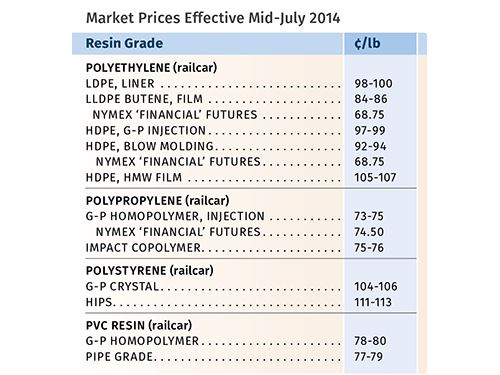

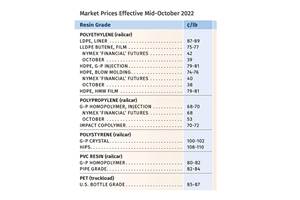

Prices Firmer for PE, PP, Looser for PS, PVC

PE and PP are expected to hold firm or head upwards, but it’s a mixed bag for PS and PVC prices.

Both PE and PP prices are firming, thanks to snug supplies and PP suppliers’ determination to boost their profit margins. While both PS and PVC prices dropped through the second quarter, price increases were underway last month. For PS, this was driven by rising feedstock costs, while for PVC, it appears to be a move to stymie any further decreases, even though market fundamentals point downward. Those are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

PE PRICES FLAT

June contract prices for PE remained flat once again. A decrease is unlikely, according to both Greenberg and Mike Burns, RTi’s v.p. for PE. “June marked two years of steady price increases, making them approximately 25% higher than in June 2012,” said Burns. “Supplier determination and higher global prices continue to be the main drivers.”

At June’s end, Greenberg reported that spot PE trading was above average, particularly for LDPE and LLDPE film grades, although he noted that spot availability for all PE grades had become markedly tighter. While prices of spot generic prime HDPE and LDPE were flat, LLDPE recorded 2¢/lb gains. According to Burns, even off-grade PE prices moved up 1¢/lb in June. He expected that the broker market would build inventory in July and August for the hurricane season and historically strong PE demand in the fall. For those reasons—and because he saw no sign of prices easing—Burns advised processors to build some inventory last month.

Commenting on the overall snugness of the PE market, Burns pointed out that the North American natural gas cost advantage has resulted in a shift from the historical resin supply “push” from Southeast Asian regions to a “pull” from Latin America. “Without a resin cost advantage from Asia, Latin America will consume North America’s incremental pounds,” he observed. Burns added that global upward price pressure on PE, combined with a healthy export market to Latin America, spelled firm or even rising prices in the domestic PE market.

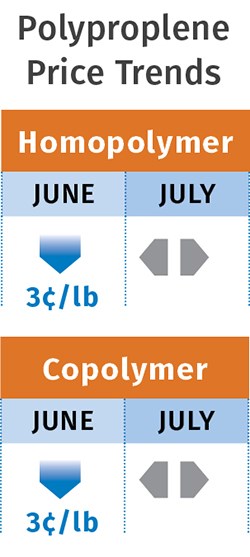

PP PRICES DROP

Polypropylene contract prices dropped another 3¢/lb in June in concert with monomer prices. The expectation was for flat July contract pricing—give-or-take 1¢ or so—for both monomer and resin.

Having fallen a total of 7¢/lb this year, PP prices could be bottoming out, according both Greenberg and Scott Newell, director of client services for PP at RTi. Several factors, starting with tight supply, could result in a price increase within the next month or so, and suppliers might even attempt a margin expansion beyond keeping up with monomer pricing, notes Newell. At press time, Total made exactly that type of move, calling for a price hike of 4¢/lb, effective July 7, above the not-yet-settled July monomer contract price. Newell anticipated similar actions from other suppliers.

