Will Prices Stabilize for Commodity Resins?

Demand outpacing supply, and petrochemical price hikes, have supported higher tabs for volume commodity resins. But moderating trends could flatten or even depress the price curve.

Continued strong demand and constrained supply of resins and/or key feedstocks—primarily from planned and unplanned shutdowns—contributed to significantly higher prices for four of the five major commodity resins and all four volume engineering thermoplastics. Temporary but significant spikes in prices of some feedstocks were also a contributing factor, as has been the case most prominently for PS.

These are the views of purchasing consultants from Resin Technology, Inc., senior editors from PetroChemWire (PCW), and CEO Michael Greenberg of The Plastics Exchange.

Editor’s note: Due to ongoing yearly contract negotiations related to newly added resin capacities, PT periodically adjusts its published prices to better reflect actual market prices. This does not reflect a change in the market direction, only a change in the estimated “typical” price.

PE Prices Continue Upswing for Now

Polyethylene prices moved up 5¢/lb in May, and suppliers announced increases of 5-7¢/lb for June, according to Mike Burns, RTi’s v.p. of PE markets, along with PCW senior editor David Barry and The Plastic Exchange’s Greenberg. Burns noted that the latest announced price hike had a good chance of going though, as demand appeared be nearly exceeding supply. Whatever inventory gains were made through April by suppliers running plants at high rates were offset by stronger demand and three unplanned PE plant shutdowns by Dow, Nova and Braskem. “Expect any price increases from June on to be disruption-driven,” said Burns. He anticipated that it would take about three months, up to September, for suppliers to build balanced inventories—providing there are no further disruptions. That’s a big caveat, considering predictions that this hurricane season will be another active one.

PCW’s Barry said, “Demand has been very robust with no sign of slowing. Still, I feel like July could be flat-to-down for PE pricing, as a lot of processors shut down for a while. And, when suppliers turn to the export market, they will need to reduce their prices.”

As Greenberg noted, suppliers have implemented price increases of 31-33¢/lb so far in 2021 (including the nickel in May) and a total of 57¢ since June 2020. He characterized spot PE demand as fairly robust, with sales limited by lack of availability. He reported that HMW-PE for film remained the only “loose” PE grade, for which availability has grown, hampered by weak exports.

PP Prices Up by Double Digits

Polypropylene prices moved up 13¢/lb in step with the May propylene monomer contract settlement. Most suppliers issued a non-monomer-related increase of 8¢/lb for June, according to Scott Newell, RTi’s v.p. of PP markets, PCW’s Barry, and The Plastic Exchange’s Greenberg. Newell ventured that propylene contracts would be flat to higher last month and that it was difficult to predict how much of suppliers’ 8¢/lb “margin increase” would gain traction. “Supply has been improving, up to 28.5 days of supply going into May. By June, it was possible that would increase to the 32-34 days that is considered pretty balanced. However, it is clear that suppliers are building their inventories and are keeping sales allocations in place until the June-July timeframe.”

PCW’s Barry ventured that June would reverse the monomer’s upwards trend though suppliers would get some of their non-monomer increase. Still, he saw the PP market becoming more balanced in July to September, making it hard for suppliers to keep driving prices any higher. Like other industry sources, he noted that demand has not suffered as a result of higher prices. Despite some good deals in PP imports, he said logistical problems and high freight costs have constrained that avenue of supply relief.

According to Greenberg, overall demand and buyer interest going into June remained strong for spot PP, “Although the number of companies clamoring for spot material has diminished.” He noted that the May double-digit PP contract increase resulted in spot prices moving up another cent or so, placing them within “striking distance of record levels.” He also noted that PP copolymer was especially scarce and that while it typically trades 2¢/lb over homopolymer, the spread has expanded to 10¢.

Newell noted that demand has been strong and most processors are tight on pellets and tight on finished goods, so that the inventory tightness has been across the supply chain. “PP demand is strong and monomer can’t keep up, so it has been priced higher in order to incentivize incremental supply. We expect to see incremental supply in June from crackers,” he said. However, he noted that Dow’s on-purpose propylene plant was down in late May and was likely to be down for a month or so.

PS Prices Up, Then Down

Polystyrene prices moved up 15¢/lb in May, following the April 9¢/lb increase, but change was in the offing, according to PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets. Both sources noted that the higher PS tabs have been driven primarily by price volatility in feedstocks, primarily benzene. After shooting up to $5/gal, benzene dropped to $3.70/gal by the end of May, and could sink lower in June. Barry reported the implied styrene cost based on a 30/70 ratio of spot ethylene/benzene was at 47.9¢/lb, down 11.9¢/lb over a four-week period.

