‘Growth Momentum’ Poised to Continue

Plastics Industry Association economist Perc Pineda says low energy prices, technology advances, and mechanization/automation are keys to manufacturing growth.

NPE2018 will be held during a period of growing optimism about the economy in general and the plastics economy in particular. To get the real skinny about where the economy is headed—both domestically and globally—Plastics Technology asked Perc Pineda, Ph.D., Chief Economist of the Plastics Industry Association (PLASTICS), to share his thoughts on the economic landscape.

Plastics Technology: What are your expectations for the U.S. economy as we roll toward NPE 2018?

Pineda: The U.S. economy is now operating at full capacity, and growth momentum is poised to continue next year. It should be noted, however, that GDP numbers tend to be underestimated in the first quarter, as we have seen in the past, but the fundamentals of the economy are expected to remain sound.

PT: What about the global economy?

Pineda: After years of sluggish global economic growth since the financial crisis in 2008, the global economy has been moving along an expansionary path. Global GDP is expected to stay above 3.6 percent in the next five years. I would argue, however, that economic growth will continue to stay uneven between countries. Nevertheless, lackluster economies in the previous years have shown signs of improvement, such as Japan and countries within the Euro Area. The emerging and developing Asian countries will continue to experience strong growth—China is expected to continue growing above 6.5 percent next year, settling to 6 percent in 2020. The advanced economies are expected to expand above 2 percent.

PT: Are you optimistic about the manufacturing economy in the U.S. in particular as we move toward NPE 2018 and beyond?

Pineda: U.S. manufacturing has steadily improved in the past few years. Low energy prices have supported manufacturing growth. Add a layer of technological innovation in the whole manufacturing value chain, and we see better manufacturing numbers in the U.S. in recent months. The low-labor-cost advantage of Chinese manufacturing has started to diminish as its economy continues to grow. U.S. manufacturing is responding by looking at new strategies—mechanization and automation, reshoring, etc.—to remain competitive.

PT: What key indicators should plastics processors be tracking as they attempt to forecast their business in 2018 and beyond? GDP? Or something more specific?

Pineda: GDP gives us a sense of how the economy is doing. When looking for factors affecting demand for goods and services; the more granular factors provide more clues. For example, disposable income, the value of the U.S. dollar, borrowing cost, new housing demand, and population growth are factors affecting durable goods. Plastics are ubiquitous, seen in all three consumption categories—durable and nondurable goods, and in services. If we look at key indicators, it is personal disposable income that affects the demand for all three consumption categories. It’s not surprising that there’s a strong correlation between plastics shipments and retail sales, since the latter is a function of disposable income.

PT: What are the underlying factors that will be driving growth in manufacturing?

Pineda: Lower energy prices, lower corporate taxes, technological innovation, stable U.S. currency, low borrowing costs, and labor supply are key factors that can put manufacturing growth in higher gear. However, the tightening labor market in the U.S. is weighing on further expansion in the manufacturing sector—and plastics manufacturing is not an exception.

PT: On a global basis, where will be growth be on a market basis? Automotive? Medical? Packaging?

Pineda: The plastics industry is expected to see broad-based growth in the coming years. Trends in end-markets are well anchored on technological innovations that require more utilization of plastics and plastic composites. The explosive growth in e-commerce will generate higher use of plastics in packaging. The continuing trend to lightweighting of automobiles can only mean a greater percentage of plastics in automobiles. Meanwhile, plastics are now the number-one choice for medical protheses. The aging population in advanced economies suggests higher demand for medical care—and by extension the use of medical supplies and medical equipment, which make extensive use of plastic materials.

PT: Do you see any signs of an uptick in employment in plastics?

Pineda: Yes, if you look at PLASTICS’ annual Size and Impact report, employment in plastics manufacturing is forecast to grow this year and in 2018 and 2019—by 0.9 percent, 0.7 percent, and 0.6 percent, respectively. Expect employment to grow faster if you look at the whole plastics industry supply chain. The business activities both downstream and upstream—considering that the U.S. economy has much improved and will remain so in the next year—could mean more jobs created in the industry. The challenge, however, is at full employment: Tight labor markets would only mean higher wages.

PT: Do you track plastics parts production? If so, what are your projections for U.S. processors for 2018 and beyond?

Pineda: We expect a 2 percent growth in real shipments this year, and 2.5 percent and 2.6 percent growth in plastics manufacturing in 2018 and 2019, respectively. PLASTICS tracks plastics shipments to different industries, including shipments of captive plastic products—those produced in plastics-processing activities like those measured by the government, but that are not located in establishments that the government identifies are being plastics-related. Captive plastics products include such items as plastic milk jugs that are blow molded in dairy establishments and automobile bumpers that are injection molded in automotive-parts manufacturing plants. While our forecast of real shipments excludes captive plastics products, it’s noteworthy that shipments of captive plastics products in 2016 added $136 billion in plastics shipments to the total of $552 billion in shipments generated directly.

PT: Let’s take a look at the supply side. What are your forecasts for 2018 and beyond for equipment and material shipments?

Pineda: I don’t foresee supply bottlenecks for equipment and materials in 2018 and the next. Higher equipment and material shipments can be expected in the next couple of years. The machinery and equipment suppliers are in good form. Commodity prices will start moving slowly higher as the global economy picks up, but my sense is that prices will remain stable. The supply of polyethylene is expected to increase by 20 percent through 2020 due to higher shale-gas production—and that should keep PE supply and prices stable moving forward.

Related Content

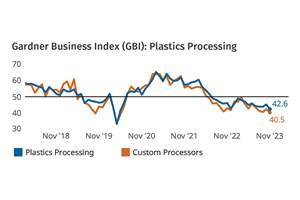

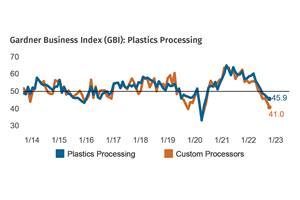

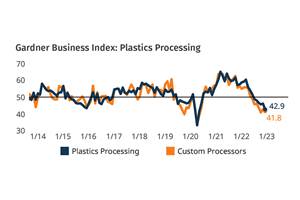

Plastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

Read MoreProcessing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More