PP Prices Down, Others Up

The second quarter started with higher prices for PE, PS, PVC, and ABS, but PP was down a bit.

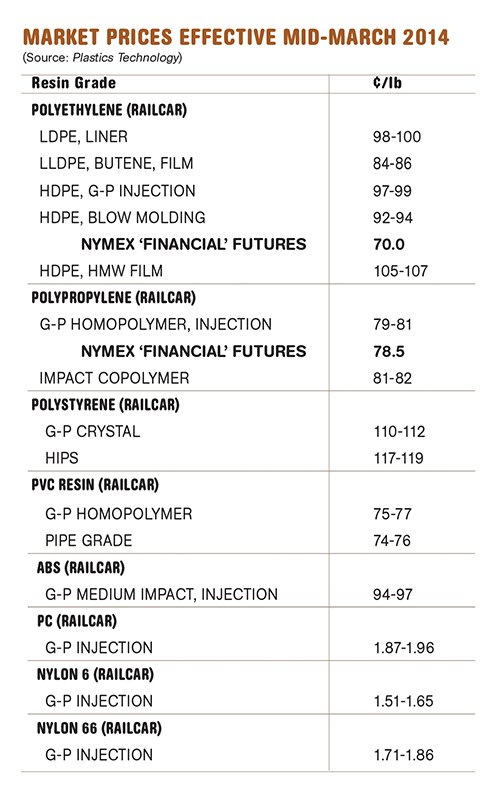

The first quarter ended with higher prices for PE, PS, PVC, and ABS, and slightly lower prices for PP. Factors driving the increases included tight supply due to weather-related interruptions, planned maintenance turnarounds, and some higher feedstock costs. Attempts to increase prices of PC and nylons 6 and 66 are also underway. Weighing in on this pricing activity are resin purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

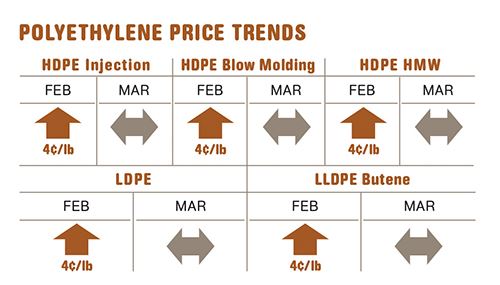

PE PRICES UP

Polyethylene prices moved up 4¢/lb in February, and most suppliers issued a 6¢ increase for Apr. 1. Full implementation of the February increase was bolstered by weather-related supply disruptions, leading to particular tightness in butene-based LLDPE and HMW-HDPE. Plant operating rates for PE, which were in the mid-90s percentage range through last year, were closer to the high 90s through the first quarter.

According to Mike Burns, v.p. for PE at RTi, these increases are not cost driven. Although suppliers have maintained that ethylene monomer prices would be moving up because of scheduled plant turnarounds, spot ethylene prices actually dropped from 58¢/lb to 52¢ by early March. The Plastics Exchange’s Greenberg reported that spot ethylene for March was trading at 52.5¢/lb and noted that the forward curve remained fairly flat: All months for the balance of the year are priced within a penny.

Burns said the new PE increase will have too many negative effects. It will enable imports of PE finished products, as Asian PE prices recently dropped 2-4¢/lb while domestic prices are already 8-10¢ higher. Processors have been passing on PE price increases to their customers. He noted, “We are pricing ourselves out of a competitive market.” He expects a buy-as-needed approach from most processors.

Interestingly, Greenberg reported at the close of February that there was a “surprisingly large number of reseller-owned railcars that still required disposition, which can be interpreted as a sign of weak domestic demand.” Moreover, he noted that Houston traders also had plenty of material to sell, but their asking prices had been rising along with replacement costs.

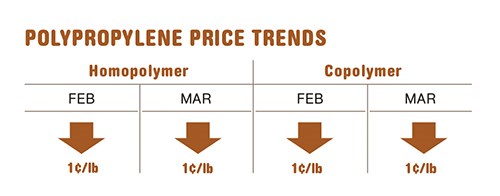

PP PRICES DOWN

Polypropylene prices dropped by 1¢/lb in February, in step with contract propylene monomer prices. There were nominations for another penny to come off March propylene contracts, but spot prices rallied a bit afterward due to planned and unplanned cracker shutdowns that will last through this month. Greenberg reported that the forward curve for spot monomer showed March as the highest price of the year with discounts provided through the end of 2014.