Both sources ventured that PS prices had potential to drop in June by at least 8-9¢/lb, with further erosion likely this month. They noted that demand dropped by 3% in the first quarter alone. Said Chesshier, “PS plant operating rates were at 70% in March, and then dropped to 62% in April, with demand down 4% that month.” Added Barry, “The trend is downward for PS. It feels like a lot of the PS packaging business is going to PET, which explains a reported tightness in that resin.”

PVC Prices Up, But May Flatten Out

PVC prices moved up 4¢/lb in April, and a further 3¢/lb hike appeared to be going into place in May, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Meanwhile, suppliers came out with another 3¢/lb increase for June 1.

Kallman ventured that the June increase could be in doubt, noting that suppliers were rebuilding inventories with healthy mid-80s production rates and that additional force majeure actions would be lifted by June. At the same time, he noted that demand was very strong. The building and construction sector, in particular, was expected to remain robust, despite reports of material delays and labor shortages. Todd reported that processors had indicated in late May that industry allocation rates had risen from 50-75% in the second half of February to 80-90% in recent weeks. Kallman ventured that July PVC prices could be flat.

PET Tabs Rising

PET resin prices rose to the high 70s at the start of June, driven by strong demand from the carbonated soft-drink and packaging sectors with the arrival of the warm-weather season, according to PCW senior editor Xavier Cronin. He noted that PET prices have risen gradually from the high-60s in April.

Cronin ventured that PET prices could top 80¢/lb by mid-June as domestic suppliers and importers aim to meet strong demand from PET bottle and container plants throughout the U.S. He noted that imported PET prices for spot truckloads were 2-5 ¢/lb lower than domestic prices, depending on port of entry.

ABS Moves Higher

ABS prices moved up a total of 30¢/lb between March and June, after rising 14¢/lb in the first two months of the year, according to RTi’s Kallman. While high prices of feedstocks like benzene contributed to the increases, the key driver was supply not keeping up with demand, due to several unplanned feedstock and resin production issues. Kallman expected that prices could flatten out this month, though he noted that suppliers were still in inventory catch-up mode while facing a lot of backed-up demand going into the third quarter.

PC Prices Up

Polycarbonate prices increased by 40¢/lb on average in the first half of the year, according to RTi’s Kallman. While most suppliers were still in force majeure through May, production was said to be improving, though lead times were still lengthy. While high prices of feedstocks such as benzene played a part in the higher PC prices, the main factor was supply outpacing demand. “People are trying to restock going into the third quarter, due to previous production issues this year, which is further contributing to the higher demand,” said Kallman.

Prices of Nylons 6 & 66 Spike

Nylon 6 prices moved up a total of 58¢/lb in March to May, after rising 15¢/lb in the first two months of the year, according to RTi’s Chesshier. She noted that prices of feedstocks benzene and caprolactam rose to all-time highs in April, but stressed that the increases were driven primarily by supply/demand imbalances. Both domestic and global demand has been very strong, with force majeure actions both here and abroad during much of the second quarter. Moreover, imports are not able to fill in the supply gaps due to logistics and a fourfold rise in freight prices. “Some processors are being told that they won’t get material until the end of the year. She ventured that prices could be flat in June and July, but upward pressure would return toward the second half of the third quarter as demand typically picks up.

Nylon 66 prices moved up another 15-20¢/lb through the second quarter after leaping 14-20¢/lb in the first, according to RTi’s Kallman. Barring hurricane season or other disruptions, he was “hopeful” that the third quarter would see the return of a more balanced supply/demand ratio, lower feedstock costs, and potentially flat-to-downward pricing. He cited continued strong demand from all key market sectors and long lead times; but he noted that while suppliers’ force majeure actions were still in place by May’s end, plants were reported to be running at good rates. The bigger problem was in compounds, as there was strong demand and tightness on nearly all key additives, particularly those from Asia, along with high freight costs.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

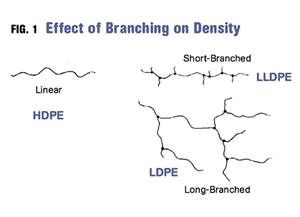

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More

(2).jpg;maxWidth=300;quality=90)