At end of June, Greenberg reported that there were few spot PP deals but it was not for a lack of interest. “A number of buyers were seeking material, but there was little well-priced supply to be found. Spot PP prices jumped up 1¢/lb for the first time in 19 weeks.” He also noted that firmer monomer spot prices prompted PP sellers to pull some resin offers off the table while raising their asking prices on remaining lots. Added Newell, “There is not a lot of excess material in the secondary market, and because spot prices are not tied to monomer but rather to supply and demand, we are likely to see spot prices rise to a premium.”

Newell cited some key events that are supporting this trend. An unplanned resin plant shutdown in June by Formosa resulted in allocations of PP impact copolymer, while Total announced that it was oversold and allocated orders for homopolymer. In the same time frame, Pinnacle Polymers declared force majeure for its PP homopolymers and copolymers due to an unplanned refinery shutdown at its monomer supplier Marathon. And in early July, there were reports of an unplanned shutdown at an ExxonMobil PP homopolymer unit.

Meanwhile, demand has been on the increase, with May being the strongest month of the year at 70 million lb over April and 220 million lb over February, the lowest demand month. Newell expected June to be stronger and possibly July as well, noting that consumer goods, automotive, and sheet markets were all strong. While demand in the second quarter was up 9% from the first quarter, the latter was negative compared with all of 2013, which ended up with basically flat growth of only 0.6%. Newell anticipates that by year’s end, demand for 2014 will be on part with last year.

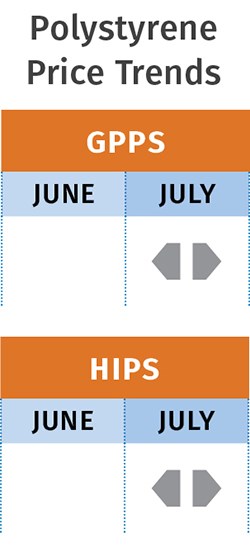

PS PRICES DROP, BUT NOT FOR LONG

Polystyrene prices dropped another 1¢/lb in June, bringing the total decrease since April to 6¢/lb. This has shaved 9¢ off the unprecedented 15¢/lb of increases implemented in the December-to-February time frame, owing to steep benzene prices. Meanwhile, suppliers have issued price increases of 7¢/lb for Aug. 1.

The June decline followed the 2% drop in benzene contract prices for that month to $4.48¢/gal. But then July benzene contracts spiked up 18% to $5.28¢/gal, which means that PS prices are very likely to move up this month, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Demand in major PS end markets was down through May by about 4% compared with 2013. Sales in the prime PS market of food packaging are down by about 1%, owing to this year’s higher prices and tight resin availability, both of which prompted a switch to other materials.

PVC PRICES DOWN

Having remained stable for two consecutive months in April-May, PVC prices were expected to drop by at least another penny last month, which would shave off some of the 9¢/lb gained by suppliers in the first quarter. But in an effort to stop price erosion, suppliers announced increases of 2¢/lb for Aug. 1, which RTi’s Kallman says are unlikely to be implemented.

In fact, Kallman ventured that PVC prices would remain flat or drop in July and into August. Driving factors are improved availability and lower prices of both ethylene and VCM monomers, along with disappointing domestic demand in the second quarter. How things shake out will depend partly on whether suppliers throttle back production, creating a tighter supply/demand situation, and on export demand, which picked up significantly in May to June.

PRICE HIKES FOR NYLON 6, FLUOROPOLYMERS

Four suppliers of engineering resins issued price increases, three of them for nylon 6. BASF has called for a 9¢/lb price hike on its nylon 6, effective July 15. Although no particular reason was given, the move appears to follow the 18% increase in July benzene contract prices. Both Honeywell Resins and Chemicals and DSM Engineering Plastics blamed higher feedstock costs for their 10¢ nylon 6 hikes, effective Aug. 1.

Meanwhile, DuPont called for price hikes up to 50¢/lb on all its Teflon and Tefzel fluropolymers, effective Aug. 1. The company generally cited “rising costs.”

Related Content

Resin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

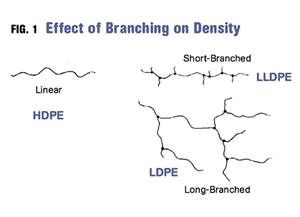

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More