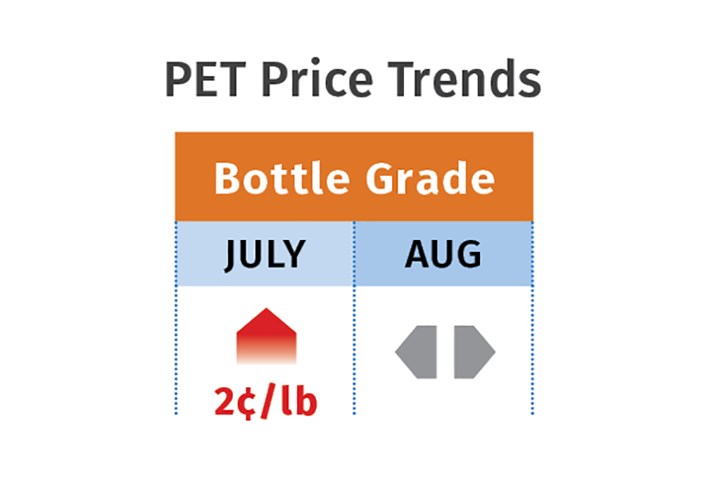

PET Prices May Stabilize

PET prices moved up 2¢/lb in July, driven by feedstock cost increases. Feedstock prices were expected to flatten out August, although a change in the upward trajectory of ethylene prices was uncertain, according to RTi’s Kallman. “I venture that PET prices will be roughly flat in the August-September timeframe as we watch the evolution of demand and hurricane weather issues.” He characterized demand as strong since May, but with processors now getting the material they need. He added that PET imports, selling at competitive prices, were also on the upswing.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

Recycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

(2).jpg;maxWidth=300;quality=90)