Scott Newell, RTi’s director of client services for PP, predicted that March PP prices would be flat to a penny higher. Supply has been on the tight side, with Phillips 66 shutting down one PP line for three weeks and another for seven weeks due to operating problems. Demand was slow in the first two months of the quarter, partly because of prebuying in 4Q 2013. Newell expected some rebound in supplier inventories and a general improvement in demand as the weather improves. Greenberg adds that domestic demand could be critical, since export markets are too weak at this price level to clear out any extra inventories that may develop.

PS KEEPS CLIMBING

Polystyrene moved up another 5¢/lb in February, bringing the total increase so far this year to 11¢. Two price hikes followed the December 4¢ increase, all of them driven principally by climbing benzene costs as well as lower styrene monomer production due to weather-related disruptions, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC.

Supplier PS inventories are lower and plant operating rates dropped as a result of the monomer woes. This tighter supply situation is further impacted by Styrolution’s decision to mothball its 350-million-lb/yr PS plant in Indian Orchard, Mass., before the year’s end (see Starting Up). Continued consolidation of the PS industry is resulting in fewer supply options and makes a future overcapacity situation unlikely, according to Kallman. He ventures that PS prices have now peaked, particularly with both ethylene and benzene costs trending downward. A bit of price relief in PS is possible in April or May.

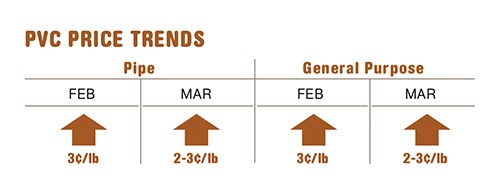

PVC PRICES UP AGAIN

PVC prices rose by another 3¢/lb in February, the second consecutive increase of the year, and suppliers were aiming to get another 3¢ last month, which would bring the first quarter’s total increase in PVC prices to 9¢/lb.

Kallman expects that suppliers will be able to implement 2-3¢/lb of the latest increase—which, like the previous two, is bolstered by shortages in ethylene and vinyl chloride monomer due to unplanned production disruptions. As a result, PVC plant operating rates were throttled back to 86% from 90% in December, while demand was up through the first two months due to significant prebuying in anticipation of higher prices. Kallman expects operating rates to recover in the very near term.

ABS PRICES UP

ABS prices moved up in first quarter as suppliers aimed to implement 4¢/lb price increases. RTi’s Kallman believes that at least 2¢ took hold in most accounts. The price increase was supported by higher benzene and butadiene feedstock costs. However, competition from imports put a lid on any further price increases.

PC PRICES FLAT TO UP

Polycarbonate suppliers issued price hikes of 7-8¢/lb for last month but little, if any, of that appeared to have been implemented. Negotiations were underway last month for April implementation of at least part of these increases, according to Kallman.

Demand has been steady for PC in the automotive arena but not as strong overall as had been expected, largely because of the delay of the construction season due to harsh winter conditions. Kallman also notes that feedstock prices are trending down and PC suppliers have more material they need to move. Whether the negotiated price increase goes through will depend on benzene and propylene prices.

NYLON PRICES FLAT TO UP

A price increase of 15¢/lb for nylon 66 was not supported industrywide in February. Very competitive pricing activity by suppliers continued from the fourth quarter into this year. Butadiene feedstock costs did go up by 9¢/lb, which might prompt some suppliers who utilize this feedstock to issue an increase, notes Kallman. Yet, the downward trend of benzene costs may interfere with any such moves.

Meanwhile, a 10¢/lb price increase with strong industrywide support was on the table for nylon 6 last month. Benzene is a bigger factor for nylon 6, and suppliers are looking to recoup the higher benzene prices of the fourth quarter and first two months of this year, explains Kallman. But March benzene contract prices dropped by 14¢/gal and spot prices were trending down.

Related Content

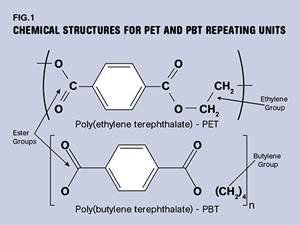

PBT and PET Polyester: The Difference Crystallinity Makes

To properly understand the differences in performance between PET and PBT we need to compare apples to apples—the semi-crystalline forms of each polymer.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MorePrices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreRead Next

Styrolution Consolidates PS Business

Styrolution takes steps to strengthen the long-term sustainability of its PS business.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More