Expanding Production Bumps Index Above 50

Index expands for first time since June 2019.

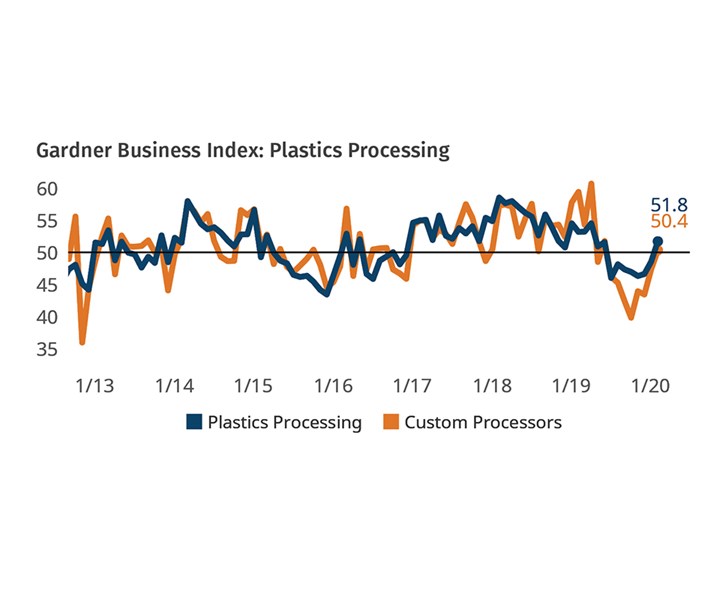

The Plastics Processing Index expanded for the first time since June 2019 with a February 2020 reading of 51.8. (Index readings above 50 indicate expanding activity, while values below 50 indicate contracting activity. The farther away a reading is from 50, the greater the change in activity as compared with the prior month.)

Most of the Index’s components reported improved figures versus the prior month. Gardner Intelligence’s review of the underlying Index reveals that the Index—calculated as an average of its components—was supported by an eight-month high in production activity and a modest expansion in employment. The Index was pulled lower by a sharp contraction in export activity and a ninth consecutive month of contracting backlog activity.

FIG 1 Both indexes expanded in February for the first time since June 2019. Plastics processors reported expanding production, new orders, supplier deliveries and employment activity. This positive news, however, will likely be soon overshadowed by COVID-19’s mounting impact on the global economy.

FIG 1 Both indexes expanded in February for the first time since June 2019. Plastics processors reported expanding production, new orders, supplier deliveries and employment activity. This positive news, however, will likely be soon overshadowed by COVID-19’s mounting impact on the global economy.

Manufacturing Outlook as a Result of Coronavirus

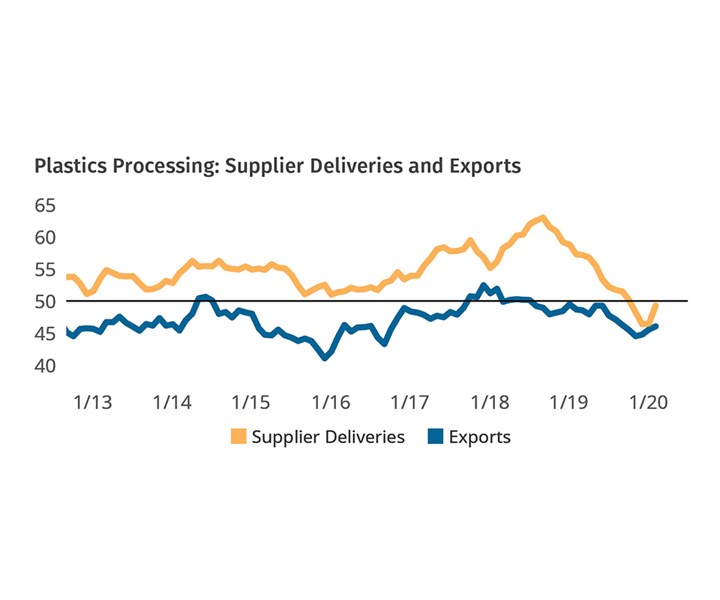

The impact of COVID-19, widely known as the Coronavirus, is expected to have an adverse effect on the Index in the coming months. The necessary efforts of Asian governments in January and February—and by a widening collection of nations in February and March—to combat the spread of COVID-19 are also having a detrimental impact on the world’s supply chain, as workers, companies and cities are affected by quarantine measures. This will most immediately restrict the normal flow of upstream and sub-component goods which are necessary for the proper functioning of the manufacturing sector.

Both the overall Plastics Processing and Custom Processor Indexes are unique in their ability to measureNorth American business conditions on a monthly basis. This means that moving forward these indexes will be able to quantify both the initial shock from the virus along with the timing and strength of the market’s eventual recovery from the economic impact of the virus.

FIG 2 Gardner Intelligence expects that most—if if not all—of its indicators will be subjected to shocks from COVID-19. That the virus originated in Asia suggests that American manufacturers in the immediate future should pay particular attention to their supply chains and expect increased volatility in export orders and material prices.

FIG 2 Gardner Intelligence expects that most—if if not all—of its indicators will be subjected to shocks from COVID-19. That the virus originated in Asia suggests that American manufacturers in the immediate future should pay particular attention to their supply chains and expect increased volatility in export orders and material prices.

As the Index is based on responses to surveys conducted each month by subscribers to Plastics Technology magazine, it is particularly important at this time for our subscribers to complete the GBI survey sent to them each month. Your participation will enable the best and most accurate reporting of the true magnitude and duration of COVID-19. It will allow you and your peers to make data-driven decisions at a time when there may be a strong temptation to make impulsive gut-decisions that could make a difficult situation worse.

ABOUT THE AUTHOR: Michael Guckes is chief economist and director of analytics for Gardner Intelligence, a division of Gardner Business Media, Cincinnati. He has performed economic analysis, modeling, and forecasting work for more than 20 years among a wide range of industries. He received his BA in political science and economics from Kenyon College and his MBA from Ohio State University. Contact: (513) 527-8800; mguckes@gardnerweb.com. Learn more about the Plastics Processing Index at gardnerintelligence.com.

Related Content

Plastics Processing’s Ups and Downs

Overall index dips, but custom processors hold steady. Employment up, backlogs down.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MorePlastics Processing Growth Slows Slightly

May reading for plastics processors is, for the most part, a continuation of what we saw in April.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read More

.jpg;width=70;height=70;mode=crop)